DALLAS, Oct. 30, 2025 (GLOBE NEWSWIRE) -- CSW Industrials, Inc. (NYSE: CSW or the "Company") today reported record results for the fiscal 2026 second quarter period ended September 30, 2025.

Fiscal 2026 Second Quarter Highlights (comparisons to fiscal 2025 second quarter)

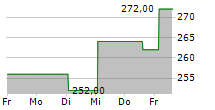

- Total revenue increased 21.5% to a quarter record of $277.0 million, driven by acquisitions during the last twelve months

- Net income attributable to CSW of $40.7 million, increased 12.8% to a second quarter record, compared to $36.1 million

- Earnings per diluted share ("EPS") of $2.41, increased 6.7% when compared to $2.26

- Adjusted EPS of $2.96, excluding the amortization of acquisition-related intangible assets and transaction expenses, increased 15.2% when compared to $2.57

- Adjusted EBITDA grew 19.9% to a quarter record of $72.9 million

- Paid down $35.0 million of debt in the quarter, strengthening the balance sheet and resulting in a net leverage ratio (net Debt to EBITDA), in accordance with our credit facility, of 0.12x

- Announced definitive agreement to acquire Motors & Armatures Parts ("MARS Parts") for $650 million, expected to close in November 2025

Fiscal 2026 First Half Highlights (comparisons to fiscal 2025 first half)

- Total revenue increased 19.0% to a record half of $540.6 million, driven by acquisitions during the last twelve months

- Net income attributable to CSW increased 9.3% to a record half of $81.6 million, as compared to $74.6 million

- EPS improved 2.3% to a record half of $4.84, compared to $4.73

- Adjusted EPS of $5.81, increased 8.6% when compared to $5.35

- Adjusted EBITDA increased 12.4% to a record half of $141.7 million

- Invested $325.5 million in acquisitions and $6.0 million in organic capital expenditures, while returning total cash of $32.1 million to shareholders through share repurchases of $23.0 million and dividends of $9.1 million

Comments from the Chairman, President, and Chief Executive Officer

Joseph B. Armes, CSW Industrials' Chairman, President, and Chief Executive Officer, commented, "I am very pleased to announce record revenue, net income, adjusted EBITDA, and adjusted EPS for the fiscal second quarter and first half of 2026. These results were driven by the outstanding performance of our recent acquisitions, which expanded our product offering in the HVAC/R and plumbing end markets. Upon the consummation of the MARS Parts acquisition expected in November, CSW will have invested an aggregate of $1.7 billion of capital in acquisitions over the past decade."

Armes continued, "Products recently added to the portfolio, that are used for repair versus replacement, innovative plumbing and HVAC/R electrical, were responsible for growth exceeding the end markets served. We expect to deliver record results for the full fiscal year in revenue, adjusted EBITDA, adjusted EPS, and operating cash flow."

Fiscal 2026 Second Quarter Consolidated Results

Fiscal second quarter revenue was $277.0 million, a $49.0 million or 21.5% increase over the prior year period. Total revenue growth included $61.9 million or 27.2% inorganic growth contributed by acquisitions over the last twelve months, which are all reported within the Contractor Solutions segment, offset by a decrease in organic revenue of $12.9 million or 5.6% due mostly to headwinds in the residential HVAC/R end market.

Gross profit in the fiscal second quarter was $119.2 million, representing 14.7% growth over $103.9 million in the prior year period. Gross margin contracted 260 bps to 43.0%, compared to 45.6% in the prior year period. The gross margin decrease was primarily a result of the inclusion of recent acquisitions and the inflation of some material costs, including the direct and indirect impact from tariffs, partially offset by pricing actions and favorable ocean freight costs.

Operating expenses as a percentage of revenue were 22.5%, or 21.9% adjusted to exclude $1.8 million in acquisition-related expenses in the current fiscal quarter, lower than the prior year period of 23.0% as we were able to leverage our operating costs. Operating expenses were $62.4 million or $60.6 million adjusted, compared to $52.4 million in the prior fiscal quarter due to additional expenses related to acquired companies.

Operating income in the current period was $56.8 million, or $58.5 million adjusted, compared to $51.5 million in the prior year period. Operating income as a percentage of revenue was 20.5%, or 21.1% adjusted, compared to 22.6% in the prior year period. The decrease in operating margin was a result of the previously mentioned contraction in the gross margin, partially offset by leveraging operating expenses.

Interest expense, net of interest income, was $1.3 million, in line with the prior year period amount of $1.3 million.

In the current period, reported net income attributable to CSW (net of non-controlling interest in the joint venture) improved 12.8% to $40.7 million, compared to $36.1 million in the prior year period. EPS was $2.41 per diluted share, an increase of 6.7% as compared to $2.26 per diluted share in the prior year period. Excluding the amortization of acquisition-related intangible assets and the aforementioned transaction expenses, adjusted EPS increased 15.2% to $2.96 per diluted share, compared to $2.57 per diluted share in the prior year period.

Fiscal 2026 second quarter adjusted EBITDA increased 19.9% to a record $72.9 million, up from $60.8 million in the prior year period. Adjusted EBITDA margin contracted 40 bps to 26.3%, compared to 26.7% in the prior year period due to the contraction in gross margin mostly offset by leveraging operating expenses.

The quarterly cash flows from operations was $61.8 million, as compared to $67.4 million in the prior year period. Excluding the $16.8 million deferral of a cash tax payment in the prior year period to the third fiscal quarter, the adjusted cash flows from operations increased $11.2 million or 22.2% primarily driven by increased profit.

Excluding the aforementioned $16.8 million deferral of a cash tax payment in the prior year period, adjusted free cash flow, defined as cash flow from operations minus capital expenditures, was $58.7 million, compared to $45.1 million in the prior year period, an increase of $13.6 million or 30.2% primarily driven by increased profit.

Following quarter-end, the Company announced its twenty-seventh consecutive regular quarterly cash dividend in the amount of $0.27 per share, which will be paid on November 14, 2025, to shareholders of record on October 31, 2025.

The Company's effective tax rate for the fiscal second quarter was 26.4%, as compared to 26.1% in the prior year period. Due to a potential $6.3 million release of uncertain tax position reserves upon statue expiration of several pre-acquisition tax returns, the GAAP effective tax rate for the fiscal third quarter may be lower than average.

On October 1, 2025, CSW Industrials announced a definitive agreement to acquire MARS Parts for $650 million in cash. The transaction also includes contingent consideration of up to $20 million based on the achievement of revenue targets during the twelve months after closing, which is expected in November 2025. The acquisition of MARS Parts will become CSW's largest acquisition to date. The acquisition will be funded with a new Term Loan A and borrowings under the Company's Revolving Credit Facility. Post-closing, the Company will have deployed an aggregate of over approximately $1.0 billion in capital toward acquisitions during fiscal 2026.

Fiscal 2026 Second Quarter Segment Results

Contractor Solutions segment revenue was $208.5 million, a $49.6 million or 31.2% increase over the prior year period, comprised of inorganic growth of $61.9 million from acquisitions in the last twelve months, offset by a 7.7% or $12.3 million reduction in organic revenue from decreased unit volumes. Organic unit volumes were down in the current quarter due to soft housing activity, and consumers' shift to repair of HVAC units versus replacement. As compared to the prior year period, net revenue growth was driven by the HVAC/R, electrical, and plumbing end markets. Including pre-acquisition revenue effect from recent acquisitions, as if they had been owned by the Company during the same period in the prior year, our organic revenue growth would have been 2.8% in the current quarter, despite market headwinds. Segment operating income improved to $53.4 million, or $54.9 million adjusted to exclude $1.6 million in acquisition-related expenses, compared to $46.3 million in the prior year period. The incremental profit resulted from the inclusion of recently acquired businesses, pricing actions, and favorable ocean freight and was partially offset by the impact of lower organic sales and increased tariffs. Segment operating income margin for the fiscal second quarter was 25.6%, or 26.3% adjusted, as compared to 29.1% in the prior year period primarily due to the gross margin impact of recent acquisitions on our overall profit margin and tariffs, offset somewhat by pricing actions and lower ocean freight costs. Segment adjusted EBITDA in the fiscal second quarter increased 25.9% to $67.6 million, or 32.4% of revenue, compared to $53.7 million, or 33.8% of revenue in the prior year period.

Specialized Reliability Solutions segment revenue was $38.8 million, flat to revenue reported in the prior year period. Revenue increased in the general industrial and mining end markets and declined in the energy and rail transportation end markets. Segment operating income was $5.1 million, as compared to $5.8 million in the prior year period, a decrease of 12.5%. Segment operating income margin for the fiscal second quarter was 13.1%, compared to the prior year period of 15.1% as a result of the escalation in material costs, indirectly driven by tariffs, as well as increased freight costs to support incremental growth of international shipments. Segment EBITDA in the fiscal second quarter was $6.4 million, or 16.5% of revenue, compared to $7.1 million, or 18.4% of revenue in the prior year period.

Engineered Building Solutions segment revenue was $31.9 million, a 2.3% decrease compared to $32.7 million in the prior year period due to softness in the market and strategic pricing in response to competitive pressures. Segment operating income was $4.8 million, or 15.1% of revenue, as compared to the prior year period of $6.1 million, or 18.6% of revenue. The reduction in operating income was driven by increased material costs and strategic pricing in response to competitive pressures. Segment EBITDA and EBITDA margin in the fiscal second quarter were $5.2 million and 16.4%, respectively, compared to $6.6 million and 20.1%, respectively, in the prior year period.

All percentages are calculated based upon the attached financial statements. Share counts used in determining the diluted EPS are based on a weighted average of outstanding shares throughout the reporting period.

Fiscal 2026 First Half Consolidated Results

Fiscal first half revenue was $540.6 million, representing 19.0% growth from $454.1 million in the prior year period, with growth coming from the Contractor Solutions reporting segment. Of the $86.5 million total growth, $105.6 million was inorganic from acquisitions in the last twelve months, offset by a $19.1 million or 4.2% decrease in organic revenue.

Gross profit in the fiscal first half was $234.6 million, representing $23.3 million or 11.0% growth from $211.3 million in the prior year period, with the incremental profit resulting predominantly from revenue growth and favorable ocean freight costs, partially offset by decreased organic volumes and increases in tariffs and material costs directly and indirectly driven by tariffs. Gross profit as a percentage of sales was 43.4%, compared to 46.5% in the prior year period. Gross margin decline was a result of the inclusion of recent acquisitions, increases in tariffs and material costs and unfavorable revenue mix, partially offset by pricing actions and favorable ocean freight costs.

Operating expenses as a percentage of revenue were 22.7%, or 22.4% adjusted, which was an improvement compared to the prior year period of 23.1%. Adjustment to operating expenses excludes $1.8 million of acquisition expenses during the current period related to the MARS and Aspen acquisitions. Operating expenses in the current year period were $123.0 million or $121.2 million adjusted as compared to $104.7 million in the prior year period. The additional expenses were related to recent acquisitions including amortization of intangible assets.

In the current period, operating income was $111.7 million or $113.4 million adjusted to exclude the aforementioned adjustment, as compared to $106.6 million in the prior year period. The incremental operating income resulted from the gross profit increase, partially offset by the operating expense increase as discussed above. Operating income margin in the current period decreased to 20.7% or 21.0% adjusted, compared to the prior year period of 23.5%. During the comparative periods, the decreased operating income margin was due to the decrease in gross margin, offset somewhat by the leverage of operating expenses.

Interest expense, net was $2.3 million, compared to $3.9 million in the prior year period. The decrease of $1.5 million was a result of a lower debt balance throughout the first half of the year.

Other income, net was $0.5 million, compared to other expense, net of $0.4 million in the prior year period. The change of $1.0 million was primarily related to gains arising from transactions in currencies other than functional currencies.

Net income attributable to CSW (net of non-controlling interest in the joint venture) increased to $81.6 million, compared to the prior year period of $74.6 million. EPS was $4.84, compared to $4.73 in the prior period. Excluding the amortization of acquisition-related intangible assets and the aforementioned transaction expenses, adjusted EPS was $5.81 vs. $5.35, an increase over the prior year period of 8.6%.

Fiscal 2026 first half adjusted EBITDA increased 12.4% to $141.7 million from $126.1 million in the prior year period. Adjusted EBITDA as a percentage of revenue contracted 160 bps to 26.2%, compared to 27.8%, in the prior year period.

Net cash provided by operating activities for the fiscal 2026 first half was $122.5 million, compared to $130.2 million in the prior year's first half. Excluding the $16.8 million cash tax payment deferral from the prior year period, operating cash flow during the first half of fiscal 2026 increased $9.1 million or 8.0% due to increased profit. The Company borrowed $135.0 million to fund the Aspen acquisition in May and paid down $75.0 million of debt in the first half, utilizing our cash flow from operations.

The Company's effective tax rate for the fiscal first half was 25.4%.

Fiscal 2026 First Half Segment Results

Contractor Solutions segment revenue was $405.2 million, a $86.0 million or 26.9% increase from the prior year period. Revenue growth was comprised of inorganic growth from acquisitions during the last twelve months ($105.6 million, or 33.1%, of growth), offset by a decrease in organic growth of $19.6 million or 6.2% due to decreased unit volumes. Organic unit volumes were down in the first half of the current fiscal year due to soft housing activity, a one-time stock up of inventory in the prior year first quarter for a customer's added distribution center network, and consumers' shift to repair of HVAC units versus replacement. As compared to the prior year period, net revenue growth was driven primarily by the HVAC/R, electrical, and plumbing end markets. Segment operating income in the current year period was $106.1 million, or $107.7 million adjusted to exclude $1.6 million in acquisition-related expenses, compared to $96.1 million in the prior year period. The incremental profit resulted primarily from the inclusion of recent acquisitions, pricing actions and favorable ocean freight costs, partially offset by decreased organic volumes and increased tariffs. Segment operating income margin was 26.2%, or 26.6% adjusted, compared to 30.1% in the prior year period, driven primarily by the inclusion of recent acquisitions, unfavorable revenue mix, and an increase in tariffs, partially offset by pricing actions and lower ocean freight costs. Segment adjusted EBITDA in the current period was $132.6 million, or 32.7% of revenue, compared to $112.0 million, or 35.1% of revenue in the prior year period.

Specialized Reliability Solutions segment revenue grew to $75.6 million, a $0.3 million or 0.4% increase from the prior year period of $75.3 million, with growth in the mining and general industrial end markets and a decrease in energy and rail transportation. In the current year period, Segment operating income was $10.3 million, or 13.7% of revenue, compared to the prior year period of $13.0 million, or 17.2% of revenue. The decline in segment operating income resulted from an escalation in material costs indirectly driven by tariffs and increased commodity rates, and the one-time expenses associated with consolidating a manufacturing plant. Segment EBITDA in the current period was $12.9 million, or 17.1% of revenue, compared to $15.6 million, or 20.7% of revenue in the prior year period.

Engineered Building Solutions segment revenue was $63.8 million, a $0.2 million or 0.4% increase over the prior year period. Segment operating income decreased 25.2% to $8.8 million, or 13.8% of revenue, compared to the prior year period of $11.8 million, or 18.6% of revenue, driven primarily by increased material costs, higher warranty expenses and strategic pricing in response to competitive pressures. Segment EBITDA in the current period was $9.7 million, or 15.1% of revenue, compared to $12.8 million, or 20.1% of revenue in the prior year period.

All percentages are calculated based upon the attached financial statements. Share count used in determining the diluted EPS is based on a weighted average of outstanding shares throughout the measurement period.

Conference Call Information

The Company will host a conference call today at 10:00 a.m. ET to discuss the results, followed by a question-and-answer session for the investment community. A live webcast of the call can be accessed at https://cswindustrials.gcs-web.com/. To access the call, participants may dial 1-877-407-0784, international callers may use 1-201-689-8560, and request to join the CSW Industrials earnings call.

A telephonic replay will be available shortly after the conclusion of the call and until Thursday, November 13, 2025. Participants may access the replay at 1-844-512-2921, international callers may use 1-412-317-6671 and enter access code 13756429. The call will also be available for replay via webcast link on the Investors portion of the CSW website www.cswindustrials.com.

Safe Harbor Statement

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. Words or phrases such as "may," "should," "expects," "could," "intends," "plans," "anticipates," "estimates," "believes," "forecasts," "predicts" or other similar expressions are intended to identify forward-looking statements, which include, without limitation, earnings forecasts, effective tax rate, statements relating to our business strategy and statements of expectations, beliefs, future plans and strategies and anticipated developments concerning our industry, business, operations, and financial performance and condition.

The forward-looking statements included in this press release are based on our current expectations, projections, estimates, and assumptions. These statements are only predictions, not guarantees. Such forward-looking statements are subject to numerous risks and uncertainties that are difficult to predict. These risks and uncertainties may cause actual results to differ materially from what is forecast in such forward-looking statements, and include, without limitation, the risk factors described from time to time in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K.

All forward-looking statements included in this press release are based on information currently available to us, and we assume no obligation to update any forward-looking statement except as may be required by law.

Non-GAAP Financial Measures

This press release includes an analysis of adjusted diluted earnings per share attributable to CSW, adjusted net income attributable to CSW, adjusted effective tax rate, adjusted operating income, adjusted operating cash flows, adjusted free cash flows and revenue calculated to include pre-acquisition revenue effect for recent acquisitions, which are non-GAAP financial measures of performance. Attributable to CSW is defined to exclude the income attributable to the non-controlling interest in the Whitmore JV.

CSW utilizes adjusted EBITDA (earnings before interest, tax, depreciation and amortization) as an additional consolidated, non-GAAP financial measure, which consists of consolidated net income including income attributable to the non-controlling interest in the Whitmore JV, adjusted to remove the impact of income taxes, interest expense, depreciation, amortization and impairment, and significant nonrecurring items.

For a reconciliation of these measures to the most directly comparable GAAP measures and for a discussion of why we consider these non-GAAP measures useful, see the "Reconciliation of Non-GAAP Measures" section of this release.

About CSW Industrials, Inc.

CSW Industrials is a diversified industrial growth company with industry-leading operations in three segments: Contractor Solutions, Specialized Reliability Solutions, and Engineered Building Solutions. CSW provides niche, value-added products with two essential commonalities: performance and reliability. The primary end markets we serve with our well-known brands include: HVAC/R, plumbing, electrical, general industrial, architecturally-specified building products, energy, mining, and rail transportation. For more information, please visit www.cswindustrials.com.

Investor Relations

Alexa Huerta

Vice President, Investor Relations and Treasurer

214-489-7113

alexa.huerta@cswindustrials.com

| CSW INDUSTRIALS, INC. CONSOLIDATED STATEMENTS OF INCOME (unaudited) | ||||||||||||||||

| Three Months Ended September 30, | Six Months Ended September 30, | |||||||||||||||

| (Amounts in thousands, except per share amounts) | 2025 | 2024 | 2025 | 2024 | ||||||||||||

| Revenues, net | $ | 276,951 | $ | 227,926 | $ | 540,597 | $ | 454,103 | ||||||||

| Cost of revenues | (157,766 | ) | (124,025 | ) | (305,970 | ) | (242,781 | ) | ||||||||

| Gross profit | 119,185 | 103,901 | 234,627 | 211,322 | ||||||||||||

| Selling, general and administrative expenses | (62,405 | ) | (52,352 | ) | (122,971 | ) | (104,712 | ) | ||||||||

| Operating income | 56,780 | 51,549 | 111,656 | 106,610 | ||||||||||||

| Interest expense, net | (1,320 | ) | (1,341 | ) | (2,341 | ) | (3,861 | ) | ||||||||

| Other income (loss), net | 8 | (677 | ) | 536 | (418 | ) | ||||||||||

| Income before income taxes | 55,468 | 49,531 | 109,851 | 102,331 | ||||||||||||

| Provision for income taxes | (14,654 | ) | (12,910 | ) | (27,867 | ) | (26,859 | ) | ||||||||

| Net income | 40,814 | 36,621 | 81,984 | 75,472 | ||||||||||||

| Less: Income attributable to redeemable noncontrolling interest | (158 | ) | (570 | ) | (403 | ) | (828 | ) | ||||||||

| Net income attributable to CSW Industrials, Inc. | $ | 40,656 | $ | 36,051 | $ | 81,581 | $ | 74,644 | ||||||||

| Net income per share attributable to CSW Industrials, Inc. | ||||||||||||||||

| Basic | $ | 2.42 | $ | 2.27 | $ | 4.86 | $ | 4.75 | ||||||||

| Diluted | $ | 2.41 | $ | 2.26 | $ | 4.84 | $ | 4.73 | ||||||||

| Weighted average number of shares outstanding: | ||||||||||||||||

| Basic | 16,785 | 15,866 | 16,796 | 15,701 | ||||||||||||

| Diluted | 16,842 | 15,941 | 16,852 | 15,770 | ||||||||||||

| CSW INDUSTRIALS, INC. CONSOLIDATED BALANCE SHEETS (unaudited) | ||||||||

| (Amounts in thousands, except for per share amounts) | September 30, 2025 | March 31, 2025 | ||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 31,471 | $ | 225,845 | ||||

| Accounts receivable, net of allowance for expected credit losses of $835 and $1,137, respectively | 159,368 | 155,651 | ||||||

| Inventories, net | 234,563 | 194,876 | ||||||

| Prepaid expenses and other current assets | 22,366 | 16,489 | ||||||

| Total current assets | 447,768 | 592,861 | ||||||

| Property, plant and equipment, net of accumulated depreciation of $120,862 and $113,219, respectively | 98,452 | 93,415 | ||||||

| Goodwill | 365,308 | 264,092 | ||||||

| Intangible assets, net | 526,838 | 357,910 | ||||||

| Other assets | 79,587 | 70,787 | ||||||

| Total assets | $ | 1,517,953 | $ | 1,379,065 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 69,083 | $ | 54,767 | ||||

| Accrued and other current liabilities | 93,022 | 92,435 | ||||||

| Total current liabilities | 162,105 | 147,202 | ||||||

| Long-term debt | 60,000 | - | ||||||

| Retirement benefits payable | 1,061 | 1,083 | ||||||

| Other long-term liabilities | 146,230 | 138,347 | ||||||

| Total liabilities | 369,396 | 286,632 | ||||||

| Commitments and contingencies (See Note 13) | ||||||||

| Redeemable noncontrolling interest | 18,590 | 20,187 | ||||||

| Equity: | ||||||||

| Common shares, $0.01 par value | 178 | 177 | ||||||

| Additional paid-in capital | 512,719 | 501,286 | ||||||

| Treasury shares, at cost (1,115 and 1,027 shares, respectively) | (148,431 | ) | (122,125 | ) | ||||

| Retained earnings | 777,496 | 705,035 | ||||||

| Accumulated other comprehensive loss | (11,995 | ) | (12,127 | ) | ||||

| Total equity | 1,129,967 | 1,072,246 | ||||||

| Total liabilities, redeemable noncontrolling interest and equity | $ | 1,517,953 | $ | 1,379,065 | ||||

| CSW INDUSTRIALS, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited) | ||||||||

| Six Months Ended September 30, | ||||||||

| (Amounts in thousands) | 2025 | 2024 | ||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 81,984 | $ | 75,472 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation | 7,848 | 7,045 | ||||||

| Amortization of acquisition-related intangible assets & inventory step-up | 19,889 | 12,831 | ||||||

| Amortization of deferred financing fees | 499 | 383 | ||||||

| Provision for inventory reserves | 218 | 840 | ||||||

| Provision for credit losses | 249 | 723 | ||||||

| Share-based compensation | 7,628 | 6,891 | ||||||

| Net loss (gain) on disposals of property, plant and equipment | 208 | (39 | ) | |||||

| Net pension benefit | 33 | 33 | ||||||

| Net deferred taxes | 296 | 1,516 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 11,685 | 11,301 | ||||||

| Inventories | (10,129 | ) | (25,282 | ) | ||||

| Prepaid expenses and other current assets | (5,679 | ) | (2,085 | ) | ||||

| Other assets | 176 | 153 | ||||||

| Accounts payable and other current liabilities | 7,298 | 40,326 | ||||||

| Retirement benefits payable and other liabilities | 264 | 61 | ||||||

| Net cash provided by operating activities | 122,467 | 130,169 | ||||||

| Cash flows from investing activities: | ||||||||

| Capital expenditures | (5,984 | ) | (8,587 | ) | ||||

| Proceeds from sale of assets | 54 | 43 | ||||||

| Cash paid for investments | - | (500 | ) | |||||

| Cash paid for acquisitions, net of cash received | (325,509 | ) | (32,305 | ) | ||||

| Net cash used in investing activities | (331,439 | ) | (41,349 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Borrowings on line of credit | 138,394 | 32,723 | ||||||

| Repayments of line of credit | (78,394 | ) | (198,723 | ) | ||||

| Payments of deferred loan costs | (2,837 | ) | - | |||||

| Purchase of treasury shares | (26,073 | ) | (12,287 | ) | ||||

| Payments of contingent consideration | (4,875 | ) | (700 | ) | ||||

| Proceeds from equity issuance | - | 347,407 | ||||||

| Distributions to redeemable noncontrolling interest shareholder | (2,000 | ) | - | |||||

| Dividends | (9,074 | ) | (6,523 | ) | ||||

| Net cash provided by financing activities | 15,141 | 161,897 | ||||||

| Effect of exchange rate changes on cash and equivalents | (543 | ) | 347 | |||||

| Net change in cash and cash equivalents | (194,374 | ) | 251,064 | |||||

| Cash and cash equivalents, beginning of period | 225,845 | 22,156 | ||||||

| Cash and cash equivalents, end of period | $ | 31,471 | $ | 273,220 | ||||

Reconciliation of Non-GAAP Measures

We use adjusted earnings per share attributable to CSW, adjusted net income attributable to CSW, adjusted operating income, adjusted effective tax rate, adjusted EBITDA, adjusted operating cash flows, adjusted free cash flows and revenue calculated to include pre-acquisition revenue effect for recent acquisitions, together with financial measures prepared in accordance with GAAP, such as revenue, cost of revenue, operating expense, operating income, net income attributable to CSW and operating cash flows, to assess our historical and prospective operating performance and to enhance our understanding of our core operating performance. Free cash flow is a non-GAAP financial measure and is defined as cash flow from operations less capital expenditures. We also believe these measures are useful for investors to assess the operating performance of our business without the effect of non-recurring items. In the following tables, there could be immaterial differences in amounts presented due to rounding.

| CSW INDUSTRIALS, INC. | ||||||||||||||||

| RECONCILIATION OF NET INCOME ATTRIBUTABLE TO CSW TO ADJUSTED NET INCOME ATTRIBUTABLE TO CSW | ||||||||||||||||

| (Unaudited) | ||||||||||||||||

| (Amounts in thousands) | Three Months Ended September 30, | Six Months ended September 30, | ||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net income attributable to CSW | $ | 40,656 | $ | 36,052 | $ | 81,581 | $ | 74,643 | ||||||||

| Adjusting items: | ||||||||||||||||

| Amortization of acquisition-related intangible assets and inventory step-up | 10,478 | 6,519 | 19,890 | 12,830 | ||||||||||||

| Amortization tax effect | (2,588 | ) | (1,610 | ) | (4,913 | ) | (3,169 | ) | ||||||||

| Acquisition-related transaction expenses, net of tax effect | 1,325 | - | 1,325 | - | ||||||||||||

| Adjusted net income attributable to CSW | $ | 49,871 | $ | 40,960 | $ | 97,883 | $ | 84,304 | ||||||||

| Net Income Attributable to CSW per diluted common share | $ | 2.41 | $ | 2.26 | $ | 4.84 | $ | 4.73 | ||||||||

| Adjusting Items, per dilutive common share: | ||||||||||||||||

| Amortization of acquisition-related intangible assets and inventory step-up | 0.62 | 0.41 | 1.18 | 0.81 | ||||||||||||

| Amortization tax effect | (0.15 | ) | (0.10 | ) | (0.29 | ) | (0.20 | ) | ||||||||

| Acquisition-related transaction expenses, net of tax effect | 0.08 | - | 0.08 | - | ||||||||||||

| Adjusted net income attributable to CSW per dilutive common share | $ | 2.96 | $ | 2.57 | $ | 5.81 | $ | 5.35 | ||||||||

| CSW Industrials, Inc. | ||||||||||||||||

| Reconciliation of Effective Tax Rate to Adjusted Effective Rate | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| (Amounts in thousands) | Three Months Ended September 30, | Six Months Ended September 30, | ||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| GAAP income before tax | $ | 55,468 | $ | 49,531 | $ | 109,851 | $ | 102,331 | ||||||||

| Adjusting items: | ||||||||||||||||

| Acquisition-related transaction expenses | 1,759 | - | 1,759 | - | ||||||||||||

| Adjusted income before tax | $ | 57,227 | $ | 49,531 | $ | 111,610 | $ | 102,331 | ||||||||

| GAAP provision for income tax | 14,655 | 12,909 | 27,866 | 26,859 | ||||||||||||

| Adjusting items: | ||||||||||||||||

| Tax impact of acquisition-related transaction expenses | 434 | - | 434 | - | ||||||||||||

| Adjusted provision for income tax | $ | 15,089 | $ | 12,909 | $ | 28,301 | $ | 26,859 | ||||||||

| GAAP effective tax rate | 26.4 | % | 26.1 | % | 25.4 | % | 26.2 | % | ||||||||

| Adjusted effective tax rate | 26.4 | % | 26.1 | % | 25.4 | % | 26.2 | % | ||||||||

| CSW Industrials, Inc. | ||||||||

| Reconciliation of Contractor Solutions Segment Reported Revenue to Revenue Calculated to Include Pre-Acquisition Revenue Effect | ||||||||

| (unaudited) | ||||||||

| (Amounts in thousands) | Three Months Ended September 30, | |||||||

| 2025 | 2024 | |||||||

| Contractor Solutions Segment Reported Revenue, Net | $ | 208,468 | $ | 158,834 | ||||

| Adjusting Items: | ||||||||

| Pre-acquisition revenue effect for recent acquisitions (a) | - | 44,025 | ||||||

| $ | 208,468 | $ | 202,859 | |||||

| (a) Revenue effect from Aspen, PF WaterWorks and PSP Products acquisitions as if the acquisitions had been owned by CSW during the three months ended September 30, 2024. This calculation is provided to allow investors to understand our organic growth, including pre-acquisition revenue effect from recent acquisitions, on a comparable basis. | ||||||||

| CSW INDUSTRIALS, INC. | ||||||||||||||||

| Reconciliation of Net Income Attributable to CSW to Adjusted EBITDA | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| (Amounts in thousands) | Three Months Ended September 30, | Six Months Ended September 30, | ||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net Income attributable to CSW | $ | 40,656 | $ | 36,051 | $ | 81,581 | $ | 74,643 | ||||||||

| Plus: Income attributable to redeemable noncontrolling interest | 158 | 570 | 403 | 829 | ||||||||||||

| Net Income | $ | 40,814 | $ | 36,621 | $ | 81,984 | $ | 75,472 | ||||||||

| Adjusting Items: | ||||||||||||||||

| Interest expense, net | 1,320 | 1,341 | 2,342 | 3,861 | ||||||||||||

| Income tax expense | 14,655 | 12,909 | 27,866 | 26,859 | ||||||||||||

| Depreciation & amortization | 14,392 | 9,951 | 27,730 | 19,883 | ||||||||||||

| EBITDA | $ | 71,180 | $ | 60,823 | $ | 139,922 | $ | 126,075 | ||||||||

| EBITDA % Revenue | 26.3 | % | 26.7 | % | 26.2 | % | 27.8 | % | ||||||||

| EBITDA Adjustments: | ||||||||||||||||

| Acquisition-related transaction expenses | 1,759 | - | 1,759 | - | ||||||||||||

| Adjusted EBITDA | $ | 72,939 | $ | 60,823 | $ | 141,681 | $ | 126,075 | ||||||||

| Adjusted EBITDA % Revenue | 26.3 | % | 26.7 | % | 26.2 | % | 27.8 | % | ||||||||

| CSW INDUSTRIALS, INC. | ||||||||||||||||

| Reconciliation of Segment Operating Income to Segment Adjusted EBITDA | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| (Amounts in thousands) | Three Months Ended September 30, 2025 | |||||||||||||||

| Contractor Solutions | Specialized Reliability Solutions | Engineered Building Solutions | Corporate and Other | Consolidated | ||||||||||||

| Revenue, net | $ | 208,468 | $ | 38,806 | $ | 31,914 | $ | (2,236 | ) | $ | 276,951 | |||||

| Operating Income | $ | 53,375 | $ | 5,093 | $ | 4,832 | $ | (6,519 | ) | $ | 56,780 | |||||

| Adjusting Items: | ||||||||||||||||

| Transaction expenses | 1,550 | - | - | 209 | 1,759 | |||||||||||

| Adjusted Operating Income | $ | 54,925 | $ | 5,093 | $ | 4,832 | $ | (6,310 | ) | $ | 58,539 | |||||

| % Revenue | 26.3 | % | 13.1 | % | 15.1 | % | 21.1 | % | ||||||||

| Adjusting Items: | ||||||||||||||||

| Other income (expense), net | 133 | (19 | ) | (40 | ) | (67 | ) | 8 | ||||||||

| Depreciation & amortization | 12,555 | 1,347 | 440 | 49 | 14,392 | |||||||||||

| Adjusted EBITDA | $ | 67,613 | $ | 6,421 | $ | 5,233 | $ | (6,328 | ) | $ | 72,939 | |||||

| % Revenue | 32.4 | % | 16.5 | % | 16.4 | % | 26.3 | % | ||||||||

| (Amounts in thousands) | Three Months Ended September 30, 2024 | |||||||||||||||

| Contractor Solutions | Specialized Reliability Solutions | Engineered Building Solutions | Corporate and Other | Consolidated | ||||||||||||

| Revenue, net | $ | 158,834 | $ | 38,534 | $ | 32,673 | $ | (2,115 | ) | $ | 227,926 | |||||

| Operating Income | $ | 46,254 | $ | 5,819 | $ | 6,082 | $ | (6,606 | ) | $ | 51,550 | |||||

| % Revenue | 29.1 | % | 15.1 | % | 18.6 | % | 22.6 | % | ||||||||

| Adjusting Items: | ||||||||||||||||

| Other income (expense), net | (543 | ) | (121 | ) | (12 | ) | (2 | ) | (678 | ) | ||||||

| Depreciation & amortization | 8,002 | 1,409 | 494 | 45 | 9,951 | |||||||||||

| Adjusted EBITDA | $ | 53,713 | $ | 7,108 | $ | 6,564 | $ | (6,562 | ) | $ | 60,823 | |||||

| % Revenue | 33.8 | % | 18.4 | % | 20.1 | % | 26.7 | % | ||||||||

| CSW INDUSTRIALS, INC. | ||||||||||||||||

| Reconciliation of Segment Operating Income to Segment Adjusted EBITDA | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| (Amounts in thousands) | Six Months Ended September 30, 2025 | |||||||||||||||

| Contractor Solutions | Specialized Reliability Solutions | Engineered Building Solutions | Corporate and Other | Consolidated | ||||||||||||

| Revenue, net | $ | 405,208 | $ | 75,611 | $ | 63,810 | $ | (4,033 | ) | $ | 540,597 | |||||

| Operating Income | $ | 106,134 | $ | 10,335 | $ | 8,831 | $ | (13,643 | ) | $ | 111,656 | |||||

| Adjusting Items: | ||||||||||||||||

| Transaction expenses | 1,550 | - | - | 209 | 1,759 | |||||||||||

| Adjusted Operating Income | $ | 107,684 | $ | 10,335 | $ | 8,831 | $ | (13,434 | ) | $ | 113,415 | |||||

| % Revenue | 26.6 | % | 13.7 | % | 13.8 | % | 21.0 | % | ||||||||

| Adjusting Items: | ||||||||||||||||

| Other income (expense), net | 831 | (94 | ) | (32 | ) | (168 | ) | 536 | ||||||||

| Depreciation & amortization | 24,095 | 2,684 | 856 | 94 | 27,730 | |||||||||||

| Adjusted EBITDA | $ | 132,609 | $ | 12,924 | $ | 9,655 | $ | (13,508 | ) | $ | 141,681 | |||||

| % Revenue | 32.7 | % | 17.1 | % | 15.1 | % | 26.2 | % | ||||||||

| (Amounts in thousands) | Six Months Ended September 30, 2024 | |||||||||||||||

| Contractor Solutions | Specialized Reliability Solutions | Engineered Building Solutions | Corporate and Other | Consolidated | ||||||||||||

| Revenue, net | $ | 319,252 | $ | 75,325 | $ | 63,566 | $ | (4,041 | ) | $ | 454,103 | |||||

| Operating Income | $ | 96,138 | $ | 12,970 | $ | 11,806 | $ | (14,304 | ) | $ | 106,610 | |||||

| % Revenue | 30.1 | % | 17.2 | % | 18.6 | % | 23.5 | % | ||||||||

| Adjusting Items: | ||||||||||||||||

| Other income (expense), net | (147 | ) | (183 | ) | (19 | ) | (68 | ) | (418 | ) | ||||||

| Depreciation & amortization | 15,985 | 2,832 | 979 | 87 | 19,883 | |||||||||||

| Adjusted EBITDA | $ | 111,976 | $ | 15,619 | $ | 12,766 | $ | (14,285 | ) | $ | 126,075 | |||||

| % Revenue | 35.1 | % | 20.7 | % | 20.1 | % | 27.8 | % | ||||||||

| CSW INDUSTRIALS, INC. | ||||||||||||||||

| Reconciliation of Operating Cash Flow to Free Cash Flow | ||||||||||||||||

| (Unaudited) | ||||||||||||||||

| (Amounts in thousands) | Three Months Ended September 30, | Six Months Ended September 30, | ||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net cash provided by operating activities | $ | 61,826 | $ | 67,401 | $ | 122,467 | $ | 130,169 | ||||||||

| Adjusting Item: | ||||||||||||||||

| Deferred cash tax payment under a federal tax relief | - | (16,800 | ) | - | (16,800 | ) | ||||||||||

| Adjusted net cash provided by operating activities | 61,826 | 50,601 | 122,467 | 113,369 | ||||||||||||

| Less: Capital expenditures | (3,080 | ) | (5,486 | ) | (5,984 | ) | (8,587 | ) | ||||||||

| Adjusted free cash flow | $ | 58,746 | $ | 45,115 | $ | 116,483 | $ | 104,782 | ||||||||

| Adjusted EBITDA | 72,939 | 60,823 | 141,681 | 126,075 | ||||||||||||

| Adj. free cash flow % Adj. EBITDA | 80.5 | % | 74.2 | % | 82.2 | % | 83.1 | % | ||||||||