SHANGHAI, Nov. 18, 2025 /PRNewswire/ -- Texxon Holding Limited (Nasdaq: NPT) (the "Company" or "Texxon"), a leading provider of supply chain management services in the plastics and chemical industries in East China, today announced its financial results for the fiscal year ended June 30, 2025.

Mr. Hui Xu, Chief Executive Officer and Chairman of Texxon, commented: "We are pleased to report strong results for the fiscal year ended June 30, 2025. To align with evolving market conditions and the broader industry environment, we implemented a strategic shift in our sales and marketing efforts toward high-growth sectors such as automotive, new energy, and chemical industries. Leveraging our core strengths in basic chemicals and plastic particles, we expanded our sales team to further broaden our customer base, market coverage, and penetration across China."

"The refinement of our basic chemical product portfolio contributed to an improved average selling price. Our plastic particle sales surged as sales volume increased in response to increased demand, driven by their expanded application in new fields such as automotive, new energy and chemical industries, despite a decline in selling prices. Collectively, these initiatives drove an 18.5% increase in overall revenue, highlighted by an 88.5% surge in plastic-particle sales, while basic-chemical sales slightly grew 1.5%."

"We prioritized business scale and long-term customer relationships over short-term margin gains. While this strategy temporarily compressed gross margin and profit, we believe it will strengthen customer retention, stabilize cash flows, and support sustainable profitability over the long term."

"We are accelerating the construction of a factory to manufacture polystyrene, including production lines, storage facilities, and supporting infrastructure, located in Henan Province, China (the "Henan Polystyrene Factory"), which is scheduled to begin production in the fourth quarter of 2025. Once operational, we expect it will enable us to better meet market demand and capture higher margins amid potential shortages in chemical and plastic raw materials."

"Looking ahead, we remain committed to achieving profitable growth through enhanced operational efficiency, deeper customer relationships, and disciplined product portfolio and pricing strategies. We believe, these initiatives will support long-term shareholder value and position Texxon for continued growth in an increasingly dynamic market."

Fiscal Year 2025 Financial Summary

- Revenue was $797.15 million for fiscal year 2025, representing an increase of 18.5% from $672.66 million for fiscal year 2024.

- Gross profit was $4.70 million for fiscal year 2025, compared to $4.82 million for fiscal year 2024.

- Gross profit margin was 0.6% for fiscal year 2025, compared to 0.7% for fiscal year 2024.

- Net loss was $1.45 million for fiscal year 2025, compared to net income of $2.51 million for fiscal year 2024.

- Net loss attributable to Texxon was $0.93 million for fiscal year 2025, compared to net income attributable to Texxon of $0.95 million for fiscal year 2024.

- Basic and diluted losses per share were $0.05 for fiscal year 2025, compared to basic and diluted earnings per share of $0.05 for fiscal year 2024.

Fiscal Year 2025 Financial Results

Revenue

Revenue was $797.15 million for fiscal year 2025, representing an increase of 18.5% from $672.66 million for fiscal year 2024.

| (($ millions, except for percentages) | | For the Fiscal Year Ended June 30, | | | Change | | ||||||||||||||||||

| In million | | 2025 | | | % | | | 2024 | | | % | | | $ | | | % | | ||||||

| Revenue: | | | | | | | | | | | | | | | | | | | ||||||

| Basic chemicals | | $ | 524.64 | | | | 65.8 | % | | $ | 517.03 | | | | 76.9 | % | | $ | 7.61 | | | | 1.5 | % |

| Plastic particles | | | 272.39 | | | | 34.2 | % | | | 144.50 | | | | 21.5 | % | | | 127.89 | | | | 88.5 | % |

| Other products | | | 0.12 | | | | 0.0 | % | | | 11.13 | | | | 1.6 | % | | | (11.02) | | | | (98.9) | % |

| Total revenue | | $ | 797.15 | | | | 100 | % | | $ | 672.66 | | | | 100 | % | | $ | 124.49 | | | | 18.5 | % |

- Sales of basic chemicals were $524.64 million for fiscal year 2025, representing an increase of 1.5% from $517.03 million for fiscal year 2024. The increase was primarily attributable to an increase in average sales price.

- Sales of plastic particles were $272.39 million for fiscal year 2025, representing an increase of 88.5% from $144.50 million for fiscal year 2024. The increase was primarily attributable to an increase in sales volume.

- Sales of other products were $0.12 million for fiscal year 2025, compared to $11.13 million for fiscal year 2024. The decrease in revenue was primarily attributable to no sales of black metal for the fiscal year 2025, which had contributed approximately $11.0 million revenue from sales of other products for the fiscal year 2024.

Cost of Sales

Cost of sales was $792.45 million for fiscal year 2025, representing an increase of 18.7% from $667.85 million for fiscal year 2024. The increase in cost of sales was largely attributable to the increase in the Company's sales volume of plastic particles by approximately 188.7 thousand tons, or 138.3%. The increase in cost of sales is in line with the increase in revenue.

Gross Profit and Gross Profit Margin

Gross profit was $4.70 million for fiscal year 2025, compared to $4.82 million for fiscal year 2024.

Gross profit margin was 0.6% for fiscal year 2025, compared to 0.7% for fiscal year 2024. Gross profit and gross margin decreased primarily due to the Company's strategic shift toward serving major customers, to whom the Company offered more competitive pricing. The Company prioritized expanding business scale and strengthening long-term customer relationships over pursuing short-term high-margin transactions. This strategy temporarily reduced gross margin but is expected to enhance customer retention, stabilize cash flows, and support sustainable profitability growth in the long term.

Operating Expenses

Operating expenses were $5.30 million for fiscal year 2025, representing an increase of 27.5% from $4.16 million for fiscal year 2024.

- Selling expenses were $2.41 million for fiscal year 2025, representing an increase of 21.2% from $1.99 million for fiscal year 2024. The increase in selling expenses was mainly due to (i) salary and welfare benefit expenses increased by approximately $0.3 million mainly due to the addition of marketing personnel to support the Company's business expansion and higher commissions and bonuses paid to sales staff in connection with the increase in sales; (ii) shipping and delivery expenses increased by approximately $0.1 million, or 7.2%, from approximately $1.0 million for the fiscal year 2024 to approximately $1.1 million for the fiscal year 2025. This increase was primarily due to an increase in sales volume and increased use of third-party shipping services for the sale of plastic particles. The total sales volume of plastic particles increased by 189 thousand tons, or 138.8%, from 136.0 thousand tons for the fiscal year 2024 to 324.8 thousand tons for the fiscal year 2025.

- General and administrative expenses were $2.89 million for fiscal year 2025, representing an increase of 33.3% from $2.17 million for fiscal year 2024. The increase was mainly due to (i) an expected credit loss of approximately $0.7 million for the fiscal year 2025, compared to $1,385 of credit loss recovered for the fiscal year 2024, primarily due to full credit losses established against specific customer receivables following assessment of credit deterioration; and (ii) an increase in salary and welfare benefit expenses of approximately $0.1 million due to an increase in personnel in general and administrative department, (iii) an increase in depreciation and amortization expenses of approximately $0.1 million, partially offset by (iv) a decrease in professional services fee of approximately $0.2 million.

- Other expenses were $1.37 million for fiscal year 2025, compared to other income of $2.57 million for fiscal year 2024. The decrease was primarily attributable to one-time government grants of approximately $2.9 million received in connection with the construction of Henan Polystyrene Factory, which are recognized as a reduction of the cost of construction in progress rather than as other income.

Net Income (loss)

Net loss was $1.45 million for fiscal year 2025, compared to net income of $2.51 million for fiscal year 2024. Net loss attributable to Texxon was $0.93 million for fiscal year 2025, compared to net income attributable to Texxon of $0.95 million for fiscal year 2024.

Basic and Diluted Earnings (losses) per Share

Basic and diluted losses per share were $0.05 for fiscal year 2025, compared to basic and diluted earnings per share of $0.05 for fiscal year 2024.

Financial Condition

As of June 30, 2025, the Company had cash and cash equivalents of $2.52 million, an increase from $0.27 million as of June 30, 2024.

Net cash provided by operating activities was $2.32 million for fiscal year 2025, compared to net cash used in operating activities of $30.80 million for fiscal year 2024.

Net cash used in investing activities was $42.25 million for fiscal year 2025, compared to $11.02 million for fiscal year 2024.

Net cash provided by financing activities was $41.36 million for fiscal year 2025, compared to $29.36 million for fiscal year 2024.

Recent Development

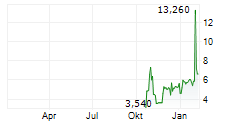

On October 23, 2025, the Company completed its initial public offering (the "Offering") of 1,900,000 ordinary shares at a public price of US$5.00 per share. On October 28, 2025, the underwriters of the Offering fully exercised their over-allotment option to purchase an additional 285,000 ordinary shares of the Company at the public offering price of US$5.00 per share. The gross proceeds were US$10,925,000 from the Offering, before deducting underwriting discounts and commissions, and other expenses. The Company's ordinary shares began trading on the Nasdaq Capital Market on October 22, 2025, under the ticker symbol "NPT."

About Texxon Holding Limited

Texxon Holding Limited is a leading provider of supply chain management services in the plastics and chemical industries in East China. Through its technology-enabled platform, the Company provides a full spectrum of services to Chinese SME customers, including procurement, shipping and logistics, payments and fulfillment services. It aspires to build the largest one-stop plastic and chemical raw material supply chain management platform in China, to streamline the complex and labor-intensive raw material procurement process and enhance convenience, cost-effectiveness, and efficiency for customers. Texxon has built a highly scalable distributed software architecture for continuous improvement, and an effective User Experience Design (UED) process to improve the customer experience. In addition, with over a decade of experience, the Company has amassed substantial transaction data, including supplier and customer information, price trends, category-specific price indexes and market demand volume, to analyze price trends and market demands and make informed decisions. For more information, please visit the Company's website: ir.npt-cn.com.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements, including, but not limited to, the timeline and effects regarding the construction and production of the Henan Polystyrene Factory. These forward-looking statements involve known and unknown risks and uncertainties related to market conditions, and other factors discussed in the "Risk Factors" section of the Company's Annual Report on Form 20-F for the fiscal year ended June 30, 2025 filed with the U.S. Securities and Exchange Commission (the "SEC") and are based on the Company's current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can find many (but not all) of these statements by the use of words such as "approximates," "believes," "hopes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "will," "would," "should," "could," "may" or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company's latest annual report on Form 20-F and other filings with the SEC. Additional factors are discussed in the Company's filings with the SEC, which are available for review at www.sec.gov.

For more information, please contact:

Texxon Holding Limited

Investor Relations Department

Email: [email protected]

Ascent Investor Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: [email protected]

| TEXXON HOLDING LIMITED AND SUBSIDIARIES | ||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||

| AS OF JUNE 30, 2025 AND 2024 | ||||||||

| (EXPRESSED IN U.S. DOLLARS) | ||||||||

| | ||||||||

| | | June 30, 2025 | | | June 30, 2024 | | ||

| ASSETS | | | | | | | ||

| CURRENT ASSETS: | | | | | | | ||

| Cash and cash equivalents | | $ | 2,517,577 | | | $ | 272,895 | |

| Restricted cash | | | 562 | | | | 785,105 | |

| Accounts receivable, net | | | 7,522,465 | | | | 11,094,702 | |

| Note receivables | | | - | | | | 1,885,183 | |

| Advanced to suppliers | | | 2,675,445 | | | | 1,632,975 | |

| Inventories | | | 973,644 | | | | 873,720 | |

| Loan to a related party | | | 153,554 | | | | 151,365 | |

| Prepayments and other current assets | | | 6,918,026 | | | | 1,353,457 | |

| TOTAL CURRENT ASSETS | | | 20,761,273 | | | | 18,049,402 | |

| | | | | | | | | |

| NON-CURRENT ASSETS: | | | | | | | | |

| Property, plant and equipment, net | | | 84,623,119 | | | | 23,363,352 | |

| Intangible assets, net | | | 6,164,781 | | | | 6,207,309 | |

| Prepayments for long-term assets | | | 24,522,149 | | | | 39,307,235 | |

| Deferred offering costs | | | 634,978 | | | | 538,584 | |

| Equity investment | | | 2,261,433 | | | | 2,229,194 | |

| TOTAL NON-CURRENT ASSETS | | | 118,206,460 | | | | 71,645,674 | |

| TOTAL ASSETS | | $ | 138,967,733 | | | $ | 89,695,076 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| CURRENT LIABILITIES: | | | | | | | | |

| Short-term borrowings | | $ | 20,624,062 | | | $ | 25,788,560 | |

| Accounts payable | | | 763,343 | | | | 1,294,480 | |

| Contract liabilities | | | 2,272,179 | | | | 637,537 | |

| Accrued expenses and other current liabilities | | | 19,258,940 | | | | 9,790,325 | |

| Due to related parties | | | 29,826,131 | | | | 19,807,637 | |

| TOTAL CURRENT LIABILITIES | | | 72,744,655 | | | | 57,318,539 | |

| | | | | | | | | |

| NON-CURRENT LIABILITIES: | | | | | | | | |

| Long-term borrowings | | | 32,175,020 | | | | - | |

| TOTAL LIABILITIES | | $ | 104,919,675 | | | $ | 57,318,539 | |

| | | | | | | | | |

| Commitments and contingencies (Note 16) | | | | | | | | |

| | | | | | | | | |

| SHAREHOLDERS' EQUITY (DEFICIT): | | | | | | | | |

| Ordinary shares, $0.0001 par value, 500,000,000 shares authorized, | | | 2,000 | | | | 2,000 | |

| Additional paid-in capital* | | | 777,992 | | | | 777,992 | |

| Accumulated deficit | | | (4,316,467) | | | | (3,383,846) | |

| Accumulated other comprehensive loss | | | (275,578) | | | | (245,500) | |

| SHAREHOLDERS' DEFICIT ATTRIBUTABLE TO TEXXON HOLDING LIMITED | | | (3,812,053) | | | | (2,849,354) | |

| Non-controlling interests | | | 37,860,111 | | | | 35,225,891 | |

| TOTAL EQUITY | | | 34,048,058 | | | | 32,376,537 | |

| TOTAL LIABILITIES AND EQUITY | | $ | 138,967,733 | | | | 89,695,076 | |

| | |

| * | Shares presented on a retroactive basis to reflect the reorganization. |

| TEXXON HOLDING LIMITED AND SUBSIDIARIES | ||||||||||||

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME/(LOSS) | ||||||||||||

| FOR THE FISCAL YEARS ENDED JUNE 30, 2025, 2024 AND 2023 | ||||||||||||

| (EXPRESSED IN U.S. DOLLARS) | ||||||||||||

| | ||||||||||||

| | | For the Fiscal Year ended June 30, | | |||||||||

| | | 2025 | | | 2024 | | | 2023 | | |||

| REVENUE | | | | | | | | | | |||

| Sales revenue generated from third parties | | $ | 797,148,640 | | | $ | 672,662,697 | | | $ | 549,879,053 | |

| Sales revenue generated from related parties | | | - | | | | - | | | | 2,647,129 | |

| Total revenue | | | 797,148,640 | | | | 672,662,697 | | | | 552,526,182 | |

| | | | | | | | | | | | | |

| COST OF SALES | | | | | | | | | | | | |

| Cost of sales charged by third parties | | | (789,783,093) | | | | (662,621,392) | | | | (541,218,715) | |

| Cost of sales charged by related parties | | | (2,015,752) | | | | (4,987,246) | | | | (7,569,836) | |

| Tax and surcharges | | | (649,245) | | | | (236,983) | | | | (204,138) | |

| Total cost of sales | | | (792,448,090) | | | | (667,845,621) | | | | (548,992,689) | |

| GROSS PROFIT | | | 4,700,550 | | | | 4,817,076 | | | | 3,533,493 | |

| | | | | | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | | | | | |

| Selling and marketing expenses | | | (2,413,149) | | | | (1,990,991) | | | | (996,638) | |

| General and administrative expenses | | | (2,888,047) | | | | (2,166,116) | | | | (1,282,757) | |

| Total operating expenses | | | (5,301,196) | | | | (4,157,107) | | | | (2,279,395) | |

| | | | | | | | | | | | | |

| (LOSS) INCOME FROM OPERATIONS | | $ | (600,646) | | | $ | 659,969 | | | $ | 1,254,098 | |

| | | | | | | | | | | | | |

| OTHER INCOME (EXPENSES): | | | | | | | | | | | | |

| Interest (expenses) income, net | | | (408,843) | | | | (470,288) | | | | 197,428 | |

| Interest income - related parties | | | - | | | | 34,922 | | | | 592,581 | |

| Other income, net | | | 55,680 | | | | 105,603 | | | | 86,585 | |

| Government grants | | | 216,574 | | | | 2,896,219 | | | | - | |

| Total other income (expenses), net | | | (136,589) | | | | 2,566,456 | | | | 876,594 | |

| | | | | | | | | | | | | |

| INCOME (LOSS) BEFORE PROVISION FOR INCOME TAXES | | | (737,235) | | | | 3,226,425 | | | | 2,130,692 | |

| | | | | | | | | | | | | |

| INCOME TAXES EXPENSES | | | (716,897) | | | | (716,782) | | | | (42,998) | |

| NET INCOME (LOSS) | | | (1,454,132) | | | | 2,509,643 | | | | 2,087,694 | |

| Less: net income (loss) attributable to non-controlling interest | | | (521,511) | | | | 1,556,083 | | | | 65,542 | |

| NET INCOME (LOSS) ATTRIBUTABLE TO TEXXON HOLDING LIMITED | | | (932,621) | | | | 953,560 | | | | 2,022,152 | |

| | | | | | | | | | | | | |

| OTHER COMPREHENSIVE INCOME (LOSS) | | | | | | | | | | | | |

| Foreign currency translation income (loss) | | | 469,036 | | | | 1,218,751 | | | | (1,502,270) | |

| TOTAL COMPREHENSIVE INCOME (LOSS) | | $ | (985,096) | | | $ | 3,728,394 | | | $ | 585,424 | |

| Less: comprehensive income (loss) attributable to non-controlling interests | | | (22,397) | | | | 1,528,622 | | | | (471,406) | |

| COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO TEXXON | | | (962,699) | | | | 2,199,772 | | | | 1,056,830 | |

| | | | | | | | | | | | | |

| BASIC AND DILUTED EARNINGS (LOSS) PER SHARE: | | | | | | | | | | | | |

| Net income (loss) attributable to Texxon Holding Limited per share | | | | | | | | | | | | |

| Basic and diluted | | $ | (0.05) | | | $ | 0.05 | | | $ | 0.10 | |

| | | | | | | | | | | | | |

| Weighted average shares outstanding used in calculating basic and | | | | | | | | | | | | |

| Basic and diluted | | | 20,000,000 | | | | 20,000,000 | | | | 20,000,000 | |

| | |

| * | Shares presented on a retroactive basis to reflect the reorganization. |

| TEXXON HOLDING LIMITED AND SUBSIDIARIES | ||||||||||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||||||

| FOR THE FISCAL YEARS ENDED JUNE 30, 2025, 2024 AND 2023 | ||||||||||||

| (EXPRESSED IN U.S. DOLLARS) | ||||||||||||

| | ||||||||||||

| | | For the fiscal year ended June 30, | | |||||||||

| | | 2025 | | | 2024 | | | 2023 | | |||

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | | | |||

| Net income (loss) | | $ | (1,454,132) | | | $ | 2,509,643 | | | $ | 2,087,694 | |

| Adjustments to reconcile net income to net cash provided | | | | | | | | | | | | |

| Depreciation and amortization | | | 288,072 | | | | 332,728 | | | | 251,081 | |

| Interest income from a related party | | | - | | | | (34,922) | | | | (592,581) | |

| Allowance (recovery) for credit losses | | | 720,054 | | | | (1,385) | | | | (220,339) | |

| Loss on disposal of property, plant and equipment | | | - | | | | - | | | | 50,236 | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | |

| Accounts receivable | | | 2,986,453 | | | | (7,512,856) | | | | 3,711,146 | |

| Notes receivable | | | 1,899,032 | | | | (1,896,246) | | | | - | |

| Inventories | | | (86,676) | | | | (466,902) | | | | (358,965) | |

| Advanced to suppliers | | | (1,011,848) | | | | 147,725 | | | | (1,447,491) | |

| Prepayments and other current assets | | | (3,315,341) | | | | (559,757) | | | | 117,283 | |

| Notes payable | | | - | | | | (13,828,757) | | | | (24,696,655) | |

| Accounts payable | | | (546,002) | | | | (10,429,603) | | | | 4,486,026 | |

| Accrued expenses and other current liabilities | | | 1,231,325 | | | | 1,902,256 | | | | 1,389,576 | |

| Contract liabilities | | | 1,614,022 | | | | (957,134) | | | | 1,043,235 | |

| NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES | | | 2,324,959 | | | | (30,795,210) | | | | (14,179,754) | |

| | | | | | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | | | | | |

| Purchase of plant, property and equipment | | | (45,103,546) | | | | (33,338,925) | | | | (22,615,531) | |

| Purchase of intangible assets | | | - | | | | (6,805) | | | | (6,683,817) | |

| Payments made for loans to related parties | | | - | | | | (152,253) | | | | (11,931,168) | |

| Government grant received in connection with the construction of | | | 2,853,622 | | | | - | | | | - | |

| Loan repayment from a related party | | | - | | | | 22,478,306 | | | | - | |

| NET CASH USED IN INVESTING ACTIVITIES | | | (42,249,924) | | | | (11,019,677) | | | | (41,230,516) | |

| | | | | | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | | | | | |

| Proceeds from short-term borrowings | | | 154,521,737 | | | | 141,956,726 | | | | 22,969,397 | |

| Proceeds from long-term borrowings | | | 30,105,666 | | | | - | | | | - | |

| Repayment of short-term borrowings | | | (154,473,136) | | | | (127,367,676) | | | | (12,327,428) | |

| Capital contribution from non-controlling interests | | | 2,647,556 | | | | 9,254,357 | | | | 18,260,003 | |

| Financing cost paid for the syndicated loan | | | (1,011,893) | | | | - | | | | - | |

| Withdrawal of capital by non-controlling interests | | | - | | | | (1,460,814) | | | | - | |

| Capital contribution from shareholder | | | - | | | | - | | | | 1,405,778 | |

| Payments made to shareholders to acquire Net Plastic Technology | | | - | | | | (12,226,342) | | | | - | |

| Proceeds from related parties | | | 9,663,775 | | | | 19,747,892 | | | | 106,062 | |

| Payments made for deferred offering costs | | | (93,243) | | | | (539,639) | | | | - | |

| NET CASH PROVIDED BY FINANCING ACTIVITIES | | | 41,360,462 | | | | 29,364,504 | | | | 30,413,812 | |

| | | | | | | | | | | | | |

| EFFECT OF EXCHANGE RATE CHANGE ON CASH, CASH | | | 24,642 | | | | 1,326,240 | | | | (1,559,510) | |

| NET CHANGE IN CASH, CASH EQUIVALENTS AND | | | 1,460,139 | | | | (11,124,143) | | | | (26,555,968) | |

| CASH, CASH EQUIVALENTS AND RESTRICTED | | | 1,058,000 | | | | 12,182,143 | | | | 38,738,111 | |

| CASH, CASH EQUIVALENTS AND RESTRICTED | | $ | 2,518,139 | | | $ | 1,058,000 | | | $ | 12,182,143 | |

| | | | | | | | | | | | | |

| SUPPLEMENTAL CASH FLOW DISCLOSURES: | | | | | | | | | | | | |

| Cash paid for income taxes | | | (10,202) | | | | (432) | | | | (785) | |

| Cash paid for interest | | | (1,942,702) | | | | (549,534) | | | | (361,912) | |

| Cash received from interest income | | | 1,845 | | | | 226,831 | | | | 508,742 | |

| | | | | | | | | | | | | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH ACTIVITIES: | | | | | | | | | | | | |

| Payable related to purchase of property, plant, and equipment | | | 5,318,449 | | | | 6,069,298 | | | | 1,385,669 | |

| Prepayment for long-term assets transferred to property, plant and | | | 19,262,697 | | | | 4,516,656 | | | | - | |

| Convertible loan transfer to other payables | | | | | | | - | | | | | |

| Interest receivable accrued related to loan to a related party | | | - | | | | 34,922 | | | | 592,581 | |

| | | | | | | | | | | | | |

| Cash and cash equivalents | | | 2,517,577 | | | | 272,895 | | | | 1,328,917 | |

| Restricted cash | | | 562 | | | | 785,105 | | | | 10,853,226 | |

| Total cash, cash equivalents and restricted cash | | | 2,518,139 | |

| | 1,058,000 | | | | 12,182,143 | |

SOURCE Texxon Holding Limited