Original-Research: Vossloh AG - from Quirin Privatbank Kapitalmarktgeschäft

Classification of Quirin Privatbank Kapitalmarktgeschäft to Vossloh AG

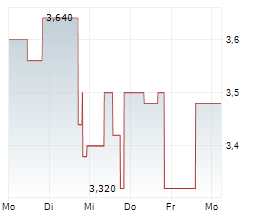

Everything will be fine if the Sateba integration goes well After the solid Q3 2025 results we maintain our Buy rating with a reduced TP of EUR 94 (102), applied by our ROE/COE valuation approach. The company was able to increase its TTM sales by 9.6% yoy or 2.2% qoq. TTM order intake fell by 0.8% yoy, however was 5.6% qoq higher, the TTM book-to-bill ratio was with 1.02x again over the important threshold of 1.0x. The TTM net income margin fell by 43 basis points yoy and by 17 basis points qoq. For FY 2025, Vossloh now expects group sales including Sateba of EUR 1.33-1.4bn (QPe: EUR 1.333bn) and consolidated EBIT before effects from the purchase price allocation (PPA effects) for Sateba of EUR 116-126m (QPe: EUR 121m). The specified forecast already takes into account transaction and integration costs. The PPA effects for Sateba are expected to have a significant negative impact on EBIT in the first 24 months after closing. As a consequence, we reduced our net income forecast for FY 2025 by 7%, for FY 2026 by 31% and for FY 2027 by 19%. Vossloh shares have risen ~+84% ytd thanks to strong performance in terms of sales and order intake in recent quarters, also driven by high investor interest in the whole infrastructure sector. In the short term, we see only limited catalysts due to the fact that, despite the sales trend, the profit trend has yet to gain momentum. Our focus is now on the successful integration of Sateba. In the medium to long term, there is enormous demand for investment in the rail sector, so we expect a very positive environment for Vossloh's further business development, also with regard to achieving its 2030 targets. You can download the research here: VOSSLOH_AG_20251103 For additional information visit our website: https://research.quirinprivatbank.de/ Contact for questions: Quirin Privatbank AG Institutionelles Research Schillerstraße 20 60313 Frankfurt am Main research@quirinprivatbank.de https://research.quirinprivatbank.de/ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||

2222692 03.11.2025 CET/CEST

© 2025 EQS Group