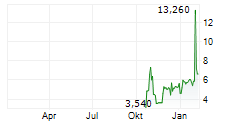

NEW YORK CITY, NEW YORK / ACCESS Newswire / October 30, 2025 / On October 23, 2025, Texxon Holding Limited (Nasdaq:NPT) (the "Company" or "Texxon"), a leading provider of supply chain management services in the plastics and chemical industries in East China, announced the closing of its Initial Public Offering (the "Offering") of 1,900,000 ordinary shares at a public offering price of US$5.00 per ordinary share. The ordinary shares began trading on the Nasdaq Capital Market on October 22, 2025, under the ticker symbol "NPT."

The Offering was conducted on a firm commitment basis. D. Boral Capital LLC acted as the Sole Bookrunner for the Offering.

On October 28th, 2025, the Company announced that D. Boral Capital has exercised in full their option to purchase an additional 285,000 ordinary shares at a public offering price of $5.00 per share to cover over-allotments. Gross proceeds of the Company's Initial Public Offering, including the exercise of the over-allotment, totaled ~$11,000,000, before deducting underwriting discounts and other related expenses.

The net proceeds from the Offering will be used for (i) construction of a factory to manufacture polystyrene, including production lines, storage facilities, and supporting infrastructure, located in Henan Province, China (the "Henan Polystyrene Factory"), and operations and the expansion of production facilities at the Henan Polystyrene Factory; (ii) updating supply chain management platform; and (iii) working capital.

A registration statement on Form F-1 relating to the Offering, as amended, has been filed with the U.S. Securities and Exchange Commission (the "SEC") (File Number: 333-281530) and was declared effective by the SEC on September 30, 2025. The Offering was made only by means of a prospectus. Copies of the prospectus relating to the Offering may be obtained from D. Boral Capital LLC by standard mail to D. Boral Capital LLC, 590 Madison Avenue, 39th Floor, New York, NY 10022, or by email at info@dboralcapital.com, or by calling +1 (212) 970-5150. In addition, copies of the final prospectus relating to the Offering can also be obtained via the SEC's website at www.sec.gov.

This press release does not constitute an offer to sell, or the solicitation of an offer to buy any of the Company's securities, nor shall such securities be offered or sold in the United States absent registration or an applicable exemption from registration, nor shall there be any offer, solicitation or sale of any of the Company's securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

About Texxon Holding Limited

Texxon Holding Limited is a leading provider of supply chain management services in the plastics and chemical industries in East China. Through its technology-enabled platform, the Company provides a full spectrum of services to Chinese SME customers, including procurement, shipping and logistics, payments and fulfillment services. It aspires to build the largest one-stop plastic and chemical raw material supply chain management platform in China, to streamline the complex and labor-intensive raw material procurement process and enhance convenience, cost-effectiveness, and efficiency for customers. Texxon has built a highly scalable distributed software architecture for continuous improvement, and an effective User Experience Design (UED) process to improve the customer experience. In addition, with over a decade of experience, the Company has amassed substantial transaction data, including supplier and customer information, price trends, category-specific price indexes and market demand volume, to analyze price trends and market demands and make informed decisions. For more information, please visit the Company's website: ir.npt-cn.com.

About D. Boral Capital

D. Boral Capital LLC is a premier, relationship-driven global investment bank headquartered in New York. The firm is dedicated to delivering exceptional strategic advisory and tailored financial solutions to middle-market and emerging growth companies. With a proven track record, D. Boral Capital provides expert guidance to clients across diverse sectors worldwide, leveraging access to capital from key markets, including the United States, Asia, Europe, the Middle East, and Latin America.

A recognized leader on Wall Street, D. Boral Capital has successfully aggregated approximately $35 billion in capital since its inception in 2020, executing ~350 transactions across a broad range of investment banking products.

Forward Looking Statement

Certain statements in this announcement are forward-looking statements, including, but not limited to, the Company's proposed offering. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company's current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy, and financial needs. Investors can find many (but not all) of these statements by the use of words such as "believe", "plan", "expect", "intend", "should", "seek", "estimate", "will", "aim" and "anticipate" or other similar expressions in its prospectus. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Registration Statement and other filings with the SEC.

For more information, please contact:

D. Boral Capital LLC

Email: info@dboralcapital.com

Telephone: +1 (212) 970-5150

SOURCE: D. Boral Capital

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/banking-and-financial-services/d.-boral-capital-acted-as-sole-bookrunner-to-texxon-holding-limited-1093637