Worldwide Healthcare Trust PLC - Update statement regarding the re-election of two Directors at the 2025 Annual General Meeting (AGM)

PR Newswire

LONDON, United Kingdom, November 28

Worldwide Healthcare Trust PLC

Update Statement Regarding the Re-Election of Two Directors

at the 2025 Annual General Meeting (AGM)

All of the resolutions proposed at the Company's AGM on 9 July 2025 were passed comfortably, although the votes in favour of the resolutions to re-elect Doug McCutcheon and Sven Borho as Directors of the Company had more than 20% of votes cast against the respective resolutions. The Board understands that some shareholders deemed Mr. McCutcheon not to be independent due to his length of service on the Board (12 years) and that Mr. Borho should not be a Director due to his role as a Managing Partner at OrbiMed Capital LLC, the Company's Portfolio Manager. The Company, including Mr. Borho and Mr. McCutcheon as Board Chair, actively engage with shareholders on these and other matters.

The Board shares the widely accepted view that length of service does not in itself impair a Director's ability to act independently. On the contrary, the Board believes that long-serving Directors' perspectives can add value to the deliberations of the Board.

Mr. McCutcheon was asked by the Board to take on the role of Board Chair from July 2022 for a period of three to five years. This was to oversee the renewal of the Board's composition, while providing continuity and ensuring an orderly succession. As stated in the Company's recently published half year report, the renewal of the Board is now largely complete. As such, and as previously announced, Mr. McCutcheon will be retiring from the Board at the conclusion of the AGM in July 2026. At that time, William Hemmings will succeed Mr. McCutcheon as the Company's Board Chair.

Having a senior OrbiMed representative on the Board dates back to the Company's inception in 1995. This arrangement has worked well for over three decades and is in accordance with the provisions of the AIC Code of Corporate Governance.

Mr. Borho was appointed a Director of the Company in June 2018. The Board believes that the Company benefits from his extensive knowledge and experience in investment matters. As the Company's only non-independent Director, he works alongside a majority of wholly independent colleagues. The Board operates independently of the Company's manager and has also taken steps to avoid any potential conflicts of interest. Mr. Borho does not sit on any of the Board's Committees and he does not receive a fee for serving as a Director. In addition, he is not involved with the selection of new Directors, the setting of Director remuneration or the review and assessment of OrbiMed's performance and the terms and conditions on which OrbiMed is engaged.

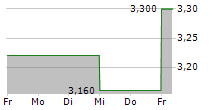

As at 27 November 2025, the Company's net asset value per share total return is +24.5% financial year to date and +13.9% annualised since inception. The share price total return during the same periods is +33.3% and 13.6%, respectively.

28 November 2025

-Ends-