Finnair Plc Stock Exchange Release 30 October 2025 at 9:00 a.m. EET

Good comparable operating result considering the negative impact of industrial action

July-September 2025

- Revenue increased by 2.0% to 834.9 million euros (818.3).

- Comparable operating result was 50.7 million euros (71.5). Industrial action had a direct negative impact of around 18 million euros on the comparable operating result.

- Operating result was 52.1 million euros (76.7).

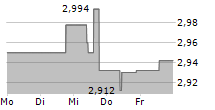

- Earnings per share were 0.15 euros (0.28).

- Net cash flow from operating activities was 64.0 million euros (98.9) and net cash flow from investing activities -46.8 million euros (-43.5)*.

- Number of passengers increased by 0.2% to 3.3 million (3.2**).

- Available seat kilometres (ASK) increased by 2.7% to 10,473.7 million kilometres (10,194.9). Including wet leases, ASKs increased by 1.0%.

- Passenger load factor (PLF) increased by 0.2 percentage points to 79.8% (79.5).

January-September 2025

- Revenue increased by 2.2% to 2,316.7 million euros (2,265.9).

- Comparable operating result was -1.5 million euros (103.5). Industrial action had a direct negative impact of around 68 million euros on the comparable operating result.

- Operating result was 17.9 million euros (102.1).

- Earnings per share were -0.04 euros (0.22).

- Net cash flow from operating activities was 299.8 million euros (411.0) and net cash flow from investing activities -203.2 million euros (-111.1)*.

- Number of passengers increased by 1.9% to 9.0 million (8.8**).

- Available seat kilometres (ASK) increased by 3.1% to 29,807.9 million kilometres (28,917.6). Including wet leases, ASKs increased by 1.4%.

- Passenger load factor (PLF) increased by 1.2 percentage points to 76.8% (75.6).

Unless otherwise stated, comparisons and figures in parentheses refer to the comparison period, i.e., the same period last year.

*In July-September, net cash flow from investing activities included 2.6 million euros of redemptions (16.6 million euros of investments) in money market funds or other financial assets (maturity over three months). In January-September, net cash flow from investing activities included 30.2 million euros of investments (16.0 million euros of investments). They are part of the Group's liquidity management.

**The number of passengers and cargo tonnes for January-November 2024 were corrected in December 2024, with a total impact of 59,100 additional passengers and 828.7 additional cargo tonnes for the period.

Outlook and guidance

Finnair's guidance regarding capacity, revenue and comparable operating result for 2025 has been specified. The upper end of the comparable operating result guidance range has been lowered, but the lower end of the range remains unchanged. Capacity and revenue guidance have been lowered.

Outlook and guidance on 30 October 2025 (specified)

Global air traffic is expected to continue growing in 2025. However, international conflicts, global political instability and the threat of trade wars cause uncertainty in the operating environment. In particular, the risk levels related to tariffs between different countries and their direct and indirect impacts are elevated. The direct cost impact of known tariffs is estimated to be limited, but it is too early to estimate the magnitude of potential indirect effects. During the year, Finnair's profitability is burdened particularly by additional costs caused by the sustainable aviation fuel distribution obligation introduced in the EU, as well as rising navigation and landing charges.

Finnair plans to increase its total capacity, measured by ASKs, by c. 2% in 2025. The capacity estimate includes the agreed wet leases. Finnair estimates its revenue to be approximately 3.1 billion euros and its comparable operating result to be within the range of 30-60 million euros in 2025 (previously 30-130 million euros). The upper end of the comparable operating result guidance range has been lowered, because reaching the previous upper end is considered unlikely. The new guidance is in line with the previous guidance, based on which the comparable operating result was estimated to be closer to the lower end of the previously given range. Lowering the upper end of the comparable operating result range as well as capacity and revenue guidance is mainly due to the continued weak demand and yield development in North Atlantic traffic, the indirect effects of industrial action on demand in broader terms, unplanned aircraft repair and maintenance needs, and fuel price developments.

The estimates above regarding capacity, revenue and comparable operating result include the impacts of the industrial action that took place in 2025. In January-September, the direct impact of industrial action was approximately -96 million euros on revenue and approximately -68 million euros on comparable operating result. The industrial action had a direct negative impact of approximately 5% on the total capacity in 2025, measured by ASKs.

Finnair will update its outlook and guidance in connection with the financial statements release for 2025.

Previous outlook and guidance issued on 16 July 2025

Global air traffic is expected to continue growing in 2025. However, international conflicts, global political instability and the threat of trade wars cause uncertainty in the operating environment. In particular, the risk levels related to tariffs between different countries and their direct and indirect impacts are elevated.

Excluding the direct impact of industrial action, Finnair has planned to increase its total capacity, measured by ASKs, by c. 10% in 2025. The capacity estimate includes the agreed wet leases. Finnair has anticipated its revenue to be within the range of 3.3-3.4 billion euros and its comparable operating result to be within the range of 100-200 million euros in 2025. However, based on the current information, the company estimates that the comparable operating result will be closer to the lower end of the given range, due to weaker-than-expected demand in North Atlantic traffic and the indirect effects of industrial action on demand in broader terms. In 2025, profitability is further burdened particularly by additional costs caused by the sustainable aviation fuel distribution obligation introduced in the EU, as well as rising navigation and landing charges. The direct cost impact of tariffs that will enter into force after the second quarter is estimated to be limited. It is too early to estimate the magnitude of potential indirect effects.

The estimates above regarding capacity, revenue and comparable operating result do not include direct impacts of industrial action. In total, the direct negative impact of industrial action in 2025 is estimated to be approximately 100 million euros on revenue, approximately 70 million euros on comparable operating result and approximately 5% on the total capacity, measured by ASKs. In the first half of 2025, industrial action had a direct impact of around -72 million euros on revenue and around -51 million euros on the comparable operating result. In addition, the three days of industrial action in July and the flights cancelled for the summer season due to a temporary lack of resources following industrial action, including wet lease out flights, are estimated to negatively impact revenue by approximately 25 million euros, other operating income by approximately 5 million euros and comparable operating result by approximately 20 million euros in the third quarter. Based on the cancellations confirmed, industrial action is estimated to have a direct negative impact of approximately 5% on the total capacity in 2025, measured by ASKs.

Considering the direct negative impacts of industrial action, Finnair plans to increase its total capacity, measured by ASKs, by c. 5% year-on-year and estimates its revenue to be within the range of 3.2-3.3 billion euros and its comparable operating result to be within the range of 30-130 million euros in 2025. However, based on the current information, the company estimates that the comparable operating result will be closer to the lower end of the given range, due to weaker-than-expected demand in North Atlantic traffic and the indirect effects of industrial action on demand in broader terms.

Finnair will update its outlook and guidance in connection with the interim report January-September 2025.

CEO Turkka Kuusisto:

The third quarter marked Finnair's return to normal, reliable operations as the industrial action, which had caused flight cancellations in the first half of year, ended at the beginning of the quarter. We carried 3.3 million customers, and our revenue grew by 2.0% to 834.9 million euros. Comparable operating result was 50.7 million euros, with industrial action having an estimated negative impact of approximately 18 million euros. The result was in line with expectations, supported by active improvements in cost efficiency, which helped reduce the impact of industrial action, increased costs related to environmental regulation, as well as higher navigation and landing charges. The continued good growth in ancillary revenue per passenger contributed to the result development.

After the industrial action ended, our flight regularity immediately returned to a high level, reaching 98.9% during the third quarter following the resolution. Customer satisfaction also began to recover quickly, and NPS stood at 32 for the entire quarter, which is close the level preceding the industrial action. We thank our customers for their trust in Finnair and the entire Finnair team for their dedicated work to ensure smooth journeys for our passengers.

We want to build stronger cooperation and reduce the risk of industrial action in the future. We continue dialogue with employee representatives and systematic work to enhance the wellbeing of our work community and personnel. Our goal is to unite 5,800 Finnair employees even more strongly as one crew working together for the benefit of our customers and Finnair.

Travel demand in Finnair's markets grew slightly compared to last year. Demand developed strongly in the Far East markets, particularly in Japan, while demand on our North American routes was weakened by general market uncertainty. We continue to monitor route-specific demand and optimise our traffic programme accordingly. During the quarter, our traffic programme was also impacted by two aircraft being out of service, which caused flight cancellations.

We continued to engage customers in reducing aviation-related CO2 emissions by introducing the option for corporate customers in the Finnair for Business programme to purchase sustainable aviation fuel (SAF) and thereby reduce the carbon footprint of their business travel. We also joined a Finnish collaboration project piloting an ecosystem and value chain for synthetic fuel production. These actions are important as costs related to EU environmental regulation increase significantly starting this year.

Flight safety is always our top priority. For this reason, we temporarily removed part of our narrow-body fleet from service in October when concerns arose regarding the verification of fire protection in seat covers. This situation led to the cancellation of approximately 70 flights and re-routing of customers until the aircraft were returned to service. We deeply regret the disruption to our customers' travel plans, but safety is an area where we never compromise.

We have specified our guidance for 2025. The upper end of the comparable operating result range, as well as our capacity and revenue expectations, have been lowered. These adjustments reflect continued softness in North Atlantic demand and yields, indirect effects of earlier industrial action, unplanned aircraft maintenance needs, and fuel price developments.

The partial renewal project of our narrow-body fleet, launched earlier this year, is progressing, and we are in negotiations with aircraft and engine manufacturers. The renewal supports our emission reduction targets, enhances customer experience, and strengthens the development of our regional network. We will share more details as the project advances.

In November, we will host a Capital Markets Update where we will present our financial targets and strategic priorities for the coming years.

Financial reporting in 2026

The publication dates of Finnair's financial reports in 2026 are the following:

- Financial Statements Release for 2025 on Wednesday 11 February 2026

- Interim Report for January-March 2026 on Wednesday 22 April 2026

- Half-year Report for January-June 2026 on Wednesday 22 July 2026

- Interim Report for January-September 2026 on Tuesday 27 October 2026

This text is a summary of Finnair's Interim Report January-September 2025. The full report is available as an attachment to this summary.

FINNAIR PLC

Board of Directors

Briefings

Finnair will hold a results press conference (in Finnish) on 30 October 2025 at 11:00 a.m. Finnish time at its office at Tietotie 9 in Vantaa, Finland. It is also possible to participate in the press conference via a live webcast at https://finnairgroup.videosync.fi/2025-10-30-media.

An English-language telephone conference and webcast will begin on 30 October 2025 at 1:00 p.m. Finnish time. To access the telephone conference, kindly register at https://events.inderes.com/finnairgroup/q3-2025/dial-in. After the registration, you will be provided with phone numbers and a conference ID. To join the live webcast, please register at https://finnairgroup.events.inderes.com/q3-2025.

For further information, please contact:

Chief Financial Officer Pia Aaltonen-Forsell, tel. +358 9 818 4960, pia.aaltonen-forsell@finnair.com

Head of Investor Relations Erkka Salonen, tel. +358 9 818 5101, erkka.salonen@finnair.com

FINNAIR PLC

Further information:

Finnair communications, +358 9 818 4020, comms(a)finnair.com

Distribution:

NASDAQ OMX Helsinki

Principal media

Finnair is a network airline, specialising in connecting passenger and cargo traffic between Asia, North America and Europe. Finnair is the only airline with year-round direct flights to Lapland. Customers have chosen Finnair as the Best Airline in Northern Europe in the Skytrax Awards for 15 times in a row. Finnair is a member of the oneworld alliance. Finnair Plc's shares are quoted on Nasdaq Helsinki.