- SE-MGH gas development on track, total project cost reduced to US$2 - $3 million with US$1.7 million spent to date.

- PT Dredolf Indonesia to construct pipeline, commencing in early 2026. First gas from SE-MGH expected to deliver 5-7 mmcf/d1 in H1 2026.

- Sustained positive cash flow from operations achieved in Q3 2025.

- Signing of gas transportation MOU with KJG Pipeline signals strategic shift in Bulu PSC and Lengo gas development.

Calgary, Alberta--(Newsfile Corp. - November 20, 2025) - Criterium Energy Ltd. (TSXV: CEQ) ("Criterium" or the "Company"), an independent upstream energy development and production company focused on energizing growth for Southeast Asia today provided an operational update on the Southeast Mengoepeh ("SE-MGH") and North Mengoepeh ("N-MGH") gas development projects, in addition to providing financial and operating results for the three-month period ended September 30, 2025.

"The SE-MGH development continues at a remarkable pace, with key commercial agreements in the final stages of negotiations, we remain on track and below budget to achieve first gas from SE-MGH in the first half of 2026," said Matthew Klukas, President and CEO of Criterium Energy. "SE-MGH will be a transformational cornerstone that will underpin future gas development in the Tungkal PSC, diversifying production and strengthening cash flow that will lead to a strengthened balance sheet and cash flow per share growth. Strengthening our balance sheet will not just come from increased cash flow but through the management of tax liabilities, and our team is working diligently with Indonesian regulators and the government tax office to address these issues and strengthen working capital in the near term."

Q3 2025 Operational & Financial Highlights

- Successful SEM-01 extended well test: SEM-01 tested 7 mmcf/d at 40/64" choke and up to 8 mmcf/d at 48/64" choke2. The results are aligned with Management expectations and support the immediate development of the 15 bcf (equivalent to 2.5 MMboe3) of contingent resource1.

- SE-MGH production volume: Pressure data collected during the extended well test and subsequent dynamic reservoir modeling support a production plateau of 5 - 7 mmcf/d1. Management also estimates that resources may increase beyond the 15 bcf through the drilling of a second production well. Further information to be communicated in the Company's 2025 Reserve Report, scheduled to be released in Q1 2026.

- SE-MGH to be developed within Cash Flow: Overall project budget has been reduced to US$2 - $3 million (initial estimate was US$3 - $5 million) of which approximately US$1.7 million has been incurred to date. Remaining costs include land acquisition for the pipeline connecting SE-MGH to existing infrastructure and approximately US$1 million of contingencies. The Company reiterates its ability to bring SE-MGH online within cash flow from operations and forecasts first gas in H1 2026.

- Pipeline vendor selected, remaining commercial contracts on track: Criterium has signed a Letter of Intent with PT Dredolf Indonesia ("Dredolf") for the construction of the SE-MGH pipeline. Construction is scheduled to commence in early 2026. The Facility Sharing Agreement ("FSA") and Gas Sales Agreement ("GSA") contracting process remains on track with gas sales price anticipated to be aligned with recent sales in South Sumatra of US$6 - $7/mmbtu range, an increase from management's initial estimate of US$5 - $7/mmbtu4.

- N-MGH extended well test scheduled for Q1 2026: MGH-20 tested 2.5 mmcf/d5 with associated oil, suggesting commercial flowrates from the N-MGH field. The tested interval was only one of multiple zones which are believed to be gas bearing. In Q1 2026, the Company will perforate these additional zones to understand the full gas resource potential of N-MGH.

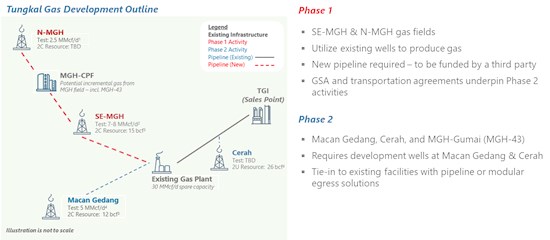

- Tungkal Gas development takes shape: The successful tests at SE-MGH and N-MGH and progress with pipeline, facility, and gas sales agreements support development of both fields with anticipated first gas in H1 2026 from SE-MGH followed by N-MGH. Both fields will be developed via pipeline which will connect to existing and underutilized processing and transportation infrastructure. Following this development, the Company will turn its focus to Macan Gedang (contingent resources of 13 bcf1), Cerah (best case prospective resources of 26 bcf1), and MGH-43 (volumes under evaluation) over the next two to three years.

- Bulu PSC Gas development progress: Criterium, via a wholly owned subsidiary, signed a Memorandum of Understanding ("MOU") with PT Kalimantan Jawa Gas ("KJG") to collaborate on gas development and transportation for industrial supply to Central, East, and West Java via the KJG Pipeline. The KJG Pipeline is an existing pipeline located approximately 25 km from the Lengo Field in the Bulu PSC.

- Q3 2025 production below forecast: Production averaged 784 bbl/d in Q3 20256, below prior Management estimates. The reduction was due to mechanical issues at key production wells in PLT and MGH during the SEM-01 re-entry operations, which were unable to be remedied quickly during SEM-01 testing. The issues have been resolved, and wells are back online.

- Positive Cash Flow from Operations in Q3 2025: Despite a reduction in oil production compared to Q2 2025, operating cash flow remained positive at C$333 thousand, further demonstrating the Company's continued focus on managing operating costs and driving gas development.

Adjusted Financial and Operational Summary

| Three months ended | |||

| ($000 CAD, except per share and per boe amounts) | September 30, 2025 | June 30, 2025 | September 30, 2024 |

| Financial | |||

| Petroleum sales | 6,898 | 7,542 | 8,240 |

| Cash flow from (used in) operating activities | 333 | 164 | 1,513 |

| Net Income (Loss) | (3,760) | (1,237) | (1,306) |

| Capital Expenditures | (696) | (714) | (2,781) |

| Weighted average common shares outstanding (000s) | 136,375 | 136,375 | 132,356 |

| Weighted average fully diluted shares outstanding (000s) | 233,371 | 233,371 | |

| Operating | |||

| Average daily production6 (bbl/d) | 784 | 890 | 879 |

| Netbacks ($CAD/bbl) | |||

| Petroleum and natural gas sales | 99.08 | 96.66 | 109.87 |

| Royalties (Government Take) | (23.81) | (17.85) | (26.72) |

| Production Costs | (43.56) | (35.77) | (32.68) |

| Operating Netback7 | 31.71 | 43.04 | 50.52 |

Criterium's unaudited financial results and supporting Management's Discussion & Analysis for the three-month period ended September 30, 2025 is available on Sedar+ and can also be found on the Company's website (Reports & Filings).

Tungkal PSC Gas Development - Building and Diversifying the Production Portfolio

For the remainder of 2025, management intends to develop the Company's gas assets with an eye toward diversifying production beyond oil, backed by long-term Gas Sales Agreements ("GSAs") and funded by expected operating cash flow. The intent is to focus on the SE-MGH field (base case 2C contingent resource of 15 bcf1), targeting production in H1 2026 followed by production from N-MGH thereafter.

Subsequently, Criterium intends to develop the Macan Gedang gas asset, where the Macan Gedang-1 well encountered gas in the Gumai Formation and tested at 5 mmcf/d8, with the intention of bringing production online in 2027. The Company's most recent resource report dated March 14, 2025 indicated a 2C gas resource at Macan Gedang of 13 bcf1.

In addition to SE-MGH, N-MGH, and Macan Gedang, the Tungkal PSC contains additional potential gas. Specifically, (i) the Cerah-1 well, drilled in 2008 encountered gas shows in the Gumai Formation but was not tested at the time due to low gas prices and lack of accessible infrastructure. Best case prospective resources in Cerah are expected to be 26 bcf recoverable1; and (ii) gas shows were encountered in the Gumai Formation during the drilling of the MGH-43 infill well which is still being evaluated. The volumes from MGH-43 and other associated gas from the MGH field can be produced via the planned pipeline connecting N-MGH to SE-MGH.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7241/275282_55a773a6844cfb67_001full.jpg

SE-MGH Development

The Company successfully re-entered the SEM-01 well and completed an extended well test in August 2025. The well sustained rates of 7 mmcf/d through a 40/64" choke over a 48-hour period and achieved up to 8 mmcf/d through a 48/64" choke2. The Company did not proceed to a larger choke size due to limitations of the existing flare pit but collected sufficient data to support reserve certification and to underpin a binding GSA.

SE-MGH will be initially developed with the existing SEM-01 well with a base case production plateau of 6 mmcf/d for a period of six years1. Pressure data collected during the extended well test and subsequent dynamic reservoir modeling suggests that a second production well may increase production, plateau period, and ultimate recovery beyond the current base case estimate of 15 bcf.

The produced gas from SEM-01 will be transported approximately 14 km via a new pipeline to existing processing and transportation facilities (the "SE-MGH Pipeline"). Gas from SE-MGH requires minimal processing which will consist of removing water and small amounts of condensate which can be sold into domestic markets. Given the strong reservoir pressure of over 1,000 psig2 no compression is required during the initial production phase, thus reducing upfront capital costs.

After a competitive procurement process, Criterium has signed a Letter of Intent ("LOI") with PT Dredolf Indonesia for the construction of the SE-MGH Pipeline. Under this LOI, Dredolf will fund and construct the pipeline with Criterium paying a monthly transportation fee commencing upon first production. Dredolf has extensive experience in the Indonesian infrastructure sector with successful onshore and offshore pipeline construction projects. The pipeline will be properly sized to accommodate potential incremental volumes from N-MGH and gas produced from the MGH field.

The anticipated sales point for gas produced from the Tungkal PSC will be the TGI metering station (see illustration above) which has access to SE Asia's largest demand centers in South Sumatra, Java, and Singapore. Criterium is progressing towards a binding Heads of Agreement and GSA with a credible Indonesia offtaker. Pricing will be determined upon successful execution of the GSA, however recent contracts in South Sumatra have ranged between US$6 - $7/mmbtu4. GSAs offer significant benefit to Criterium as they provide stable long-term fixed price, therefore gas production is not subject to external price fluctuations as it is with oil sales, building a steady and resilient cash flow profile.

The estimated capital required to achieve first production from SE-MGH has been reduced to US$2 - $3 million net to Criterium, with approximately US$1.7 million spent to date. The remaining costs include land acquisition required for the SE-MGH Pipeline and approximately US$1 million for contingencies during pipeline construction. The Company reiterates its ability to achieve first production with current cash on balance sheet combined with cash flow from operations.

N-MGH Development

The N-MGH field consists of four wells drilled to date which were all shut-in in 2014 due to high gas production rates and no means of offtake. Criterium intends to produce gas from a maximum of two wells (MGH-20 & MGH-32) with incremental oil production also expected. Oil produced from N-MGH can be stored on site and transported via truck to the MGH Central Processing Facility located 7 km away on existing roads owned by Criterium.

In July 2025, the Company conducted an initial flow test at the re-entered MGH-20 well in N-MGH, which flowed 2.5 mmcf/d through an 8/64" choke with associated oil production of approximately 215 bbls5. This initial test produced gas from one of at least four zones within the Talang Aker Formation which are anticipated to be gas-bearing. In Q1 2026, Criterium will perforate three additional intervals to understand the full gas resource potential of the N-MGH field.

The gas from N-MGH is anticipated to be produced via a newly constructed pipeline connecting the field to the SE-MGH Pipeline (the "N-MGH Pipeline"). The N-MGH Pipeline will conveniently utilize existing right of ways and connect the MGH Central Processing Facility to gas egress, thus allowing any associated gas within the MGH field or identified gas zones within the MGH field to flow to sales markets at minimal additional costs. Construction and funding mechanism of the N-MGH Pipeline is anticipated to be of similar structure to that of the SE-MGH Pipeline.

The estimated capital requirement for N-MGH, including the production testing of additional zones within MGH-20 and MGH-32 is anticipated to be less than US$ 1 million net to Criterium. Final costs will depend on the agreed pipeline funding mechanism. All gas sold from N-MGH will be sold within the terms and conditions of the GSA currently being completed for the Tungkal PSC.

Bulu Asset Update

Given the continued delay of the original transaction dated May 21, 2024, Criterium has taken a more active role in the development of the Lengo gas field, including notifying KrisEnergy (Satria) Ltd. (the "Operator") of numerous breaches and deficiencies identified in the Joint Operating Agreement. Following the failure of the Operator to remedy these deficiencies, Criterium has held discussions with key project stakeholders with an aim to revise the development plan and progress key commercial contracts including transportation agreements and gas sales agreements.

To support this initiative, Criterium, via a wholly owned subsidiary, signed an MOU with KJG which underpins our shared commitment to advancing a long-term gas infrastructure project involving the Lengo Gas Field and the KJG Pipeline. Lengo is located within the Bulu PSC and contains an estimated gross 2C contingent resource of 360 bcf9. Criterium holds a 42.5% non-operated working interest in the Bulu PSC. KJG owns and operates an offshore pipeline servicing the East, Central, and West Java markets and is conveniently located approximately 25 km from the Lengo field.

Outlook

Based on the capital program and activities for the SE-MGH development, Criterium believes it has the potential to more than double current oil equivalent production in H1 2026 which it expects to fund from operating cash flow. By duplicating its SE-MGH development strategy on nearby N-MGH and Macan Gedang, production can be increased further with relatively modest capital expenditures to generate improved, near-term returns.

During the next 12 months, key milestones for the Company and its gas developments in the Tungkal PSC and Bulu PSC include:

- Gas Sales Agreement and other commercial agreements: With the pipeline vendor identified, attention now shifts to finalizing terms with the credible domestic Indonesian offtaker for a long-term GSA. These agreements will provide Criterium with processing and transportation services, connecting produced gas from the Tungkal PSC to under-supplied gas markets.

- Extended well testing of N-MGH: Mobilizing the Company's service rig to conduct extended well testing at MGH-20 and MGH-32 to confirm well deliverability and support the plan of development and pipeline construction for gas at the N-MGH field.

- SE-MGH & N-MGH site preparations: Pending the finalization of the GSA and other commercial contracts, the Company will commence pipeline construction at SE-MGH and subsequently N-MGH to accommodate production and transportation of produced gas.

- Tungkal First Gas: With the successful completion of the SE-MGH Pipeline, Criterium anticipates initial production from SE-MGH to be 5 - 7 mmcf/d1 which can be further supplemented with 2 - 3 mmcf/d5 from the successful completion of the N-MGH Pipeline.

- Bulu PSC stakeholder engagement: Criterium will coordinate with the Bulu PSC Operator, and the Indonesian oil and gas regulator, SKK MIGAS, to develop commercial terms with KJG for gas transportation, in addition to revising the plan of development for the Lengo gas field.

Management continues to monitor and assess the cash flow impact and margin implications of volatile global commodity pricing driven by the rapidly shifting macroeconomic environment. However, management firmly believes that this environment reinforces the Company's strategy focused on acquiring undercapitalized assets in an energy hungry Southeast Asian market. With a portfolio that contains contingent resources heavily weighted towards natural gas, which attracts stable long-term pricing in domestic markets the Company is primed to materially increase and diversify production in the near term.

Stay Connected to Criterium

Shareholders and other interested parties who would like to learn more about the Criterium opportunity are encouraged to visit the Company's website, review a recent corporate presentation, and follow the Company on X (formerly Twitter) and LinkedIn for ongoing corporate updates and relevant international oil and gas industry information.

About Criterium Energy Ltd.

Criterium Energy Ltd. (TSXV: CEQ) is Canadian-based upstream energy company focused on the aggregation and sustainable development of assets in Southeast Asia that can deliver scalable growth and cash flow generation. This region is expected to reach a population approaching 800 million people within the next 25 years, driving world-leading economic growth and record-high energy demand. With international operating expertise and a local presence, Criterium intends to contribute responsible, safe and secure sources of energy to help meet this demand. The Company is committed to maximizing total shareholder return by executing across three strategic pillars that include (1) fostering a successful and sustainable reputation; (2) leveraging innovation and technology arbitrage; and (3) achieving operational excellence with an unwavering commitment to safety. For further information please visit our website (www.criteriumenergy.com) or contact:

| Matthew Klukas President and Chief Executive Officer Criterium Energy Ltd. Email: info@criteriumenergy.com Phone: +1-403-668-1630 | Andrew Spitzer Chief Financial Officer Criterium Energy Ltd. Email: info@criteriumenergy.com Phone: +1-403-668-1630 |

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES.

Notes

1 2024 Report: Reserve Report commissioned by Criterium Energy Ltd. and prepared by ERCE Australia Pty. Ltd, an independent reserves evaluator and auditor, dated March 14, 2025 with effective date of December 31, 2024 (the "2024 Report"), which was prepared in accordance with the definitions, standards, and procedures contained in the Canadian National Instrument 51-101 Standards of Disclosure of Oil and Gas Activities. The Reserve Report will be made available on Criterium's SEDAR profile.

2 SEM-01 Well Test Results: SEM-01 completed extended well test on August 24 and is currently suspended while observing pressure build-up. The production test resulted in a clean-up period which produced 7.9 mmcf/d through a 48/64" choke with 706 psig WHP for a period of 4 hours. The 3-stage completion test was as follows: Stage 1; 24/64" choke, 3.0 mmcf/d, 1,150 psig WHP for 48 hours, Stage 2; 32/64" choke, 5.1 mmcf/d, 1,070 psig WHP for 48 hours, Stage 3; 40/64" choke, 7.1 mmcf/d, 960 psig WHP for 48 hours.

3 "Barrel Oil Equivalent" or "boe" is determined by converting a volume of natural gas to barrels using the ratio of 5.615 mcf to one barrel. BOEs may be misleading, particularly if used in isolation. A boe conversion ratio of 5.615 mcf:1 boe is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

4 Recent sales agreements in South Sumatra may not be indicative of future pricing for SE-MGH and solely relying on non-public information such as gas sales agreements may be misleading.

5 MGH-20 gas test results: 24-hour test of 2.1 mmcf/d through 4/64" choke, FTHP 500 psi and 24 hours at 2.5 mmcf/d through 8/64" choke, FTHP 360psi. Liquid carryover was recovered with a total of 215 bbls of oil recovered. Oil recovered had an API of 30.3 and a pour point of 40oC.

6 Estimate based on field production reports

7 Non-IFRS financial measure or ratio that does not have any standardized meaning as prescribed by International Financial Reporting Standards, and therefore, may not be comparable with calculations of similar measures or ratios for other entities. See "Advisories - Non-IFRS and Other Financial Measures" contained within this press release and in the Company's most recently filed MD&A, available on SEDAR+ at sedarplus.ca. Netback is calculated by subtracting direct operating costs from net revenue and dividing by the amount of barrels produced over the same time frame.

8 Macan Gedang gas test duration was approximately 2 days and produced 4.6 mmcf/d through a 48/64" choke.

9 Management estimate based on the Resource Report prepared by Netherland, Sewell & Associates, Inc. dated February 6, 2023 with an effective date of December 31, 2022, which was prepared in accordance with the definitions, standards, and procedures contained in the Canadian National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities. The Resource Report is available in the Annual Information Form on Criterium's SEDAR profile.

Abbreviations

| API CEQ bbls bbls/d bcf boe boe/d ERCE FSA FTHP LOI mmbtu mmcf mmcf/d MOU MGH N-MGH PLT PSC PSIG SE-MGH SEM-01 SKK MIGAS TGI TSXV WHP | American Petroleum Institute (gravity) Criterium Energy Ltd. barrels of oil barrels of oil per day billion cubic feet barrel of oil equivalent barrels of oil equivalent per day ERCE Australia Pty Ltd Facility Sharing Agreement Flowing Tubing Head Pressure Letter of intent million British thermal units million cubic feet million cubic feet per day Memorandum of Understanding Mengoepeh North Mengoepeh Pematang Lantih Production Sharing Contract Pounds per Square Inch Gauge Southeast Mengoepeh Southeast Mengoepeh Well 01 Indonesia's Oil & Gas Regulator Transportasi Gas Indonesia TSX Venture Exchange Well Head Pressure |

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain forward-looking information and statements that are based on expectations, estimates, projections, and interpretations as at the date of this news release. The use of any of the words "expect", "anticipate", "continue", "estimate", "may", "will", "project", "should", "believe", "plans", "intends", "seek", "aims" and similar expressions are intended to identify forward-looking information or statements.

Factors that could cause actual results to vary from forward-looking statements or may affect the operations, performance, development and results of Criterium's businesses include, among other things: risks and assumptions associated with operations; risks inherent in Criterium's future operations; increases in maintenance, operating or financing costs; the availability and price of labour, equipment and materials; competitive factors, including competition from third parties in the areas in which Criterium intends to operate, pricing pressures and supply and demand in the oil and gas industry; fluctuations in currency and interest rates; inflation; risks of war, hostilities, civil insurrection, pandemics, instability and political and economic conditions in or affecting Indonesia or other countries in which Criterium intends to operate (including the ongoing Russian-Ukrainian conflict); severe weather conditions and risks related to climate change; terrorist threats; risks associated with technology; changes in laws and regulations, including environmental, regulatory and taxation laws, and the interpretation of such changes to Criterium future business; availability of adequate levels of insurance; difficulty in obtaining necessary regulatory approvals and the maintenance of such approvals; general economic and business conditions and markets; and such other similar risks and uncertainties. The impact of any one assumption, risk, uncertainty or other factor on a forward-looking statement cannot be determined with certainty, as these are interdependent and the Company's future course of action depends on the assessment of all information available at the relevant time. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

With respect to forward-looking statements contained in this press release, Criterium has made assumptions regarding, among other things: future exchange and interest rates; supply of and demand for commodities; inflation; the availability of capital on satisfactory terms; the availability and price of labour and materials; the impact of increasing competition; conditions in general economic and financial markets; access to capital; the receipt and timing of regulatory and other required approvals; the ability of Criterium to implement its business strategies; the continuance of existing and proposed tax regimes; and effects of regulation by governmental agencies.

The forward-looking statements contained in this press release are made as of the date hereof and the parties do not undertake any obligation to update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

Non-IFRS and Other Financial Measures

Throughout this press release and other materials disclosed by the Company, Criterium uses certain measures to analyze financial performance, financial position and cash flow. These non-IFRS and other specified financial measures do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to similar measures presented by other entities. The non-IFRS and other specified financial measures should not be considered alternatives to, or more meaningful than, financial measures that are determined in accordance with IFRS as indicators of Criterium's performance. Management believes that the presentation of these non-IFRS and other specified financial measures provides useful information to shareholders and investors in understanding and evaluating the Company's ongoing operating performance, and the measures provide increased transparency and the ability to better analyze Criterium's business performance against prior periods on a comparable basis.

Operating Netback per bbl

Operating netback per bbl equals petroleum sales less royalties and net opex calculated on a per bbl basis. Management considers operating netback per bbl an important measure to evaluate its operational performance as it demonstrates its field level profitability relative to current commodity prices.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275282

SOURCE: Criterium Energy Ltd.