WASHINGTON (dpa-AFX) - CMS Energy Corp. (CMS) announced the pricing of its upsized offering of $850 million aggregate principal amount of 3.125% convertible senior notes due 2031 in a private placement.

The sale is expected to close on November 6.

The company expects net proceeds of about $839.3 million, or $987.7 million if the option is fully exercised.

The company plans to use the funds to retire its $250 million 3.60% Senior Notes due November 15, with the remainder for general corporate purposes.

The initial purchasers were also granted an option to buy up to an additional $150 million in notes within 13 days.

The notes will bear interest at 3.125% per annum, payable semiannually starting May 1, 2026, and will mature on May 1, 2031.

The notes will be convertible at an initial rate of 11.0360 shares per $1,000 principal amount, equivalent to a price of about $90.61 per share, a 25% premium to the November 3 closing price.

The company may redeem the notes beginning May 7, 2029, if its stock trades at least 130% above the conversion price for 20 out of 30 consecutive trading days. The holders may also require repurchase upon a fundamental change.

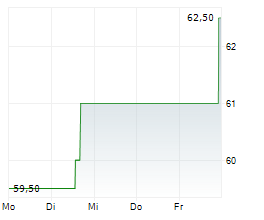

In the pre-market trading, 0.19% higher at $72.63 on the New York Stock Exchange.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News