Original-Research: THE NAGA GROUP AG - from NuWays AG

Classification of NuWays AG to THE NAGA GROUP AG

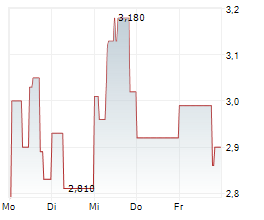

Guidance cut due to subdued market conditions; chg Earlier this month, NAGA cut its FY25 guidance as a result of ongoing subdued market conditions.Further, the company announced the implementation of a reverse stock split. Here is what isimportant: NAGA cut its sales outlook to € 62-66m from € 74m previously (vs € 63m in FY24). We hadalready anticipated a shortfall of the guidance (eNuW old: € 70m), but the magnitude was a bitsurprising. The main reason for the muted outlook was according to management the persistently lowvolatility throughout 2025. Mind you, that volatility is usually the main driver of number of transactionsand hence volumes. Due to the ongoing low volatility, number of transaction fell short of expectationsand should now come in at only 7.6m (eNuW; vs 7.6m in FY24 vs eNuW old: 8.3m). Assuming thatrevenues per transaction remain rather stable, we now expect sales to come in at € 64m. EBITDA guidance is cut to € 3-6m from € 12m (vs. eNuW old: € 10m, vs € 8m in FY24). Positively, the cost base remained stable and largely aligned with planned strategic initiatives within 2025.Hence, EBITDA is primarily affected by the adjusted sales guidance. Initially, we had expected meaningful growth in 2025 after the transition year 2024 was mainlycharacterized by integration, automation and efficiency processes. This expectation was based onthe restart of the company's growth engine in early 2025, supported by measures such as thecooperation with BVB (Q4'24) and with Mike Tyson in (Q1'25). Still, we expect the measures bearingfruit once volatility is normalizing again. Nevertheless and in order to take a conservative stance, weslightly trimmed our estimates also for FY26 to € 70m in sales (vs eNuW old: € 79m) and to € 9.5m inEBITDA (vs eNuW old: € 14.9m). In addition to the guidance cut, management implemented a reverse stock split at a ratio of 10:1. Given that the share price had fallen well below € 1, this step was appropriate to bring the share priceback into a more "normal" range. A higher nominal share price should also help improve marketperception and liquidity. Moreover, with the share price now above € 1, capital measures are onceagain technically possible. BUY with a reduced PT of € 9.50 based on DCF. You can download the research here: the-naga-group-ag-2025-12-19-update-en-aa31c For additional information visit our website: https://www.nuways-ag.com/research-feed Contact for questions: NuWays AG - Equity Research Web: www.nuways-ag.com Email: research@nuways-ag.com LinkedIn: https://www.linkedin.com/company/nuwaysag Adresse: Mittelweg 16-17, 20148 Hamburg, Germany ++++++++++ Diese Meldung ist keine Anlageberatung oder Aufforderung zum Abschluss bestimmter Börsengeschäfte. Offenlegung möglicher Interessenskonflikte nach § 85 WpHG beim oben analysierten Unternehmen befinden sich in der vollständigen Analyse. ++++++++++ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||||

2249114 19.12.2025 CET/CEST

© 2025 EQS Group