VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / November 19, 2025 / CoTec Holdings Corp. (TSXV:CTH)(OTCQB:CTHCF) ("CoTec" or the "Company") is pleased to announce that it has filed its unaudited interim condensed consolidated financial statements and the accompanying management's discussion and analysis ("MD&A") for the three and nine months ended September 30, 2025. The financial statements and MD&A can be accessed under the Company's SEDAR+ profile at www.sedarplus.ca.

Julian Treger, CoTec CEO commented: "During the third quarter we delivered significant progress across our portfolio, accelerated our strategic initiatives, advanced our flagship projects toward key milestones and completed a very successful oversubscribed financing initiative. At our U.S.-based rare earth magnet recycling joint venture, HyProMag USA LLC ("HyProMag USA"), the detailed design and engineering phase remains on schedule and within budget, site selection and lease negotiations are in final stages. ILS has been engaged as our first feedstock supplier and we are working on accelerating the expansion from one recycling and magnet manufacturing hub in Fort Worth, Texas to three hubs over the next three to five years.

Our Québec iron tailings project at Lac Jeannine is moving into feasibility study following the successful completion of our 2025 infill and expansion drilling program, with drilling results expected in Q1, 2026. The feasibility study will include the application of Salter gravity separation technology, which we believe could add significant value to the project.

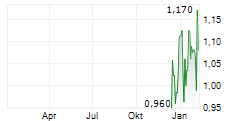

The Company continues to explore other opportunities in iron ore, copper and other minerals that could benefit from our suite of technologies. We believe the Company's market price remain materially undervalued compared to the intrinsic value of our asset base and technology portfolio and we have significantly stepped up our marketing efforts to reduce this gap."

The Company reported a net loss of approximately $2.9 million for the quarter and $8.1 million year-to-date. However, administrative overheads, comprising Professional consulting fees and General and administrative expenses totaled only $1.13m and $2.97m for the quarter and the year to date respectively, with the remainder of the loss mainly derived from non-cash items, accounting adjustments and finance expense provisions.

Highlights for the quarter include:

Operational - HyProMag USA

Detailed Design and Engineering ("DDE") more than 25% complete, on time and within budget

Expanded Texas hub scope from two to three HPMS vessels, increasing NdFeB co-product output

Commissioned expansion studies evaluating additional hubs in South Carolina and Nevada, which would expand HyProMag USA from one integrated hub to a three-hub national platform - effectively tripling the scale of the original business contemplated in the Feasibility Study

Commissioned Worley to contemplate a concept study on "Long Loop" recycling

Executed a feedstock supply and pre-processing site-sharing agreement with Intelligent Lifecycle Solutions ("ILS") covering South Carolina and Nevada; stockpiling of e-waste has commenced

Purchased three Inserma/PCB pre-processing units for Texas, Nevada, and South Carolina, with delivery expected before year-end

Continued engagement with U.S. federal and state agencies and commercial lenders regarding project financing and incentives

Operational - Lac Jeannine

Completed the 2025 infill and expansion drill program on August 27, 2025; assays expected in Q1 2026

Purchased a commercial-scale multi-gravity separation unit from Salter to evaluate ultra-fine iron recovery

Ongoing engagement with the Government of Québec, local stakeholders, and First Nations

Corporate

Completed the $13.5 million Listed Issuer Financing Exemption ("LIFE") and concurrent private placement financing, 35% oversubscribed

Secured $6.6 million in new convertible loan facilities from Kings Chapel and Epic Capital; no amounts drawn as at quarter-end

Converted $6.851 million of prior Kings Chapel convertible loans into equity following the automatic conversion trigger

Ended the quarter with $5.8 million in cash and cash equivalents, strengthened by the Q3 financing activities

Reported a net loss of $2.9 million for the quarter, driven primarily by G&A expenses, non-cash foreign-exchange and valuation adjustments, and share-based compensation

About CoTec

CoTec is a publicly traded investment issuer listed on the TSX Venture Exchange ("TSX-V") and the OTCQB and trades under the symbols CTH and CTHCF respectively. CoTec Holdings Corp. is a forward-thinking resource extraction company committed to revolutionizing the global metals and minerals industry through innovative, environmentally sustainable technologies and strategic asset acquisitions. With a mission to drive the sector toward a low-carbon future, CoTec employs a dual approach: investing in disruptive mineral extraction technologies that enhance efficiency and sustainability while applying these technologies to undervalued mining assets to unlock their full potential. By focusing on recycling, waste mining, and scalable solutions, the Company accelerates the production of critical minerals, shortens development timelines, and reduces environmental impact. CoTec's strategic model delivers low capital requirements, rapid revenue generation, and high barriers to entry, positioning it as a leading mid-tier disruptor in the commodities sector.

Please visit www.cotec.ca.

For further information, please contact:

Braam Jonker - (604) 992-5600

Forward-Looking Information Cautionary Statement

Statements in this press release regarding the Company and its investments which are not historical facts are "forward-looking statements" which involve risks and uncertainties, including statements relating to the roll out of its HyProMag USA and Lac Jeannine projects and its investments in MagIron, Ceibo, BSL and Salter, as well as management's expectations with respect to other current and potential future investments and the benefits to the Company which may be implied from such statements. Since forward-looking statements address future events and conditions, by their very nature, they involve inherent risks and uncertainties. Actual results in each case could differ materially from those currently anticipated in such statements, due to known and unknown risks and uncertainties affecting the Company, including but not limited to resource and reserve risks; environmental risks and costs; labor costs and shortages; uncertain supply and price fluctuations in materials; increases in energy costs; labor disputes and work stoppages; leasing costs and the availability of equipment; heavy equipment demand and availability; contractor and subcontractor performance issues; worksite safety issues; project delays and cost overruns; extreme weather conditions; and social disruptions. For further details regarding risks and uncertainties facing the Company please refer to "Risk Factors" in the Company's filing statement dated April 6, 2022, a copy of which may be found under the Company's SEDAR+ profile at www.sedarplus.ca. The Company assumes no responsibility to update forward-looking statements in this press release except as required by law. Readers should not place undue reliance on the forward-looking statements and information contained in this news release and are encouraged to read the Company's continuous disclosure documents which are available on SEDAR+ at www.sedarplus.ca.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: CoTec Holdings Corp.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/cotec-holdings-corp.-files-third-quarter-financial-statements-and-mdanda-1104147