WASHINGTON (dpa-AFX) - Carlyle (CG) is considering a move to acquire Lukoil's foreign assets, according to three people familiar with the discussions.

The potential deal comes as the United States blocks Lukoil from selling those assets to Switzerland-based Gunvor ahead of a November 21 sanctions deadline tied to the war in Ukraine.

Lukoil produces about 2 percent of global oil output and has been seeking buyers for its international portfolio, which accounts for more than 0.5 percent of global supply and is valued at roughly 22 billion dollars based on last year's filings. The assets span refineries in Europe, oilfield stakes across Central Asia, the Middle East, and Africa, and hundreds of fuel stations worldwide.

One source said Carlyle is still at an early stage and is looking at applying for a US licence before starting due diligence, while also noting the firm could still decide to back out. Another source said Lukoil is aware of Carlyle's interest. Carlyle did not comment, and Lukoil did not respond to inquiries.

Sanctions have already disrupted parts of Lukoil's business in Iraq, Finland, and Bulgaria. Carlyle, which manages about 474 billion dollars in assets, is evaluating whether a deal is viable under the current regulatory and geopolitical environment.

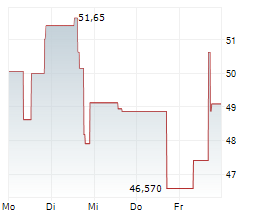

CG currently trades at $53.31, or 3.2% lower on the NasdaqGS.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News