70% debt write-off, from €40M to €12M

Remaining debt to be repaid over 10 years, with 90% between the end of 2029 and the end of 2035

Capital raise of €6.1M extending cash runway to the second half of 2027

Regulatory News:

Mauna Kea Technologies (Euronext Growth: ALMKT) (the "Company"), inventor of Cellvizio, the multidisciplinary probe and needle-based confocal laser endomicroscopy (p/nCLE) platform, today announced the full success of its financial restructuring and of its capital increase (the "Operation"), launched yesterday following the approval of its safeguard plan (the "Plan") by the Paris Court of Economic Activities (Tribunal des Activités Économiques de Paris

This operation concludes a major restructuring that sets a solid foundation for the Company to execute its operational plan:

- Improved balance sheet: Equity increased by €7.7M and total gross debt reduced by €28M (from €40M to €12M).

The Company is now effectively largely debt-free in the short and medium term, with 90% of repayments of the remaining debt (€12M) scheduled between the end of 2029 and the end of 2035, which should be funded by future cash flow. - Financial visibility secured: The €6.1M capital raise secures the company's cash runway until the second half of 2027.

In connection with this approval, the Company has raised a gross amount of €6.1M. The Operation consists of (i) a capital increase reserved for a category of investors for an amount of €5.9M by issuing 60,688,585 new ordinary shares with attached warrants (the "New ABSA") at a price of €0.0973 per New ABSA (the "Reserved Capital Increase"), (ii) an offer for an amount of €0.2M by issuing 1,889,301 New ABSA at a price of €0.0973 per New ABSA, with waiver of shareholders' preferential subscription rights, by way of a public offering to individual investors via the PrimaryBid platform (the "PrimaryBid Offer"), (iii) a capital increase reserved for the EIB (the "EIB Capital Increase") for an amount of €1.7M by issuing 17,495,728 new ordinary shares (the "New Shares") at a price of €0.0973 per New Share, fully paid up by set-off against claims, and (iv) a free allotment of 9,488,366 share subscription warrants (the "Warrants" or "BSA") to the Company's shareholders.

The final terms of the Operation, including details of the dilution associated with the Operation, are detailed in the Appendix.

The operation was successfully completed thanks to strong support from Vester Finance and other long-term investors, demonstrating support and confidence in the Company's new roadmap.

In line with its commitments, the Company also confirms the upcoming implementation of the free allotment of free Warrants to all its shareholders to involve them in future value creation.

Sacha Loiseau, Chairman, CEO, and founder of Mauna Kea Technologies, commented "The completion of our financial restructuring is a major milestone that marks the beginning of a new chapter for Mauna Kea, built on much stronger foundations which comes at a time when signs of growing global adoption of our products are becoming increasingly strong. The significant support of our new equity investors combined with the strong reduction in the Company's debt enables Mauna Kea to focus on its sales growth and achieving profitability. I want to thank our investors, advisors, employees, customers and lenders for their engagement and support."

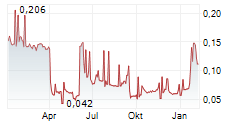

The resumption of trading of Mauna Kea Technologies shares (ISIN: FR0010609263 Ticker: ALMKT) will occur today at the opening of the Euronext Growth markets.

Dechert (Paris) LLP acted as legal counsel to the Company for the Operation. Clémence Vanacker acted as restructuring legal counsel in the context of the safeguard proceedings.

Invest Securities acted as placement agent for the Reserved Capital Increase.

About Mauna Kea Technologies

Mauna Kea Technologies is a global medical device company that manufactures and sells Cellvizio, the real-time in vivo cellular imaging platform. This technology uniquely delivers in vivo cellular visualization which enables physicians to monitor the progression of disease over time, assess point-in-time reactions as they happen in real time, classify indeterminate areas of concern, and guide surgical interventions. The Cellvizio platform is used globally across a wide range of medical specialties and is making a transformative change in the way physicians diagnose and treat patients. For more information, visit www.maunakeatech.com.

Disclaimer

This press release and the safeguard plan contain forward-looking statements relating to Mauna Kea Technologies, its activities, and the progress of the safeguard proceedings opened for the benefit of the Company. All statements other than statements of historical fact included in this press release and in the safeguard plan, including, without limitation, those regarding the financial position, business, strategies, plans, and objectives of Mauna Kea Technologies' management for future operations are forward-looking statements. Mauna Kea Technologies believes that these forward-looking statements are based on reasonable assumptions. However, no assurance can be given as to the achievement of the forecasts expressed in these forward-looking statements, which are subject to numerous risks and uncertainties, including those described in Chapter 2 of Mauna Kea Technologies' 2024 Annual Report filed with the Autorité des marchés financiers (AMF) on April 30, 2025, available on the Company's website (www.maunakeatech.fr), as well as risks related to changes in the economic environment, financial markets, and the markets in which Mauna Kea Technologies operates. The forward-looking statements contained in this press release and in the safeguard plan are also subject to risks unknown to Mauna Kea Technologies or that Mauna Kea Technologies does not consider significant at this date. The occurrence of some or all of these risks could cause the actual results, financial conditions, performance, or achievements of Mauna Kea Technologies to differ significantly from the results, financial conditions, performance, or achievements expressed in these forward-looking statements. This press release, the safeguard plan, and the information they contain do not constitute an offer to sell or subscribe, or the solicitation of an order to buy or subscribe, for shares of Mauna Kea Technologies in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of said jurisdiction. Likewise, they do not constitute and should not be treated as investment advice. They do not have regard to the investment objectives, financial situation, or particular needs of any recipient. No representation or warranty, express or implied, is given as to the accuracy, completeness, or reliability of the information contained in these documents. They should not be considered by recipients as a substitute for the exercise of their own judgment. All opinions expressed in these documents are subject to change without notice. This document does not constitute an offer to sell or the solicitation of an order to buy or subscribe for the Company's securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to the registration of the securities concerned or other qualification under the stock market regulations of such a country or jurisdiction. The distribution of this document may, in certain countries, be subject to specific regulations. Persons in possession of this document must inform themselves of any local restrictions and comply with them. This press release does not constitute a prospectus within the meaning of Regulation (EU) 2017/1129 of the European Parliament and of the Council of June 14, 2017 (the "Prospectus Regulation"). With regard to the Member States of the European Economic Area (each, a "Relevant Member State"), no offer of the securities mentioned in this document is made or will be made to the public in that Relevant Member State, except (i) to any legal person which is a qualified investor as defined in the Prospectus Regulation, (ii) to fewer than 150 natural or legal persons per Relevant Member State, or (iii) in other circumstances falling within Article 1(4) of the Prospectus Regulation; provided that no such offer shall require the publication by the Company of a prospectus pursuant to Article 3 of the Prospectus Regulation. For the purposes of the foregoing, the expression "offer to the public" in any Relevant Member State has the meaning given to it in Article 2(d) of the Prospectus Regulation. Solely for the purposes of each manufacturer's product approval process, the target market assessment regarding the securities offered in the capital increases has led to the conclusion that, with respect to the criteria relating to the type of clients: (i) the target market for the securities is eligible counterparties and professional clients, each as defined in Directive 2014/65/EU, as amended ("MiFID II"); and (ii) all channels for distribution of the securities offered in the capital increases to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling, or recommending the ABSA (a "distributor") shall take into consideration the manufacturers' client type assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment with respect to the ABSA offered in the capital increases (by either adopting or refining the manufacturers' target market assessment) and determining appropriate distribution channels. This press release has been prepared in French and English. In the event of any discrepancy between the two versions of the press release, the French version shall prevail.

Appendix

Main characteristics of the Operation

The Operation consists of (i) a capital increase reserved for a category of investors for an amount of €5.9M by issuing 60,688,585 new ordinary shares with attached warrants (the "New ABSA") at a price of 0.0973 per New ABSA (the "Reserved Capital Increase"), (ii) an offer for an amount of €0.2M by issuing 1,889,301 New ABSA at a price of 0.0973 per New ABSA, with waiver of shareholders' preferential subscription rights, by way of a public offering to retail investors via the PrimaryBid platform (the "PrimaryBid Offer"), (iii) a capital increase reserved for the EIB (the "EIB Capital Increase") for an amount of €1.7M by issuing 17,495,728 new ordinary shares (the "New Shares") at a price of €0.0973 per New Share, and (iv) a free allotment of 9,488,366 share subscription warrants (the "Warrants" or "BSA") to the Company's shareholders.

The issuance of new shares was decided last night by a decision of the CEO of the Company, acting on delegation from the Company's Board of Directors.

The ordinary shares composing the New ABSA and the New Shares (which are of the same class as the Company's existing ordinary shares) will be the subject of an application for admission to trading on Euronext Growth under the same ISIN code FR0010609263 and are expected to be admitted to trading around November 18, 2025.

The Warrants allotted to existing shareholders and the Warrants composing the New ABSA will be the subject of an application for admission to trading on Euronext Growth under the same ISIN code FR00140140W9.

Use of proceeds from the Reserved Capital Increase and the PrimaryBid Offer

The proceeds from the Reserved Capital Increase and the PrimaryBid Offer amount to a cumulative gross amount of €6.1M in immediate new financing for the Company. It will be allocated to the Company's implementation of the strategy described in the Plan. As of the first anniversary of the Plan's approval, the funds raised will also be allocated to the progressive repayment of the Company's debts subject to the payment schedule in accordance with the Plan.

The Company may receive additional financing in the event that the Warrants allotted to existing shareholders and the Warrants composing the New ABSA are exercised by their holders, it being recalled that the exercise of these Warrants is not guaranteed.

The Company intends to achieve profitability by 2027 and requires financing of approximately €8M for this purpose. The proceeds from the Reserved Capital Increase and the PrimaryBid Offer will finance this need up to €6.1M. The Company expects to be able to finance any necessary supplement through the expected proceeds from the potential exercise of the Warrants. Otherwise, the Company will consider other sources of additional financing.

Reserved Capital Increase

The 60,688,585 New ABSA resulting from the Reserved Capital Increase will be issued by way of a capital increase with waiver of shareholders' preferential subscription rights and reserved for a specific category of investors (as described in more detail in the resolution) in application of the first resolution attached to the Plan.

The New ABSA will be issued at a unit price of €0,0973 per New ABSA, including par value and issue premium, corresponding to the volume-weighted average price of the ten (10) last trading sessions preceding this date (i.e., from October 29, 2025 to November 12, 2025, inclusive).

The Warrants attached to the New ABSA will be exercisable for a period of five years and their exercise price will be equal to €0.1216 per warrant, with each Warrant allowing the subscription of one ordinary share. If the Warrants issued in the context of the Reserved Capital Increase are exercised, the Company could receive an additional amount of up to €7.4M.

The Warrants attached to the New ABSA will be freely transferable, subject to applicable law and regulations. An application for the admission of the Warrants to trading on Euronext Growth will be filed as soon as possible following their issue date.

PrimaryBid Offer

The 1,889,301 New ABSA to be issued under the PrimaryBid Offer will be issued by way of a public offering with waiver of shareholders' preferential subscription rights in application of the 10th resolution of the ordinary and extraordinary general meeting of the Company's shareholders held on June 5, 2025 (the "AGOE

The PrimaryBid Offer began yesterday at 7:45 AM and closed the same day at 5:30 PM.

The New ABSA issued in the PrimaryBid Offer have the same characteristics as those issued in the Reserved Capital Increase.

EIB Capital Increase

The 17,494,728 New Shares will be issued by way of a capital increase with waiver of shareholders' preferential subscription rights and reserved for the EIB in application of the first resolution attached to the Plan. The New Shares will be issued at a unit price of €0.0973 per New Share, including par value and issue premium, corresponding to the volume-weighted average price of the ten (10) last trading sessions preceding this date (i.e., from October 29, 2025 to November 12, 2025, inclusive). The EIB Capital Increase would be paid up in full by way of set-off against certain, liquid, and due claims held by the EIB on the Company at the time of subscription.

As part of the Plan, the European Investment Bank (EIB) is subject to special treatment. The agreement provides for the repayment of 45% of the debt, i.e., €10.3M over 10 years, as well as the conversion of part of the debt into shares, giving the EIB 10% of the capital and voting rights of Mauna Kea Technologies (valued at €1.7M to date), and a better fortunes clause of €2.5M (20% of the outstanding amount). In total, the EIB debt write-off amounts to €22M.

The EIB has also undertaken to hold the New Shares issued as part of the EIB Capital Increase, in accordance with the Plan, for a period of two years following approval of the Plan.

Warrant Allotment (BSA)

Warrants will be allotted free of charge to the Company's shareholders at the rate of one (1) Warrant for every ten (10) shares held, corresponding to a maximum of 9,488,366 Warrants in application of the 9th resolution of the AGOE.

The Warrants will be issued and allotted free of charge to the Company's shareholders of record as of November 17, 2025, at the end of the trading session, thus taking into account transactions carried out up to November 12, 2025.

The Warrants will be exercisable for a period of five years and their exercise price will be equal to €0.1216 per Warrant.

The number of ordinary shares to be issued upon exercise of the Warrants will not exceed 9,488,366 ordinary shares, subject to possible adjustments to protect the rights of the Warrant holders. The Warrants will be freely transferable, subject to applicable law and regulations.

An application for the admission of the Warrants to trading on Euronext Growth will be filed as soon as possible following their issue date.

Documentation

The Operation will not require the publication of a Prospectus pursuant to Regulation (EU) 2017/1129 of the European Parliament and of the Council of June 14, 2017 (the "Prospectus Regulation

Impact of the transaction on shareholding

The share capital of Mauna Kea Technologies will consist of 174,957,281 shares following the settlement-delivery. For information purposes, a shareholder holding 1% of the capital before the Operation will hold 0.54% after the Operation (non-diluted basis) and 0.35% after the Operation (fully diluted basis).

Share capital and voting rights breakdown before and after the Operation

Shareholding | Before capital increases | After capital increases | After warrants exercise | After exercise of all dilutive instruments | ||||||||

Holder | # shares |

| # shares |

| # shares |

| # shares |

| ||||

Telix | 11 911 852 | 12.6% | 11 911 852 | 6.8% | 13 103 037 | 5.3% | 13 103 037 | 4.9% | ||||

Johnson Johnson (JJDC) | 10 811 687 | 11.4% | 10 811 687 | 6.2% | 11 892 855 | 4.8% | 11 892 855 | 4.4% | ||||

Management, Employees and Directors (excl. Sacha Loiseau) | 568 106 | 0.6% | 568 106 | 0.3% | 624 916 | 0.3% | 7 736 335 | 2.9% | ||||

Sacha Loiseau | 691 740 | 0.7% | 1 719 489 | 1.0% | 2 816 412 | 1.1% | 4 716 412 | 1.8% | ||||

Float | 70 900 282 | 74.7% | 70 900 282 | 40.5% | 77 990 310 | 31.6% | 82 269 252 | 30.8% | ||||

Vester Finance(1) | 20 554 984 | 11.7% | 41 109 968 | 16.6% | 48 111 865 | 18.0% | ||||||

Others Investors in the Operation | 40 995 153 | 23.4% | 81 990 306 | 33.2% | 81 990 306 | 30.7% | ||||||

EIB | 17 495 728 | 10.0% | 17 495 728 | 7.1% | 17 495 728 | 6.5% | ||||||

Total | 94 883 667 | 100.0% | 174 957 281 | 100.0% | 247 023 532 | 100.0% | 267 315 790 | 100.0% | ||||

(1) Share numbers on a fully diluted basis assume a conversion of Vester Finance's convertible bonds at a share price of €0.10 per share. | ||||||||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20251113856222/en/

Contacts:

Mauna Kea Technologies

investors@maunakeatech.com

NewCap Investor Relations

Aurélie Manavarere Thomas Grojean

+33 (0)1 44 71 94 94

maunakea@newcap.eu