Original-Research: Mister Spex SE - from Quirin Privatbank Kapitalmarktgeschäft

Classification of Quirin Privatbank Kapitalmarktgeschäft to Mister Spex SE

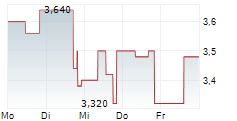

FY 2025 guidance confirmed Mister Spex continues its performance from earlier in the year into Q3: lower sales due to a reduction in discount campaigns and withdrawal from low-margin international markets. However, there has also been a significant increase in gross margin and a reduction in bottom-line losses, particularly due to the increased share of prescription glasses in stores. The company has begun acquiring profitable optician businesses, which is good news. Mister Spex confirmed its FY 2025 guidance and expects a decline in net revenue of 10% to 20% and an EBIT margin between -5% and -15%. We confirm our Buy recommendation and the long-term EUR 5.00 TP. You can download the research here: MISTER_SPEX_20251114k For additional information visit our website: https://research.quirinprivatbank.de/ Contact for questions: Quirin Privatbank AG Institutionelles Research Schillerstraße 20 60313 Frankfurt am Main research@quirinprivatbank.de https://research.quirinprivatbank.de/ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||

2230212 14.11.2025 CET/CEST

© 2025 EQS Group