STOCKHOLM, Nov. 24, 2025 /PRNewswire/ -- Einride AB, a technology company driving the transition to electric and autonomous freight operations for some of the world's largest shippers ("Einride" or the "Company"), today announced the appointment of Anubhav Verma as Chief Financial Officer in preparation for the Company's planned public listing on the New York Stock Exchange via its proposed business combination with Legato Merger Corp. III (NYSEAMERICAN: LEGT), a special purpose acquisition company ("Legato").

Verma, whose appointment will become effective in January 2026, brings over 16 years of global experience in capital markets, mergers and acquisitions, and strategic finance. Most recently, he served as CFO of LiDAR technology company MicroVision (NASDAQ: MVIS) for four years. During this tenure, he led the expansion of MicroVision's deep tech software capabilities across U.S. and EU markets, successfully broadening the company's reach across the automotive, industrial, and defense tech sectors, while scaling manufacturing operations to support commercial growth. Previously, he held senior finance roles at Exela Technologies, including leading a $2.8 billion SPAC reverse merger, and began his career in investment banking at Credit Suisse.

"Anubhav's experience in leading a multi-billion dollar SPAC combination and cross-border expansion in automotive and industrial sectors directly aligns with our growth strategy as we prepare to make our public market debut," said Roozbeh Charli, CEO of Einride. "As freight operators worldwide recognize the advantages of electric and autonomous solutions, his leadership will be instrumental in positioning Einride to capture this market shift."

Einride is a leading technology platform positioning to capture significant market share in the $4.6 trillion global road freight market's transition to electric and autonomous operations. The Company has established proven commercial traction with over 25 enterprise customers across seven countries, including a strong base in the United States, its second largest market. This includes a contracted ARR base of $65 million and over $800 million in potential long-term ARR through Joint Business Plans with blue-chip clients.

"Einride has built a remarkable foundation of technology, talent, and global momentum. As the Company prepares for a public listing, my focus will be to drive financially disciplined growth and rapidly scale operations globally to become the leading player in the multi-trillion dollar freight and logistics industry and establish long-term enterprise partnerships especially in the U.S. markets," said Anubhav Verma.

Einride has received industry-first regulatory permits for autonomous vehicle operations across the U.S. and Europe, maintains a zero traffic incident safety record, and has developed proprietary AI-powered technology that enables cost-effective freight solutions through its comprehensive platform. The business combination with Legato, which is expected to close in the first half of 2026, values Einride at a $1.8 billion pre-money equity valuation and equips the Company to scale its dual Freight-Capacity-as-a-Service (FCaaS) and Software-as-a-Service (SaaS) approach through its AI-powered platform.

About Einride

Founded in 2016, Einride is a technology company that develops and operates digital, electric and autonomous freight solutions to accelerate the transition away from diesel-based road transportation in a cost-efficient way. Its technology platform includes AI planning optimization, one of the world's largest electric heavy-duty fleets, charging infrastructure, and autonomous technologies. Einride is serving customers across North America, Europe and the Middle East.

On November 12, 2025, Einride and Legato, a special purpose acquisition company, announced they had entered into a definitive business combination agreement for a proposed business combination (the "Transaction") that would result in Einride becoming a NYSE-listed public company. The Transaction was unanimously approved by the Boards of Directors of Legato and Einride. Completion of the proposed Transaction is anticipated to occur in the first half of 2026 subject to customary closing conditions, including regulatory approvals.

About Legato Merger Corp. III:

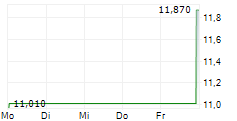

Legato Merger Corp. III (NYSEAMERICAN: LEGT) is a blank check company organized for the purpose of effecting a merger, capital stock exchange, asset acquisition or other similar business combination with one or more businesses or entities.

Forward-Looking Statements

This communication contains certain "forward-looking statements" within the meaning of U.S. federal securities laws with respect to the proposed transaction between Einride and Legato, including, but not limited to, statements regarding the planned business combination with Legato and the addressable market for Einride's solutions and services. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "future," "opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Forward-looking statements are their managements' current predictions, projections and other statements about future events that are based on current expectations and assumptions available to the Company and Legato, and, as a result, are subject to risks and uncertainties. Any such expectations and assumptions, whether or not identified in this communication, should be regarded as preliminary and for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of definitive agreements with respect to the business combination; (2) the outcome of any legal proceedings that may be instituted against Legato, Einride, the combined company or others following the announcement of the business combination and any definitive agreements with respect thereto; (3) the amount of redemption requests made by Legato public shareholders and the inability to complete the business combination due to the failure to obtain approval of the shareholders of Legato, to obtain financing to complete the transaction or to satisfy other conditions to closing; (4) risks related to the scaling of the Company's business and the timing of expected business milestones; (5) the ability to meet stock exchange listing standards following the consummation of the business combination; (6) the risk that the transaction disrupts current plans and operations of the Company as a result of the announcement and consummation of the transaction; (7) the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (8) costs related to the business combination; (9) risks associated with changes in laws or regulations applicable to the Company's solutions and services and the Company's international operations; (10) the possibility that the Company or the combined company may be adversely affected by other economic, geopolitical, business, and/or competitive factors; (11) supply shortages in the materials necessary for the production of Einride's solutions; (12) negative perceptions or publicity of the Company; (13) risks related to working with third-party manufacturers for key components of Einride's solutions; (14) the termination or suspension of any of Einride's contracts or the reduction in counterparty spending; and (15) the ability of Einride or the combined company to issue equity or equity- linked securities in connection with the proposed business combination or in the future.

Forward-looking statements are not guarantees of future performance. You should carefully consider the foregoing factors and the other risks and uncertainties described in the "Risk Factors" section of the Company's registration statement on Form F-4 to be filed by the Company with the U.S. Securities and Exchange Commission (the "SEC"), and other documents filed by the Company and/or Legato from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward- looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and all forward-looking statements in this communication are qualified by these cautionary statements. The Company and Legato assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except to the extent required by applicable law. Neither the Company nor Legato gives any assurance that either the Company or Legato will achieve its expectations. The inclusion of any statement in this communication does not constitute an admission by the Company or Legato or any other person that the events or circumstances described in such statement are material.

Additional Information and Where to Find It

In connection with the transaction, the Company intends to file a registration statement on Form F-4 with the SEC that will include a proxy statement of Legato and a prospectus of the Company. After the registration statement is declared effective, the definitive proxy statement/prospectus will be sent to all Legato shareholders as of a record date to be established for voting on the proposed transaction. Legato also will file other documents regarding the proposed transaction with the SEC. This communication does not contain all the information that should be considered concerning the proposed transactions and is not intended to form the basis of any investment decision or any other decision in respect of the transactions.

Before making any voting or investment decision, investors and shareholders of Legato are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction. Investors and shareholders will be able to obtain free copies of the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Legato through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Legato may be obtained by written request to Legato at Legato Merger Corp. III, 777 Third Avenue, 37th Floor, New York, NY 10017.

Participants in the Solicitation

Legato and the Company and their respective directors and officers may be deemed to be participants in the solicitation of proxies from Legato's shareholders in connection with the proposed transaction. Information about Legato's directors and executive officers and their ownership of Legato's securities is set forth in Legato's filings with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available.

Shareholders, potential investors and other interested persons should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This communication not constitute a solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the proposed transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Legato, Einride or the combined company resulting from the proposed transaction, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act. This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction in where such distribution or use would be contrary to local law or regulation.

Investor & Media Contacts

Einride

Christina Zander

Head of Communications

Einride

press@einride.tech

Einride@icrinc.com

Legato Merger Corp. III

Eric Rosenfeld

Chief SPAC Officer

Legato Merger Corp. III

ir@legatomerger.com

This information was brought to you by Cision http://news.cision.com.

https://news.cision.com/einride/r/einride--a-leader-in-electric-and-autonomous-freight--appoints-anubhav-verma-as-chief-financial-offi,c4265858

The following files are available for download:

https://mb.cision.com/Main/22016/4265858/3801830.pdf | Release |

https://news.cision.com/einride/i/anubhavverma,c3490036 | AnubhavVerma |

![]() View original content:https://www.prnewswire.co.uk/news-releases/einride-a-leader-in-electric-and-autonomous-freight-appoints-anubhav-verma-as-chief-financial-officer-ahead-of-planned-public-listing-302624473.html

View original content:https://www.prnewswire.co.uk/news-releases/einride-a-leader-in-electric-and-autonomous-freight-appoints-anubhav-verma-as-chief-financial-officer-ahead-of-planned-public-listing-302624473.html