VANCOUVER, British Columbia, Nov. 12, 2025 (GLOBE NEWSWIRE) -- Fancamp Exploration Ltd. ("Fancamp" or the "Corporation") (TSX Venture Exchange: FNC) is pleased to announce that it has signed an option agreement with Harfang Exploration Inc. ("Harfang"), whereby Fancamp, subject to the approval of the TSX Venture Exchange ("TSX-V"), has the option to acquire up to 80% interest in the Egan property (the "Agreement"). Egan is comprised of 449 claims totaling ~12,000 hectares, which hosts a syenite gold system featuring high-grade bulk tonnage and discovery potential, situated in the gold-rich Abitibi greenstone belt of Ontario, a region with a long history of prominent gold discoveries and active operations. With this Agreement, Fancamp benefits from exposure to a promising gold asset in one of Canada's most productive and proven gold districts, strengthening the Corporation's gold portfolio.

SALIENT FEATURES: EGAN OPTION AGREEMENT

Under the First Option, Fancamp shall acquire an initial 40% interest in the Egan property for a total consideration of $100,000 in cash and shares, under the following terms:

- An initial payment of $50,000, on the day of the TSX-V approval of the Agreement; and

- A payment of $50,000, on the 1st anniversary date of the Agreement.

To exercise the First Option, the Corporation shall also fund an aggregate amount of $1,500,000 in exploration expenditures prior to the 2nd anniversary date of the Agreement.

Following the initial earn-in and at Harfang's election, upon confirmation by Fancamp of its intention to elect its Second Option, Harfang will have the option ("Harfang Option") to convert the Second Option into a 51% / 49% joint venture in favor of Fancamp. Should this occur, the Companies will proportionally fund $2,500,000 in exploration expenditures, after which all additional exploration and development costs will be shared on a pro rata basis.

If Harfang does not exercise the Harfang Option, Fancamp, shall acquire a further 40% interest in the Egan property for a total consideration of $100,000 in cash and shares, under the following terms:

- An initial payment of $50,000, within five (5) business days of Fancamp notifying its interest in exercising the Second Option; and

- A payment of $50,000, on the 3rd anniversary date of the Agreement.

To exercise the Second Option, Fancamp shall also fund an aggregate amount of $2,500,000 in exploration expenditures prior to the 4th anniversary date of the Agreement.

Fancamp will serve as the operator under the terms of the Agreement.

About the Egan Property

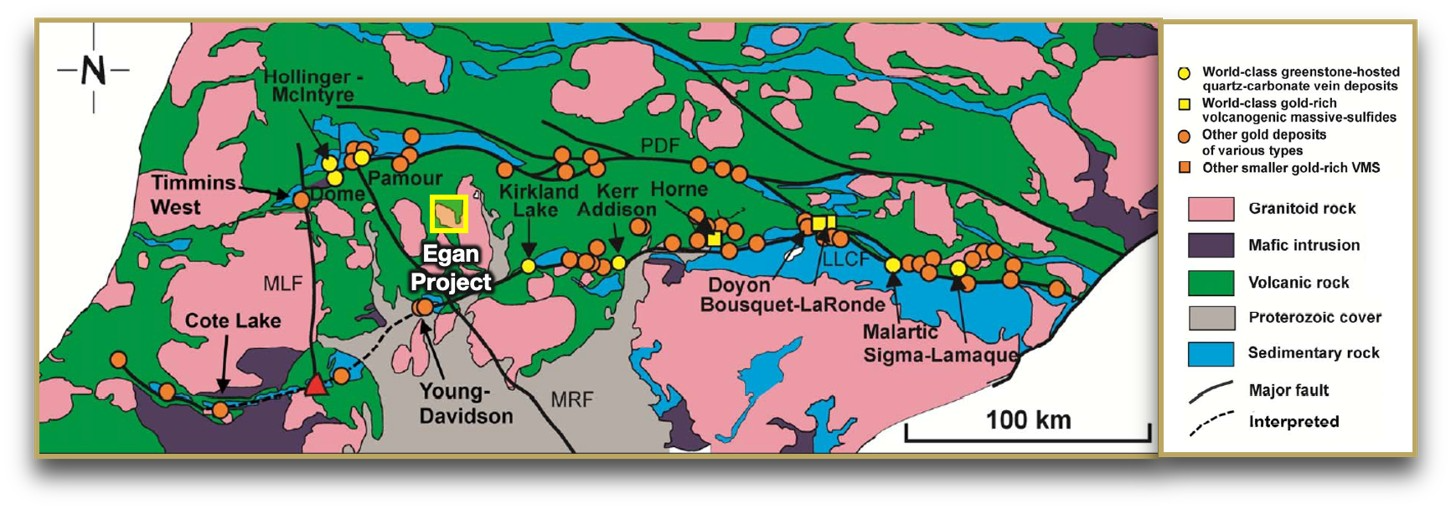

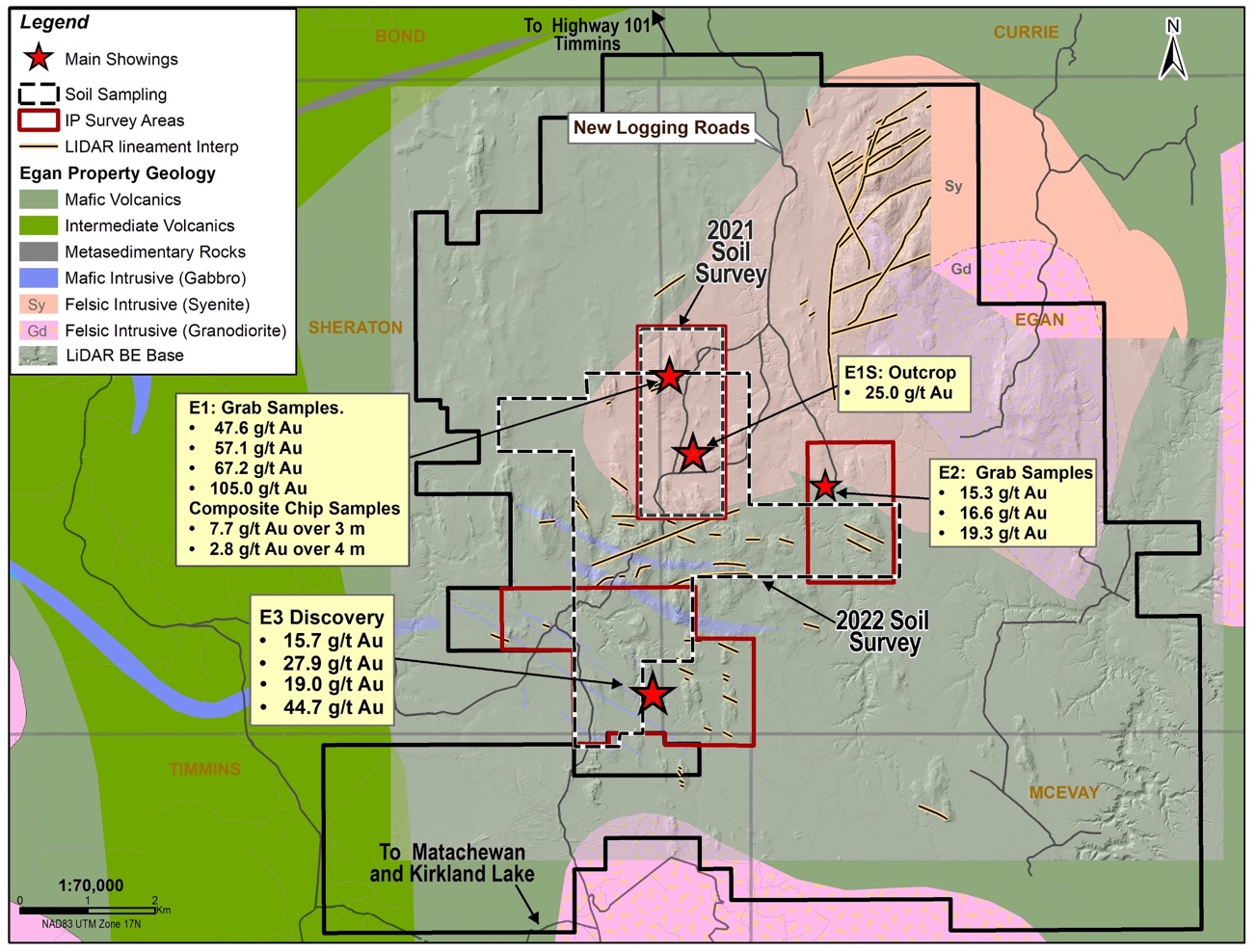

The Egan property combines favorable geology, proven gold-bearing structures and high-grade showings within an underexplored segment of the Abitibi Belt, offering clear discovery potential in one of the world's best-endowed gold districts, responsible for over 200 million ounces of historical gold production. Egan is strategically located between the Kirkland Lake and Timmins mining camps in Ontario, which both host multiple multi-million-ounce deposits (Figure 1), this regional context provides a stable and attractive surrounding that significantly enhances Egan's discovery potential. The property is underlain by Archean volcanic and intrusive rocks situated between two major and productive deformation zones, Destor Porcupine Fault and Cadillac Larder Lake Fault. These structures are the host of multiple high-grade gold mines, such as those in the Kirkland Lake and Timmins camps. Gold mineralization at Egan is believed to be associated with multiple gold-bearing structural and lithologic targets linked to the syenite intrusions and volcanic contacts. Surface sampling and drilling at Egan have already defined three key gold occurrences, returning notable high-grade gold values particularly from the E1 Zone where historical results include grab samples up to 105.0 g/t Au, and the E3 Zone which recorded grab samples up to 44.7 g/t Au and 19.0 g/t Au, demonstrating the presence of robust gold-bearing structures near surface (Figure 2, refer to Harfang Exploration website). Despite the historical high-grade results and earmarks of a compelling syenite gold system, Egan remains largely underexplored with significant untested ground.

Figure 1. Location map of Egan property, surrounding deposits and nearby Gold Camp.

Figure 2. Select exploration highlights at Egan including the E1, E1S, E2, and E3 targets, Source: Harfang Exploration Website.

STRATEGIC CORPORATE REORGANIZATION

The Corporation plans to implement a strategic reorganization to accelerate value creation by separating Fancamp's financial assets from its exploration assets into two distinct entities, thereby enhancing the overall value of its diverse asset base. Through this process, shareholders will be provided with an opportunity to benefit from two targeted paths for value creation.

The financial entity portfolio will include Fancamp's investments, royalties and other financial instruments. It will dedicate its efforts to the growth, monetization, and expansion of its portfolio by adopting a focused strategy. The financial entity seeks to provide investors with a streamlined portfolio and maintenance of a capital light business model with a focus on scale through strategic acquisitions.

The exploration entity will offer investors direct exposure to Fancamp's high-quality exploration projects, including the newly optioned Egan property. This entity will serve as a gold and gold-rich base metal focused exploration vehicle, providing opportunities for value creation through the development of promising, well-located projects with discovery, resource and expansion potential.

This corporate reorganization is anticipated to attract targeted capital and increased investor interest by offering two distinct streams for investment. Fancamp intends to communicate definitive plans for the execution of this reorganization in the near future.

"I am more confident than ever in Fancamp's path to unlocking meaningful value for our shareholders. This strategic reorganization represents the culmination of our efforts to strengthen and streamline our portfolio, while simplifying the Fancamp narrative to ensure that the significant underlying value of our assets is fully realized and recognized by the market." said Rajesh Sharma, CEO of Fancamp Exploration Ltd. "This partnership with Harfang marks a strategic opportunity for our exploration entity to expand its presence in one of Canada's most prolific mining regions while providing exposure to a high-quality gold asset. Egan fits perfectly within our strategy of pursuing high-potential exploration assets that complement our existing projects and provide a clear path to discovery."

Qualified Person

The technical information contained in this press release was reviewed and approved by Mr François Auclair, PGeo, M.Sc. Vice President Exploration of Fancamp, designated as a Qualified Person under National Instrument 43-101.

About Fancamp Exploration Ltd. (TSX-V: FNC)

Fancamp is a Canadian mineral exploration corporation focused on creating value through medium term growth and monetization opportunities with strategic interests in high potential mineral projects, royalty portfolio and exploration properties. The Corporation is focused on an advanced asset play poised for growth and selective monetization with a portfolio of mineral claims across Ontario, Quebec and New Brunswick, Canada; including copper, gold, zinc, titanium, chromium, strategic rare-earth metals and others. The Corporation has future monetization opportunities from its Koper Lake transaction in the highly sought-after Ring of Fire in Northern Ontario. Fancamp holds 96% interests in Magpie Mines Inc., which owns the Magpie property, one of the world's largest undeveloped hard rock titanium (+V) deposits, per USGS data. Fancamp has investments in an existing iron ore operation in the Quebec Labrador trough, a rare earth elements corporation, NeoTerrex Minerals Inc., a copper-gold exploration corporation, PTX Metals Inc., an opportunity to develop an emerging gold-copper exploration play with Lode Gold Resources Inc. in addition to an investment in a near term cash flow generating zinc mine, EDM Resources Inc. in Nova Scotia. Fancamp is developing an energy reduction and titanium waste recycling technology with its advanced titanium extraction strategy. The Corporation is managed by a focused leadership team with decades of mining, exploration and complementary technology experience. Further information of the Corporation can be found at: www.fancamp.ca

Forward-looking Statements

This news release contains certain "forward-looking statements" or "forward-looking information" (collectively referred to herein as "forward-looking statements") within the meaning of applicable securities legislation. Such forward-looking statements include, without limitation forecasts, estimates, expectations, and objectives for future operations that are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Corporation. Forward-looking statements are statements of fact that are not historical facts or are events or conditions that may occur or be achieved.

Although Fancamp believes that the material factors, expectations and assumptions informing such forward-looking statements are reasonable based on information available to it on the date such statements were made, no assurances can be given as to future results of such statements.

Such forward-looking statements involve known and unknown risks, uncertainties and other factors relating to the delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; other risks involved in the mineral exploration and development industry and other factors that may cause actual events to differ materially from those anticipated in such forward-looking statements.

Readers are cautioned that the foregoing list of factors is not exhaustive. Statements including forward-looking statements are made as of the date they are given and, except as required by applicable securities laws, Fancamp disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

For Further Information

| Rajesh Sharma, President & Chief Executive Officer rsharma@fancamp.ca | Tara Asfour, Director of Investor Relations tasfour@fancamp.ca |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/05d81e36-114c-44bd-9621-16428bf166cc

https://www.globenewswire.com/NewsRoom/AttachmentNg/0601e9f6-9628-474d-9bce-f8526c75b25b