Hagens Berman Urges Investors to Contact Firm Following Revelations of Integration Failure and 36% Stock Crash

SAN FRANCISCO, Nov. 28, 2025 /PRNewswire/ -- Investor rights law firm Hagens Berman reminds investors of the January 12, 2026, deadline to move the Court for appointment as lead plaintiff in the securities fraud class action lawsuit filed against Primo Brands Corporation (NYSE: PRMB) and its predecessor, Primo Water Corporation (PRMW).

The lawsuit alleges that the company misled investors by claiming the integration of its merger was "flawless" when, in reality, it was botched, leading to massive customer service failures and a devastating stock drop.

"The core of this lawsuit is that Primo Brands allegedly concealed severe problems during a critical merger, painting a false picture of operational success while the foundation was cracking," said Reed Kathrein, the Hagens Berman partner leading the investigation. "We urge investors who suffered substantial losses to contact our firm immediately to discuss their rights."

Key Allegations & Facts for PRMB Investors

- Class Period: June 17, 2024 - Nov. 6, 2025

- Lead Plaintiff Deadline: Jan. 12, 2026

- Core Allegations: Misleading statements that the merger integration was "flawless," concealing severe technology failures and supply disruptions that caused customer loss and led to a CEO replacement.

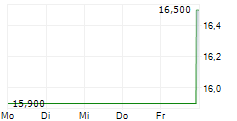

- Financial Impact: Stock fell approximately 36% following the November 6, 2025, disclosure of operational failures and the need to slash 2025 revenue forecasts.

What Investors Should Know

The lawsuit alleges that Primo Brands' executives repeatedly assured investors that the merger was tracking well and would accelerate growth. These statements were allegedly false because the integration was suffering from significant, undisclosed technological and service issues.

The truth began to emerge in stages, culminating on November 6, 2025, when the Company announced a major leadership change, replacing its CEO, and admitted they "probably moved too far too fast on some of the various integration work streams." This final disclosure confirmed the operational failures, leading to the dramatic 36% stock crash as investors realized the true extent of the financial damage.

Hagens Berman is investigating whether the Company violated federal securities laws by making false or misleading statements to inflate its stock price during the Class Period.

Next Steps for Investors:

If you purchased Primo Brands (PRMB) or Primo Water (PRMW) securities during the Class Period and suffered losses, you may be eligible to serve as Lead Plaintiff. The deadline to file your motion for Lead Plaintiff is January 12, 2026.

TO SUBMIT YOUR PRIMO BRANDS (PRMB) STOCK LOSSES NOW OR FOR A CONFIDENTIAL CONSULTATION:

Visit: www.hbsslaw.com/investor- fraud /prmb

Contact the Firm Now: [email protected]

844-916-0895

If you'd like more information and answers to frequently asked questions about the Primo case and our investigation, read more »

Whistleblowers: Persons with non-public information regarding Primo should consider their options to help in the investigation or take advantage of the SEC Whistleblower program. Under the new program, whistleblowers who provide original information may receive rewards totaling up to 30 percent of any successful recovery made by the SEC. For more information, call Reed Kathrein at 844-916-0895 or email [email protected].

About Hagens Berman

Hagens Berman is a global plaintiffs' rights complex litigation firm focusing on corporate accountability. The firm is home to a robust practice and represents investors as well as whistleblowers, workers, consumers and others in cases achieving real results for those harmed by corporate negligence and other wrongdoings. Hagens Berman's team has secured more than $2.9 billion in this area of law. More about the firm and its successes can be found at hbsslaw.com. Follow the firm for updates and news at @ClassActionLaw.

SOURCE Hagens Berman Sobol Shapiro LLP