Regulatory News:

THERACLION (ISIN: FR0010120402; Mnemo: ALTHE), an innovative company developing Sonovein, a robotic platform for non-invasive High-Intensity Focused Ultrasound (HIFU) varicose vein treatment, provides an update on its strategic progress and announces its first-half results.

- United States: Pivotal study successfully completed with a 12-month occlusion rate of 96.8%, confirming strong efficacy.

- Europe: CE MDR certification obtained and commercial rollout continued with the opening of two new centers in Bulgaria and in Spain.

- China: Obtained GB 9706.1-2020 certification for the safety of electromedical equipment, the national equivalent of international standard IEC 60601-1.

- Revenue up 89% and operating loss reduced by 23%.

- Cash position strengthened by the issuance of BEOCA and the exercise of 2023 warrants.

Martin Deterre, Chief Executive Officer of Theraclion, stated: "The results achieved over the past few weeks mark the culmination of several years of dedicated work in the U.S., Europe and China. The major success of our U.S. pivotal study, together with the obtainment of European CE MDR and Chinese GB 9706.1-2020 technical certifications, clearly demonstrate our team's ability to deliver. At the same time, revenue growth-recurring revenue in particular-and reduction in operating losses confirm the strength of our trajectory. Along with a stronger cash position, these achievements reinforce our credibility and support the commercial rollout now at the heart of our efforts

United States: Successful FDA Pivotal Study

The VEINRESET FDA pivotal study was successfully completed. Results showed that at 12 months, 96.8% of treated patients achieved complete occlusion of the great saphenous vein, meeting the primary endpoint, and 98.5% showed no reflux. All secondary endpoints confirmed the device's efficacy and safety. Pain was eliminated in all patients and symptoms had completely disappeared in most of them.

These results form the basis of the regulatory submission that Theraclion plans to file with the U.S. Food and Drug Administration (FDA) in the coming weeks. FDA clearance, expected in the second quarter of 2026, would allow Theraclion to access the U.S. market the world's largest for venous disease treatments for which the company is already preparing its operational development plan.

Europe: CE Certification under MDR

In September, Sonovein obtained certification under the Medical Device Regulation (MDR, EU 2017/745). The MDR is the European Union's regulatory framework for medical devices and is considered one of the strictest in the world in terms of safety, quality and performance for the medical technology industry.

Independent assessment confirmed that both the Sonovein device and Theraclion's quality management system fully comply with MDR requirements, paving the way for long-term commercialization of the latest generation of Sonovein

China: A Key Step toward Market Access

Sonovein successfully passed the GB 9706.1-2020 Chinese standard for the safety of electromedical equipment-the national equivalent of the international IEC 60601-1 standard.

This certification confirms that Sonovein meets China's latest requirements for electrical safety and focused ultrasound emissions, validating the robustness of its design and manufacturing processes. It demonstrates Sonovein's ability to meet the stringent technical and safety standards established by the National Medical Products Administration (NMPA).

From a regulatory standpoint, compliance with GB 9706.1-2020 is a crucial milestone in the NMPA approval process, fulfilling one of the key prerequisites for market authorization in China.

Commercial Launch in Europe

As part of its intensified commercial efforts, Theraclion is actively building its sales and marketing organization in order to expand sales and pay-per-use (PPU) deployments of Sonovein

In parallel, Sonovein's technological credibility and clinical maturity have been further strengthened through the publication of new scientific papers and more than a dozen presentations at major international conferences by leading physicians.

This growing visibility was accompanied by the launch of a new product identity and website (www.sonovein.com), providing the Sonovein brand with a refreshed image that embodies innovation, clinical excellence and ambition. These factors have translated into a marked increase in expressions of interest from potential customers for Sonovein in recent months.

Two new Sonovein PPU contracts were signed in Bulgaria and Spain during the first half of the year, strengthening Theraclion's European presence and expanding the installed base of its technology.

2025 Half-Year Results

In €K | 30/06/2025 | 30/06/2024 | Var | Var. % |

Revenue: | 834 | -239 | 1,072 | 450% |

Revenue from equipment sales | 309 | -572 | 881 | 154% |

Revenue from consumable sales | 372 | 287 | 85 | 30% |

Revenue from service sales | 153 | 46 | 107 | 233% |

Grants and subsidies | 3 | 138 | -135 | -98% |

Other income | 43 | 38 | 5 | 13% |

Inventoried and capitalized production | 107 | 0 | 107 | 0% |

Other operating income reversals | 98 | 11 | 87 | 791% |

Total Production | 1,085 | -52 | 1,137 | 2,182% |

Cost of goods sold and inventory variation | 277 | -231 | 508 | -220% |

Gross margin | 557 | -8 | 564 | 7,393% |

Gross margin | 67% | -3% | 0 | 2187% |

Purchases and other external expenses | 1,652 | 1,640 | 12 | 1% |

Salaries and social charges | 1 786 | 1 661 | 125 | 7.5% |

Depreciation, amortization, and provisions | 174 | 544 | -370 | -68% |

Other operating expenses | 12 | 12 | 0% | |

Operating income | -2,816 | -3,666 | 850 | -23% |

Financial income | -143 | 83 | -226 | -272% |

Exceptional income | -54 | 16 | -70 | -435% |

Research tax credit | 475 | 525 | -49 | -9% |

Net income | -2,538 | -3,043 | 505 | -17% |

Average headcount | 31 | 28 | 3 | 11% |

These financial statements were subject to a limited review by the company's statutory auditors.

Revenue

Revenue for the first half of 2025 amounted to €834K, up 89% compared with €442K in the first half of 2024, before the exceptional adjustment of €680K relating to the cancellation of Echopulse system sales recorded in 2024.

Consumables, which include recurring pay-per-use (PPU) revenues, increased by 30% compared with the first half of 2024, while service revenues rose by 233% over the same period. This strong momentum is a key indicator of the growing adoption of Sonovein by treatment centers and reflects the technology's sustained commercial traction in the field.

Combined consumables and service revenues, representing recurring revenue streams, increased by 58% compared with 2024.

With the start of commercial deployment, the Company had set revenue targets for fiscal year 2025 in the second half of 2024. As current market demand favors the pay-per-use (PPU) model over system purchases, the company has chosen to align its commercial strategy with this sustainable model. This strong trend in Europe and in the United States supports the immediate adoption of the technology and generates steadily increasing recurring revenues, strengthening the company's long-term growth prospects. System sales, which are subject to longer decision cycles, remain harder to forecast. In this early commercialization phase, accurate forecasting of future revenues therefore still carries a degree of uncertainty.

Operating Performance

Production totaled €1,085K, including €107K in capitalized production related to a system placed with a customer under a PPU agreement, initially recorded in inventory.

Operating expenses for the period amounted to €3,715K, compared with €3,578K in 2024-an increase of 4%-and included the following:

- Purchases of goods: €289K vs. €287K in the same period of 2024.

- Personnel expenses (salaries, wages and social charges): €1,786K vs. €1,661K in the prior year, up 7.5%, mainly driven by Sales staffing.

- External expenses: €1,652K vs. €1,640K in the prior year, remaining stable.

Considering accrued interests on convertible bonds issued during the first half and an unfavorable foreign exchange revaluation, the financial result was a loss of €143K.

The research tax credit (CIR) amounted to €475K as of June 30, 2025, compared with €525K in 2024.

As a result, net loss stood at €2,538K, representing a 17% reduction compared with 2024.

Cash Position and Going Concern

The Board of Directors confirmed the company's ability to carry out its development, taking into account the following:

- As of June 30, 2025, Theraclion's available cash amounted to €3.4 million.

- On February 20, 2025, the Company issued Convertible Bonds (OCA) with respective maximum amounts of €6 million and €580K.

This financing through the issuance of bonds convertible into shares (the "BEOCA") enabled the subscription and payment of an initial tranche of €3.3 million in the first half of the year.

An option to subscribe to a second tranche was attached to the subscription to the first tranche. Our shareholders and management renewed their confidence in the strategy by subscribing to the second tranche of "OCA," strengthening the cash with a new contribution of €1.25 million.

In addition, the exercise of certain stock warrants issued during the capital increase carried out in June 2023 enabled the collection of €284K from existing shareholders.

Additional short-term cash flows include the payment of €2.5 million by the Furui group for the subscription of the second tranche of convertible bonds and the exercise of warrants, payment of 2024 Research Tax Credit, amounting to €950K, and expected revenue growth for 2025 compared with 2024.

Based on these factors, the Company has sufficient resources to finance its commercial development while continuing its R&D efforts and clinical studies.

About Theraclion

Theraclion is a French MedTech company committed to developing a non-invasive alternative to surgery through the innovative use of focused ultrasound.

High Intensity Focused Ultrasound (HIFU) does not require incisions or an operating room. HIFU treatment concentrates therapeutic ultrasounds on an internal focal point from outside the body.

Theraclion is developing Sonovein, a MDR CE-marked, robotic HIFU platform for varicose vein treatment that could replace millions of surgical procedures every year. To date, Sonovein has been adopted by more than a dozen centers worldwide and used in over 3,500 procedures. In the U.S., Sonovein is not yet available for sale.

For more information, please visit www.theraclion.com and follow the LinkedIn account

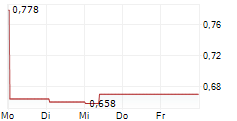

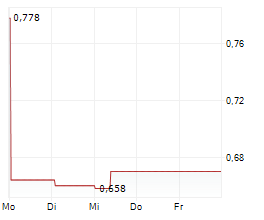

Theraclion is listed on Euronext Growth Paris

Eligible for the PEA-PME scheme

Mnemonic: ALTHE ISIN code: FR0010120402

LEI: 9695007X7HA7A1GCYD29

View source version on businesswire.com: https://www.businesswire.com/news/home/20251029406656/en/

Contacts:

Theraclion

Martin Deterre

Chief Executive Officer

contact@theraclion.com