2024 Drilling Highlights

- Eduwiges Extension Vein

- 519 g/t AgEq over 3.2 metres

- San Miguel Vein

- 364 g/t AgEq over 7.5 metres

- 425 g/t AgEq over 3.3 metres

- 365 g/t AgEq over 2.6 metres

- 301 g/t AgEq over 5.9 metres

- 322 g/t AgEq over 3.7 metres

Vancouver, British Columbia--(Newsfile Corp. - October 30, 2025) - Quetzal Copper Corp. (TSXV: SICO) (doing business as Silverco Mining Ltd.) ("Silverco" or the "Company") is pleased to report assay results from its 5,500-metre 2024 diamond drill program at the Company's 100%-owned and permitted Cusi Property ("Cusi"), located approximately 90 kilometres northwest of the Los Gatos Mine in Chihuahua, Mexico.

The Cusi Mine was in commercial production until September 2023, when it was placed on care and maintenance. The property has seen limited modern exploration, and results from the 2024 drill campaign represent a step change in both size and grade potential of the mineralized system. Building on these results, Silverco is advancing a 15,000-metre 2025 drill program, with initial assays expected in the fourth quarter of 2025. The Company's objective is to convert this new geological understanding into an expanded, higher-grade resource base to support possible restart of operations as soon as H2 2026, subject to technical studies, financing, permitting and a positive restart decision.

Mark Ayranto, CEO of Silverco, commented:

"When we acquired the Cusi Mine in early 2024, we recognized the untapped potential of the San Miguel Vein within the inset claims which we were able to acquire concurrently through an additional transaction. Our initial 2024 drill program has confirmed significant, open-ended resource potential that we are now actively expanding. We believe the San Miguel Vein can underpin a higher-grade production profile upon the planned mine restart in H2 2026."

"Perhaps even more significant is our interpretation that all major mined veins at Cusi may continue within a down-thrown block to the northeast. This model was validated by the recent discovery of 519 g/t AgEq over 3.2 metres in a 200-metre step-out hole at the Eduwiges Extension. This marks the third vein with open mineralization confirmed in extension drilling. Collectively, these results demonstrate that Cusi has the potential to be substantially larger and higher grade than previously recognized."

"Two drill rigs are currently active on these targets, and we anticipate the first results from the ongoing 2025 program in November."

Details of the 2024 Drill Program

The 2024 program consisted of 14 diamond drill holes, totaling 5,518 metres. The 2024 program was primarily focused on testing the down-dip plunge of historical drilling on the consolidated San Miguel inset claims and testing the extension of Eduwiges to the east of the Cusi fault. Drilling was performed from surface by a local contractor, utilizing portable drill rigs. All core was HQ in size.

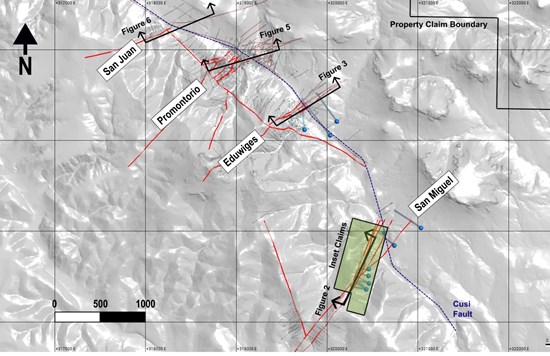

Figure 1: 2024 Drill Program Collar Locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10393/272520_f48493a1040a88a6_002full.jpg

San Miguel Vein - Inset Claims Target

With the acquisition of the Cusi Property, the Company additionally acquired and consolidated two inset claims along the San Miguel vein system. This area has a small open pit mine at surface (~30 m depth) and minor underground workings from historical mining, assumed to be pre-2000s.

Historical drilling, conducted in 2006 and 2007, targeted approximately 30 m below the open pit and returned excellent results, including hole DC07B077 which hit 482 g/t Ag over 7.5 m and DC06B030 which returned 390 g/t Ag over 7.0 m. No drilling was completed after 2007 as the ownership of the claims was subsequently disputed.

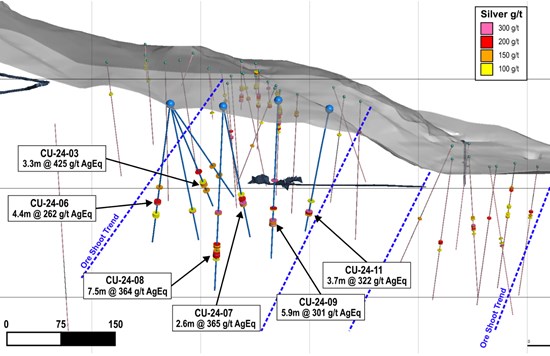

The 2024 drilling in this area targeted the interpreted, high-grade, down-plunge extension of the San Miguel vein system, which had never been drilled. The objective was to test the continuity of the structure within the Company's recently acquired inset claims. A strike length of approximately 250 m was drilled over the vein with the deepest intercept at 250 m below surface. This drilling was on average 175 m below the historical intercepts.

The San Miguel vein system was hit in the majority of the drill holes, with the best intercept in CU-24-08 with 7.5 metres of 364 g/t AgEq. Hole CU-24-08 was the deepest intercept of the program highlighting that the vein system is currently open at depth and increasing in width. Other intercepts of note are highlighted in Figure 2 and Table 1. The system remains completely open at depth and along strike. Another ore shoot directly to the east of this drilling remains open as well, with only historical, near surface drilling.

Figure 2: San Miguel Long Section, +/- 150 m, Looking WNW

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10393/272520_f48493a1040a88a6_003full.jpg

The mineralization at the San Miguel vein system is hosted within a sequence of rhyolite lapilli tuff. The host rock is characterized by strong to moderate silicification and local oxidation and chlorite alteration, indicating a significant hydrothermal system was active in the area.

The mineralized structures consist of a series of steeply-dipping, parallel veins, primarily presenting as a hydrothermal breccia. This breccia is a fractured and cemented rock, with fragments of the host rock and angular quartz clasts cemented by silica. Vein widths are variable, ranging from less than 1.0 m to exceeding 5.0 m, and are steeply dipping at 70-80o.

Eduwiges Downthrown Block Target

This portion of the 2024 program was designed to test the interpreted fault-displaced, or "downthrown," continuation of the Eduwiges vein system. This downthrown extension was previously discovered and partially mined in the Promontorio zone (Figure 4) where deeper drilling has shown both lateral and vertical continuity past existing workings. Similarly, surface exploration drilling at the San Juan system (Figure 5) in 2021 also intersected this key structural feature.

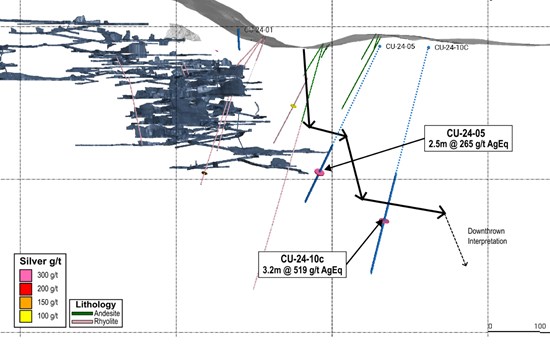

Hole CU-24-10C successfully intersected the Eduwiges vein structure to the east of the Cusi fault, returning 3.2 metres of 519 g/t AgEq. This intercept is a 200 metre step out from historical workings at Eduwiges 190 m from hole CU-24-05 intercept of 2.5 metres of 265 g/t AgEq. Historical drilling in the area was unable to successfully target the vein. This intercept confirms the Company's structural model and provides a new, deeper exploration horizon that is predicted to host the same high-grade potential as its shallow, un-faulted counterpart, on all the vein systems on the Cusi property.

Figure 3: Eduwiges Long Section +/- 100 m (mine as-built unclipped), Looking NNW

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10393/272520_f48493a1040a88a6_004full.jpg

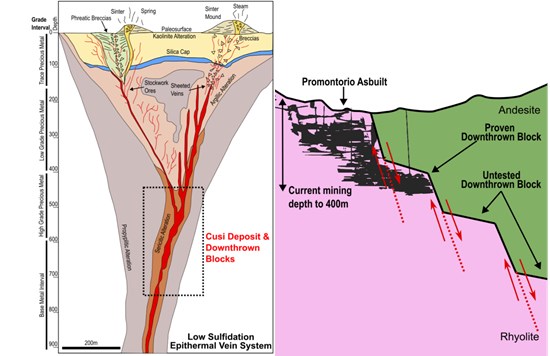

Cusi Downthrown Block Targets

The Company's exploration target is based on a structural model which suggests a significant post-mineral fault has displaced all the vein systems on the property to the east of the Cusi fault. This means the downthrown block, while occurring at a deeper elevation relative to surface, represents the same favorable relative elevation within the overall epithermal mineral system. This structural understanding indicates the continued potential for the same high-grade silver mineralization found in the un-faulted portions of the deposit. A conceptual exploration model is provided in Figure 4, with the Promontorio underground workings reference for scale.

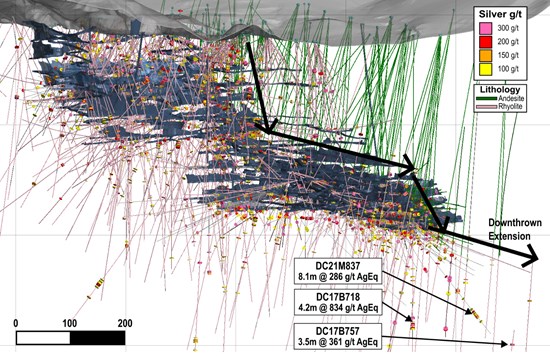

The previous project owner had discovered this structural continuation east of the Cusi fault in the Promontorio vein system, mining a portion of the first downthrown extension. Exploration drilling at Promontorio shows that the vein system continues, however only limited step out drilling has been performed. This drilling had outlined historical intercepts such as DC21M837 with 8.1 m of 286 g/t AgEq, DC17B718 with 4.2 m of 834 g/t AgEq, and DC17B757 with 3.5 m @ 361 g/t AgEq. The Company plans on following up on these results through underground drilling at Promontorio. These historical results are highlighted in Figure 5.

Figure 4: Cusi Geological & Conceptual Exploration Model

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10393/272520_f48493a1040a88a6_005full.jpg

Figure 5: Promontorio Long Section +/- 250 m, Looking NNW

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10393/272520_f48493a1040a88a6_006full.jpg

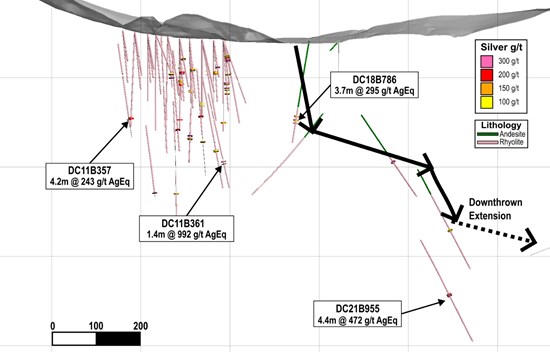

Following up on the discovery at Promontorio, drilling was also completed on the San Juan vein system in 2021. This drilling involved a significant step out of approximately 500 m from previous drilling and successfully intercepted the San Juan vein in DC21B955 with 4.4 m @ 472 g/t AgEq. San Juan remains open in all directions, and the Company plans on infilling the vein. Select historical intercepts from San Juan are displayed in Figure 6.

Figure 6: San Juan Long Section +/- 75 m, Looking NNW

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10393/272520_f48493a1040a88a6_007full.jpg

Detailed drill results, along with notable assays results are provided in Tables 1 and 2.

Table 1: Significant Assay Results from the 2024 Drill Program

| Hole ID | Zone | From (m) | To (m) | Length (m)(2) | Au g/t | Ag g/t | Pb % | Zn % | AgEq g/t (1) |

| CU-24-01 | Eduwiges | 220.3 | 222.0 | 1.7 | 0.13 | 202 | 0.83 | 4.46 | 287 |

| CU-24-01 | Eduwiges | 415.3 | 415.9 | 0.6 | 0.14 | 116 | 9.47 | 1.76 | 337 |

| CU-24-02 | San Miguel | No Significant intercept | |||||||

| CU-24-03 | San Miguel | 168.0 | 171.3 | 3.3 | 0.15 | 450 | 0.31 | 0.42 | 425 |

| incl. | 170.7 | 171.3 | 0.6 | 0.41 | 1,766 | 0.76 | 0.70 | 1,634 | |

| CU-24-04 | San Miguel | 190.2 | 193.0 | 2.8 | 0.20 | 306 | 0.28 | 0.29 | 294 |

| CU-24-05 | Eduwiges | 332.5 | 334.9 | 2.5 | 0.62 | 236 | 0.81 | 0.62 | 265 |

| CU-24-06 | San Miguel | 178.9 | 183.3 | 4.4 | 0.22 | 270 | 0.33 | 0.17 | 262 |

| incl. | 182.1 | 182.3 | 0.2 | 1.35 | 1,740 | 1.47 | 0.16 | 1,653 | |

| CU-24-06 | San Miguel | 201.0 | 205.3 | 4.4 | 0.06 | 114 | 1.08 | 0.36 | 134 |

| CU-24-07 | San Miguel | 177.5 | 180.0 | 2.6 | 0.26 | 385 | 0.29 | 0.13 | 365 |

| CU-24-07 | San Miguel | 184.5 | 189.9 | 5.4 | 0.14 | 184 | 0.08 | 0.08 | 174 |

| CU-24-08 | San Miguel | 171.4 | 174.4 | 3.0 | 0.20 | 181 | 0.10 | 0.08 | 323 |

| incl. | 171.4 | 171.7 | 0.3 | 2.51 | 1,590 | 20.00 | 5.06 | 2,037 | |

| CU-24-08 | San Miguel | 223.5 | 227.9 | 4.4 | 0.10 | 129 | 0.07 | 0.05 | 122 |

| CU-24-08 | San Miguel | 237.1 | 244.7 | 7.5 | 0.30 | 291 | 2.17 | 2.45 | 364 |

| incl. | 239.0 | 239.7 | 0.7 | 0.96 | 958 | 2.01 | 5.02 | 1,035 | |

| CU-24-09 | San Miguel | 125.8 | 126.5 | 0.7 | 0.13 | 288 | 0.25 | 0.67 | 282 |

| CU-24-09 | San Miguel | 191.4 | 197.2 | 5.9 | 0.16 | 315 | 0.42 | 0.12 | 301 |

| incl. | 193.4 | 194.3 | 0.9 | 0.23 | 803 | 0.76 | 0.06 | 748 | |

| CU-24-10C | Eduwiges | 383.2 | 386.4 | 3.2 | 0.23 | 498 | 1.34 | 1.83 | 519 |

| CU-24-10C | Eduwiges | 647.6 | 649.5 | 1.9 | 0.12 | 78 | 1.76 | 1.53 | 140 |

| CU-24-11 | San Miguel | 165.1 | 168.7 | 3.7 | 0.26 | 304 | 1.28 | 0.66 | 322 |

| CU-24-12 | San Miguel | No Significant intercept | |||||||

| CU-24-13 | San Miguel | No Significant intercept | |||||||

| CU-24-14 | San Miguel | No Significant intercept | |||||||

Notes

(1) AgEq = Ag g/t x Ag Recovery + [(Au g/t x Au Rec x Au price/gram)+(Pb% x Pb rec. X Pb price/t) + (Zn% x Zn rec. X Zn price/t)]/Ag price/gram. Metal price assumptions are: $30.00/oz silver, $2400/oz gold, $1.00/lb lead, 1.35/lb zinc. Metallurgical recovery assumptions are 90% for silver, 50% for gold, 90% for lead, and 60% for zinc. Metallurgical recoveries used in this release are based on historical operational results on the Cusi project.

(2) Reported intervals are downhole core lengths. True widths are estimated at ~70-80% based on vein orientation observed in drill core; however, actual true widths may vary with additional drilling.

Table 2: Drill Collar Location

| Hole ID | Easting | Northing | Elevation | Azimuth (1) | Dip (1) | Depth |

| CU-24-01 | 319,751 | 3,125,118 | 2,034 | 356 | -52 | 552.0 |

| CU-24-02 | 320,431 | 3,123,359 | 2,067 | 318 | -35 | 223.5 |

| CU-24-03 | 320,431 | 3,123,358 | 2,067 | 310 | -40 | 220.5 |

| CU-24-04 | 320,431 | 3,123,359 | 2,067 | 304 | -50 | 244.5 |

| CU-24-05 | 320,034 | 3,125,056 | 2,000 | 322 | -46 | 721.5 |

| CU-24-06 | 320,431 | 3,123,358 | 2,067 | 281 | -48 | 255.0 |

| CU-24-07 | 320,462 | 3,123,425 | 2,063 | 302 | -46 | 252.0 |

| CU-24-08 | 320,462 | 3,123,425 | 2,063 | 286 | -58 | 298.5 |

| CU-24-09 | 320,455 | 3,123,508 | 2,071 | 285 | -61 | 249.0 |

| CU-24-10C | 320,107 | 3,125,209 | 2,000 | 325 | -61 | 802.5 |

| CU-24-11 | 320,459 | 3,123,581 | 2,059 | 271 | -58 | 198.0 |

| CU-24-12 | 320,631 | 3,123,980 | 1,973 | 287 | -68 | 256.5 |

| CU-24-13 | 320,741 | 3,123,842 | 1,987 | 310 | -59 | 459.0 |

| CU-24-14 | 321,035 | 3,124,036 | 2,017 | 304 | -64 | 785.5 |

Notes

(1) Hole azimuths and dips are based on average of surveyed intervals

Quality Assurance/Quality Control and Sampling Procedures

All diamond drill core from the 2024 program at the Cusi Project was logged, photographed, and sawn in half using a diamond blade core saw. One half of the core was submitted for geochemical analysis, while the other half was retained in secure storage for reference. Sampling intervals were determined based on geological boundaries and typically ranged from 0.3- 1.5 metres. Control samples comprised approximately 18% of all samples submitted, including certified reference standards, analytical blanks, field duplicates, preparation duplicates and analytical duplicates. QA/QC results were reviewed in real time, and all data have been verified as meeting acceptable thresholds for accuracy, precision, and contamination before inclusion in this release.

Drill core and rock samples were sent to ALS Minerals for analysis with sample preparation in Chihuahua, Mexico and analysis in North Vancouver, British Columbia. Samples remained under Company custody until delivery to ALS; sealed bags were transported by Company personnel to ALS Chihuahua. The ALS Chihuahua and North Vancouver facilities are ISO/IEC 17025 certified. Samples are dried, weighed, and crushed to at least 70% passing 2mm, and a 250 g split is pulverized to at least 85% passing 75 µm (PREP-31). Silver and base metals are analyzed using a four-acid digestion and ICP-AES. Over-limit analyses for silver (>100 ppm), lead (>10,000 ppm), and zinc (>10,000 ppm) are re-assayed using an ore-grade four-acid digestion and ICP-AES (ME-OG62). Samples with over-limit silver assays > 1500 ppm are analyzed by 30-gram fire assay with a gravimetric finish (Ag-GRA21). Gold is assayed by 30-gram fire assay and AAS (Au-AA23)

Technical Disclosure

The scientific and technical information contained in this news release has been reviewed and approved by Nico Harvey, P.Eng., Vice President Project Development of Silverco, a Qualified Person as defined in National Instrument 43-101. Mr. Harvey is not independent of the Company. Mr. Harvey has reviewed the sampling, analytical and QA/QC data underlying the technical information disclosed herein.

No production decision has been made at Cusi. Any decision to restart operations will follow completion of the requisite technical, financial and permitting milestones.

About Silverco Mining Ltd.

The Company owns a 100% interest in the 11,665-hectare Cusi Project located in Chihuahua State, Mexico (the "Cusi Property"). It lies within the prolific Sierra Madre Occidental gold-silver belt. There is an existing 1,200 ton per day mill with permitted tailings capacity at the Cusi Property.

The Cusi Property is a permitted, past-producing underground silver-lead-zinc-gold project approximately 135 kilometres west of Chihuahua City. The Cusi Property boasts excellent infrastructure, including paved highway access and connection to the national power grid.

The Cusi Property hosts multiple historical Ag-Au-Pb-Zn producing mines each developed along multiple vein structures. The Cusi Property hosts several significant exploration targets, including the extension of a newly identified downthrown mineralized geological block and additional potential through claim consolidation.

On Behalf of the Board of Directors

"Mark Ayranto"

Mark Ayranto, President & CEO

Email: mayranto@silvercomining.com

For further information, please contact:

Investor relations & Communications

Email: info@silvercomining.com

www.silvercomining.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement and Forward-Looking Information

This news release contains "forward-looking statements" and "forward-looking information" (together, "forward-looking statements") within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or the Company's future performance and are generally identified by words such as "anticipate", "believe", "continue", "could", "estimate", "expect", "forecast", "goal", "intend", "may", "objective", "outlook", "plan", "potential", "priority", "schedule", "seek", "should", "target", "will", and similar expressions (including negative and grammatical variations).

Forward-looking statements in this release include, but are not limited to: the Company's interpretation of geological results at the Cusi Property; the significance of the San Miguel and Eduwiges intercepts; the concept and potential extent of "down-thrown" or fault-displaced vein extensions and the continuity of mineralization at depth and along strike; the Company's plans, timing, scope and budgets for exploration, including the ongoing 2025 drill program (~15,000 metres), the use of results from 2024 and 2025 work to refine high-priority drill targets, and follow-up/underground drilling at Promontorio and San Juan; expectations regarding initial assay results from the 2025 program (anticipated November 2025); estimates or expectations regarding true widths, AgEq calculations, metallurgical recoveries and comparability; the possible expansion and/or upgrading of mineral resources; statements regarding a potential restart of operations as early as late 2026, including any prerequisites and sequencing (technical studies, financing, permitting and approvals, construction/readiness activities); availability and terms of financing; the filing or availability of figures and additional technical information; and any other statements that express management's expectations or beliefs of future events or results.

These forward-looking statements are based on a number of assumptions that, while considered reasonable by the Company as of the date of this release, are inherently subject to significant business, technical, economic and competitive uncertainties and contingencies. Key assumptions include: the accuracy, representativeness and continuity of sampling and assay results; that drill hole orientation and modeling reasonably estimate true widths; that metallurgical recoveries used to calculate AgEq (90% Ag, 50% Au, 90% Pb, 60% Zn) are reasonable proxies based on historical operational data at Cusi; the availability of drill rigs, personnel and analytical laboratory capacity on expected timelines; timely receipt of permits and approvals necessary for planned work; access to surface rights and community support; no material adverse changes to general business, economic, market and political conditions; commodity price and foreign exchange assumptions; inflation and input costs remaining within expectations; and the Company's ability to secure additional financing on acceptable terms when required.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially from those expressed or implied. Such factors include, without limitation: exploration, development and operating risks (including drilling, sampling, assaying, interpretation and modeling uncertainties; variability of mineralization; representativity of samples; true-width estimation; metallurgical variability; water management; geotechnical and ground conditions); risks inherent in estimating or converting mineral resources; the absence of current mineral reserves at the Cusi Property; that AgEq is a reporting metric only and does not imply economic recoverability; permitting, licensing and regulatory risks in Mexico (including changes in mining, environmental, labour, water, land access and related regimes); community relations, social licence and stakeholder engagement risks; title, surface rights, access and environmental liability risks; health, safety and security risks; commodity price and FX volatility (silver, gold, lead, zinc; MXN/CAD/USD); cost inflation, supply-chain disruptions and contractor availability; political and macroeconomic instability; financing and liquidity risks (including the availability and terms of debt and/or equity); TSX Venture Exchange and other regulatory approvals; counterparty risks; limitations and uncertainties relating to historical data and third-party reports (including the risk that historical results cannot be verified to NI 43-101 standards); force majeure events; litigation and enforcement risks; and those additional risks set out in the Company's public disclosure filings available on SEDAR+ at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on forward-looking statements. The purpose of forward-looking statements is to provide readers with information about management's current expectations and plans and may not be appropriate for other purposes. No assurance can be given that such statements will prove to be accurate; actual results and future events could differ materially. The Company undertakes no obligation to update or revise any forward-looking statements contained herein, except as required by applicable securities laws

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/272520

SOURCE: Silverco Mining Ltd.