- Prime membership grew by 18%, adding 1.2 million net adds over the last 12 months

- Profitability increased by 16% to €94 million; Overall revenues increased by 5% to €344 million.

- Strong financial position and cash-generation enable continued shareholder remuneration: €32.6 million invested in share repurchases in the first half and €100 million anticipated over the next two years.

- New multi-year strategic roadmap unveiled, targeting accelerated growth to over 13 million Prime members by 2030, 40% higher than analyst consensus.

eDreams ODIGEO (hereinafter, 'The Company' or 'eDO'), the world's leading travel subscription platform, today announced its results for the first half of its fiscal year 2026 ended 30 September 2025.

The Company's subscription model continued to be the primary driver of growth and profitability. Prime membership grew by 18% year-on-year to 7.7 million, with 1.2 million net new members added in the last twelve months. Net additions reached 457,000 in the first half, a strong performance that drove a 16% increase in profitability1 to €94 million.

Building on its proven subscription model and the successful completion of its 3.5-year strategic roadmap earlier this year, eDO today unveils its new long-term plan to accelerate Prime membership growth through 2030.

H1 FY26 RESULTS HIGHLIGHTS

- The Prime model continued to drive strong growth

- Prime membership reached 7.7 million, an 18% increase year-on-year.

- Prime added 1.2 million net new members in the last twelve months, including 457,000 net additions in the first half.

- Significant uplift in profits

- Strong profitability and margin expansion. Cash EBITDA grew 16% year-on-year to €94 million.

- The margin on the core customer offering2 also increased to 42% (up from 36% in H1 FY25).

- Overall revenues3 increased by 5% to €344 million, while revenues from the Prime business4 increased by a notable 20% year-on-year, to €294 million, reflecting the successful focus on the Prime business.

- eDO is now a subscription business with Prime-related revenue now making up 74% of Cash Revenue Margin, a 9pp increase in just one year.

- Adjusted Net Income showed substantial growth increasing to €47.1 million, a notable increase from the €8.1 million reported in the first half of fiscal year 2025.

- Capital allocation and shareholder remuneration

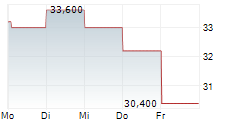

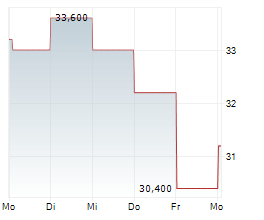

- Executing its approved share buyback plan, eDO invested €32.6 million in share repurchases in the first half of the fiscal year.

- Likewise, the Company executed on its planned capital reduction strategy by cancelling 5.98 million own shares (approximately 5% of shares outstanding), a move designed to increase earnings per share and directly enhance shareholder value.

- Demonstrating its strong financial position and commitment to delivering shareholder value, eDO is also aiming to invest a further €100 million in share repurchases over the next 2 years.

- Current trading

- Acquisition of new customers has recently been affected by increased blocking efforts by Ryanair; their efforts have not affected retention, and have continued and intensified despite final European High Court decisions confirming eDO's right to distribute their content.

- Taking this into account, the Company is adopting a conservative stance for the short term, aiming to add 600,000 new Prime members for full fiscal year 2026.

- New long-term strategy unveiled

- Exactly four years after unveiling its inaugural subscription-led strategy, in November 2021, and following its successful completion this year, eDO today presents to the market a new long-term strategic roadmap through 2030.

- The plan targets accelerated Prime member growth of 15-20% annually from FY28-FY30, aiming to reach over 13 million members by 2030, from the current 7.7 million. This target is 40% higher than the analyst consensus.

- This will be driven by investments in product diversification (notably Rail), accelerated international expansion, and the roll-out of new monthly and quarterly subscription options.

Dana Dunne, CEO of eDreams ODIGEO said: "We continue to prove the power of our subscription platform, a truly unique proposition in the market, delivering significant growth and strengthening our business quarter after quarter.

We are now delighting 7.7 million subscribers by providing exceptional value, including unique, flexibility features that boost customer engagement and satisfaction. On top of this, our model is a proven attraction for our shareholders; its strong and predictable cash generation has allowed us to deliver continued, significant shareholder remuneration, which we will continue to do.

Our proven track record of delivery gives us a powerful foundation to launch our next ambitious phase. The new long-term strategic roadmap we are presenting today is a direct result of that success. It is designed to accelerate our journey, building on our strengths to scale our model to new products, markets, and an even stronger future."

SUMMARY INCOME STATEMENT

(in million) | H1 FY26 | Var

| H1 FY25 | 2Q FY26 | Var.

| 2Q FY25 |

Revenue Margin | 343.8 | 5% | 327.9 | 171.1 | 2% | 167.8 |

Cash Marginal Profit | 144.2 | 10% | 130.8 | 79.1 | 12% | 70.8 |

Cash EBITDA | 94.0 | 16% | 81.1 | 55.0 | 22% | 45.1 |

Adjusted EBITDA | 98.1 | 105% | 47.8 | 48.9 | 94% | 25.2 |

Net Income | 31.5 | 2,270% | 1.3 | 17.9 | 615% | 2.5 |

Adjusted Net Income | 47.1 | 481% | 8.1 | 23.5 | 329% | 5.5 |

(in thousands) | ||||||

Prime Members | 7,720 | 18% | 6,538 | 7,720 | 18% | 6,538 |

About eDreams ODIGEO

eDreams ODIGEO is the world's leading travel subscription platform. It pioneered Prime, the first and largest travel subscription programme, which has topped over 7.7 million members since launching in 2017. Prime members are subscribed to global travel, gaining access to a comprehensive multi-product offering for all their travel needs-including hotels, rail, flights, dynamic packages and car rental, among others- compounded by industry-leading flexibility features and exclusive, member-only benefits. This entire Prime experience is powered by a proprietary, industry-leading AI platform that delivers a hyper-personalised service to its members. Listed on the Spanish Stock Market, the Company operates in 44 markets through its renowned brands-eDreams, GO Voyages, Opodo, Travellink, and the metasearch engine Liligo-to deliver a smarter, hyper-personalised, and comprehensive travel experience globally.

(*) GLOSSARY OF TERMS

Reconcilable to GAAP measures

Adjusted EBITDA means operating profit loss before depreciation and amortisation, impairment and profit loss on disposals of non-current assets, as well as adjusted items corresponding to certain share-based compensation, restructuring expenses and other income and expense items which are considered by Management to not be reflective of the Group's ongoing operations. Adjusted EBITDA provides to the reader a better view about the ongoing EBITDA generated by the Group.

Adjusted Net Income means the IFRS net income less certain share-based compensation, restructuring expenses and other income and expense items which are considered by Management to not be reflective of the Group's ongoing operations. Adjusted Net Income provides to the reader a better view about the ongoing results generated by the Group.

Cash EBITDA means "Adjusted EBITDA" plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on a gradual method. Cash EBITDA provides to the reader a view of the sum of the ongoing EBITDA and the full Prime fees generated in the period. The Group's main sources of financing (the 2027 Notes and the SSRCF) consider Cash EBITDA as the main measure of results and the source to meet the Group's financial obligations.

Cash Marginal Profit means "Marginal Profit" plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on a gradual method. Cash Marginal Profit provides a measure of the sum of the Marginal Profit and the full Prime fees generated in the period.

Revenue Margin means the IFRS revenue less the cost of supplies. The Group's Management uses Revenue Margin to provide a measure of its revenue after reflecting the deduction of amounts payable to suppliers in connection with the revenue recognition criteria used for products sold under the principal model (gross value basis). Accordingly, Revenue Margin provides a comparable revenue measure for products, whether sold under the agency or principal model. The Group used to act under the principal model in regards to the supply of hotel accommodation. Currently, the Group only offers hotel intermediation services, therefore no cost of supply is registered and Revenue and Revenue Margin are of equal amounts. Prime Revenue Margin refers to the Revenue Margin of the Prime segment.

Revenue Margin is split into the following categories:

- Gradual represents revenue which is recognised gradually over the period of the service agreement and mostly relates to recognised subscription fees, the service of Cancellation for any reason and Flexiticket and airlines overcommissions.

- Transaction Date represents revenue which is recognised at booking date and mostly relates to service fees, ancillaries, insurance, incentives (other than airlines overcommissions) and other fees.

- Other is a residual category and mainly relates to advertising and metasearch revenue, tax refunds and other fees.

Other Defined Terms

Prime members means the total number of customers that have a Prime subscription in a given period.

1 Cash EBITDA |

2 Cash Marginal Profit Margin |

3 Revenue Margin |

4 Prime Revenue Margin |

View source version on businesswire.com: https://www.businesswire.com/news/home/20251118968867/en/

Contacts:

edreams@instinctif.com