Original-Research: bet-at-home.com AG - from NuWays AG

Classification of NuWays AG to bet-at-home.com AG

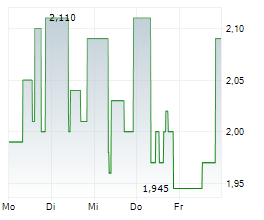

Topic: Last week, bet-at-home reported soft Q3 figures that were below our estimates on both, top and bottom line. Further, the majority shareholder Betclic Everest Group SAS announced that it will sell its 53.9% stake in bet-at-home. In detail: Sales came in at € 10.2m (-14% qoq, -16% yoy), significantly below our estimates of € 12.5m (eNuW), mainly driven by the absence of major events such as a soccer World Cup or a European championship this year as well as unfavourable soccer results in Q3 (i.e. many favourite wins), resulting in lower betting margins. With betting volumes of € 66m (-19% yoy) and margins of 13.0% (vs. 14.1% in Q2), € 8.5m GGR (-20% yoy) were achieved in the Betting segment . The Gaming segment developed nicely and in line with expectations: € 1.7m GGR (+12% yoy) stemming from € 14m volume (6% yoy) and a margin of 12.1% (vs 11.5% in Q3'24). Still, the Gaming segment with only 17% revenue share is not yet able to compensate for the soft results in the Betting segment. EBITDA before special items of € -0.9m was below estimates of € 1.0m and previous year's figure of € 1.6m, due to the soft top line, while OPEX came in broadly in line with estimates. Lower personnel expenses of € 2.0m (1% yoy vs eNuW: € 2.2m) and lower other OPEX of € 2.9m (-65% yoy vs eNuW: € 3.1m) compensated for higher marketing expenses of € 4.3m (23% yoy vs eNuW: € 3.8m). Reported EBITDA stood at € -1.7m (vs € 1.2m in Q3'24 vs eNuW: € 1.0m). After the disappointing Q3, we are expecting a stronger Q4 and Q1'26, as the inflated marketing expenses usually materialize within 3-6 month and as Q4 and Q1 are historically the strongest quarters of the year, always compensating for softer Q2/Q3. Despite the fact that we cut our estimates after the weak Q3 results, the company should easily achieve its guidance of € 46-54m sales and € 0-4m EBITDA before special items (vs. eNuW: € 49m sales and € 2.0m EBITDA before special items). Going forward, the structural trends (growing online betting and gaming market, the dry out of the black market and the increasing acceptance and adoption of betting and gaming) are fully intact. Tailwinds should come potential positive ECJ ruling that is now expected for Q1 next year. With a likely ruling of the ECJ in favour of the betting providers, the current customer claims against bet-at-home and - even more importantly - the looming risks of new customer claims would be off the table, together with related lifted legal costs. Apart from that, the Banijay Group N.V, which is the mother of bah's major shareholder Betclic Everest Group SAS, announced that it has entered into an agreement to acquire a majority stake in the Tipico Group. As part of the transaction, Betclic will sell its 53.9% stake in bah. We we assume that antitrust reasons are behind the divestment. More details around the divestment are expected to be published until year end. Regarding the potential selling price everything but a significant premium to the current low share price would be a surprise for us (still, we do not expect one party to disclose the price). We reiterate BUY with an unchanged PT of € 5.50 based on FCFY'26e. You can download the research here: bet-at-homecom-ag-2025-11-10-previewreview-en-0ac4c_nd For additional information visit our website: https://www.nuways-ag.com/research-feed Contact for questions: NuWays AG - Equity Research Web: www.nuways-ag.com Email: research@nuways-ag.com LinkedIn: https://www.linkedin.com/company/nuwaysag Adresse: Mittelweg 16-17, 20148 Hamburg, Germany ++++++++++ Diese Meldung ist keine Anlageberatung oder Aufforderung zum Abschluss bestimmter Börsengeschäfte. Offenlegung möglicher Interessenskonflikte nach § 85 WpHG beim oben analysierten Unternehmen befinden sich in der vollständigen Analyse. ++++++++++ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||

2226580 10.11.2025 CET/CEST

© 2025 EQS Group