Relais Group Plc

PRESS RELEASE - 22 December 2025 at 10:20 am EET

Relais Group Plc's Swedish group company Strands Group AB has today on 22 December 2025 agreed to acquire 70 percent of Qpax AB from its founder entrepreneurs. The entrepreneurs will stay on as minority shareholders for the coming two years. The closing of the acquisition is expected to take place on 2 January 2026, subject to certain customary closing conditions. QPAX is expected to be consolidated into Relais Group from the beginning of January 2026, as part of the Scandinavia segment.

Founded in 1999, QPAX has a long and rich history of designing and constructing lightweight aluminium bars for extra light mounts for light commercial vehicles. The company is located in Färila, Sweden. QPAX products are desired by customers and known in the market for their high quality and attractive design. Historically, QPAX has been able to grow profitably. In fiscal year 2024 QPAX had net sales of approximately SEK 19.6 million and an operating profit of approximately SEK 2.7 million (audited, Swedish GAAP). As part of and with the help of Relais Group, the aim is to accelerate QPAX's profitable growth.

Johan Carlos, Managing Director responsible for Relais Group's Products business area:

"We are very excited to welcome QPAX to the Relais Group family and to see the second generation of the family stepping up to lead the business forward. This marks an important milestone for QPAX and ensures continuity, entrepreneurial drive and long-term commitment.

Our ambition within the Products business area is to build a portfolio of the most attractive and desirable brands in the vehicle aftermarket. QPAX is a strong strategic fit, with a brand that stands for high quality, distinctive design and products that enhance both the appearance and functionality of vehicles.

As part of Relais Group's Products business area, QPAX will benefit from our proven growth platform, enabling accelerated and profitable growth while preserving the brand's identity, culture, and customer focus."

Marlene Sandstedt, Managing Director & Founder and Peder Sandstedt, Head of Product & Co-Founder:

"We are very pleased to welcome Relais Group as a strategic majority owner of QPAX. As a family-owned company, it was important for us to find a partner who shares our values, understands our culture and brings both stability and experience. Relais Group feels like a very natural and secure choice for us as we take the next step in QPAX's development. Marlene will continue as Managing Director during the transition period before handing over leadership to the next generation."

Sandra Låks, Head of Sales & Marketing and successor to Marlene as Managing Director:

"This partnership enables us to scale QPAX in a structured and sustainable way while preserving the culture, values and ownership mindset that have been central to the company since day one. With Relais Group as a strategic majority owner, we strengthen the foundation for future growth as I prepare to take over leadership when current Managing Director Marlene hands over the role."

Further information:

Arni Ekholm, CEO

Phone: +358 40 760 3323

E-mail: arni.ekholm@relais.fi

Relais Group:

Relais Group is a leading compounder and acquisition platform on the commercial vehicle aftermarket in Northern Europe. We have a sector focus in vehicle life cycle enhancement and related services. We also serve as a growth platform for the companies we own.

We are a profitable company seeking strong growth. We carry out targeted acquisitions in line with our growth strategy and want to be an active player in the consolidation of the aftermarket in our area of operation. Our acquisitions are targeted at companies having a good strategic fit with our group companies.

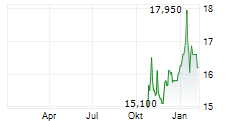

Our net sales in 2024 were EUR 322.6 (2023: 284.3) million. So far during 2025, we have made seven acquisitions. We employ approximately 1,700 professionals in eight different countries. The Relais Group share is listed on the Main Market of Nasdaq Helsinki with the stock symbol RELAIS.

www.relais.fi