Key Year-over-Year Highlights:

Gross Margin Expansion: Increased to 88%, up from 71%, representing a 17-point improvement.

Operating Loss Reduced by 65%: Narrowed to $439,000, from $1.25 million in 2024.

Net Loss Reduced by 63%: Improved to $482,000, compared to $1.31 million last year.

Deferred Revenue Growth: Rose 186% to $582,000, from $203,000 in 2024, reflecting secured multi-year customer contracts and strong adoption of the Map D platform.

Total Assets Up +92%: Grew to $2.17 million, from $1.13 million a year earlier.

Margin Expansion, and Operational Improvements Ahead of Eventdex Acquisition

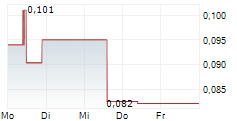

NEW YORK CITY, NY AND TORONTO, ON / ACCESS Newswire / October 30, 2025 / Nextech3D.ai (CSE:NTAR)(OTCQB:NEXCF)(FSE:1SS), an AI-first technology company specializing in AI event management through its flagship Map D and Eventdex platforms, 3D modeling, and spatial computing, is pleased to announce its financial results for the quarter ended September 30, 2025.

20% Sequential Quarter-over-Quarter Growth Marks a New Growth Curve Driven by The company's AI Event Suite (Q2 vs. Q1 2025)

Nextech3D.ai delivered solid quarter-over-quarter sequential performance, underscoring the continued strength of its high-margin event technology business.

Revenue increased 20% sequentially, rising to $390,755 in Q2 2025, up from $325,000 in Q1 2025 marking the beginning of a new growth curve.

Deferred revenue up +186% year over year from $203,000 to $521,000

Gross margins remained strong at 88%, supported by higher contributions from the Map D platform and continued AI-driven workflow efficiencies.

The Company maintained disciplined cost controls, driving operational leverage and improved profitability.

Year-over-Year Comparison (Sep 2025 vs. Sep 2024)

While total revenue declined 48% year-over-year from $756,476 in 2024 to $390,755 in 2025, this reduction reflects the planned conclusion of Nextech's Amazon 3D modeling contract in Q4 2024. This strategic transition allowed the Company to fully refocus on its higher-margin AI and event-technology ecosystem, which is now driving sustainable growth and profitability.

Key Year-over-Year Highlights:

Gross Margin Expansion: Increased to 88%, up from 71%, representing a 17-point improvement.

Operating Loss Reduced by 65%: Narrowed to $439,000, from $1.25 million in 2024.

Net Loss Reduced by 63%: Improved to $482,000, compared to $1.31 million last year.

Deferred Revenue Growth: Rose 186% to $582,000, from $203,000 in 2024, reflecting secured multi-year customer contracts and strong adoption of the Map D platform.

Total Assets Up +92%: Grew to $2.17 million, from $1.13 million a year earlier.

Accounts Payable Down 32%: Reduced to $3.0 million, from $4.4 million, demonstrating disciplined cash management and operational efficiency.

Strategic Growth Outlook

The acquisition of Eventdex, which closed in Q3 2025, marks the acceleration of Nextech3D.ai's next growth phase. Eventdex generated approximately $700,000 in revenue in 2024 and brings a strong customer base, complementary product suite, and recurring revenue model.

Together with Map D, the combined companies now serve over 550 customers, creating opportunities to cross-sell products across a unified event technology ecosystem that includes registration, ticketing, mobile apps, floor mapping, AI matchmaking, and blockchain ticketing.

CEO Commentary - Evan Gappelberg, CEO of Nextech3D.ai

"This quarter's results show meaningful progress on all fronts - profitability, margins, and recurring revenue. The conclusion of our Amazon contract in Q4 2024 was a strategic turning point that allowed us to fully commit to our AI-first event technology model. With Eventdex now integrated and demand accelerating, we see a clear path to sustainable growth through 2026 and beyond."

"With improved gross margins to 90%, operating costs cut by more than 60%, we narrowed our net loss by over 70% and believe we have now firmly set the stage for profitability. These results reflect the discipline, focus and hard work of our team as we have streamlined operations and prioritized scalable, high-value product lines and revenue growth."

About Nextech3D.ai

Nextech3D.ai (OTCQX:NEXCF)(CSE:NTAR)(FSE:1SS) is an AI-first technology company developing advanced solutions for event management, 3D modeling, and spatial computing. Through its flagship Map D and Eventdex platforms, Nextech3D.ai powers thousands of events annually with interactive floor mapping, registration, ticketing, mobile apps, AI matchmaking, and now, blockchain ticketing and accreditation.

For further information, please visit: www.Nextech3D.ai.

See full report on SEDAR

Investor Relations: investors@nextechar.com

For more information, visit Nextech3D.ai.

Sign up for Investor News and Info - Click Here

For more information and full report go to

https://www.sedarplus.ca

For further information, please contact:

Nextech3D.ai

Evan Gappelberg /CEO and Director

866-ARITIZE (274-8493)

Forward-looking Statements The CSE has not reviewed and does not accept responsibility for the adequacy or accuracy of this release. Certain information contained herein may constitute "forward-looking information" under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as, "will be" or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements regarding the completion of the transaction are subject to known and unknown risks, uncertainties and other factors. There can be no assurance that such statements will prove to be accurate, as future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Nextech will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

SOURCE: NexTech3D.AI Corp

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/computers-technology-and-internet/nextech3d.ai-reports-strong-20-q2-sequential-revenue-growth-with-1093479