Earlier this month, NAGA cut its FY25 guidance as a result of ongoing subdued market conditions. Further, the company announced the implementation of a reverse stock split. Here is what is important:

NAGA cut its sales outlook to € 62-66m from € 74m previously (vs € 63m in FY24). We had already anticipated a shortfall of the guidance (eNuW old: € 70m), but the magnitude was a bit surprising. The main reason for the muted outlook was according to management the persistently low volatility throughout 2025. Mind you, that volatility is usually the main driver of number of transactions and hence volumes. Due to the ongoing low volatility, number of transaction fell short of expectations and should now come in at only 7.6m (eNuW; vs 7.6m in FY24 vs eNuW old: 8.3m). Assuming that revenues per transaction remain rather stable, we now expect sales to come in at € 64m.

EBITDA guidance is cut to € 3-6m from € 12m (vs. eNuW old: € 10m, vs € 8m in FY24). Positively, the cost base remained stable and largely aligned with planned strategic initiatives within 2025. Hence, EBITDA is primarily affected by the adjusted sales guidance.

Initially, we had expected meaningful growth in 2025 after the transition year 2024 was mainly characterized by integration, automation and efficiency processes. This expectation was based on the restart of the company's growth engine in early 2025, supported by measures such as the cooperation with BVB (Q4'24) and with Mike Tyson in (Q1'25). Still, we expect the measures bearing fruit once volatility is normalizing again. Nevertheless and in order to take a conservative stance, we slightly trimmed our estimates also for FY26 to € 70m in sales (vs eNuW old: € 79m) and to € 9.5m in EBITDA (vs eNuW old: € 14.9m).

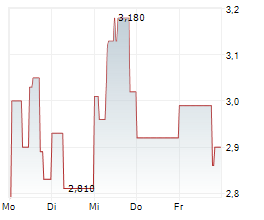

In addition to the guidance cut, management implemented a reverse stock split at a ratio of 10:1. Given that the share price had fallen well below € 1, this step was appropriate to bring the share price back into a more "normal" range. A higher nominal share price should also help improve market perception and liquidity. Moreover, with the share price now above € 1, capital measures are once again technically possible.

BUY with a reduced PT of € 9.50 based on DCF.

ISIN: DE000A41YCM0