Vancouver, British Columbia--(Newsfile Corp. - December 22, 2025) - Entheon Biomedical Corp. (CSE: ENBI) (OTCQB: ENTBF) (FSE: 1XU) ("Entheon" or the "Company") is pleased to announce that it has entered into a binding Letter of Intent (the "LOI") dated December 18, 2025, with Nutravisor Inc. ("Nutravisor") whereby Entheon will acquire all of the issued and outstanding common shares of Nutravisor (the "Proposed Transaction"). Upon completion of the Proposed Transaction, the combined entity will continue the business of Nutravisor (the "Resulting Issuer").

"Nutravisor is thrilled to move forward with this transaction. The successful completion of Proposed Transaction is expected to help Nutravisor achieve its goal in becoming a global leader in providing consumers with pouch and nutraceutical products," said Max Krangle, CEO of Nutravisor.

"We see this transaction is an excellent opportunity for the ENBI shareholders and look forward to a bright future with Nutravisor," said Timothy Ko, CEO of Entheon.

Transaction Terms

The Proposed Transaction is expected to be completed by way of a share exchange, merger, amalgamation, arrangement or other similar form of transaction whereby the shareholders of Nutravisor will receive common shares in the capital of the Entheon in exchange for their shares in the capital of Nutravisor. The final structure and form of the Proposed Transaction remains subject to satisfactory tax, corporate and securities law advice for both Entheon and Nutravisor and will be set forth in a definitive agreement (the "Definitive Agreement") to be entered into among the parties.

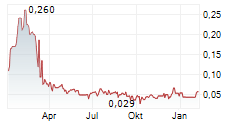

Under the terms of the LOI, Entheon has agreed to issue an aggregate of 53,333,333 shares of Entheon to existing shareholders of Nutravisor at a per share price equal to $0.75 for aggregate consideration equal to approximately $40,000,000 on a post-consolidation basis. Entheon shall be required to complete an approximately 6.93:1 share consolidation such that the value allocated to Entheon shareholders shall be $1,500,000. A finder's fee in the amount of $500,000 is being paid in connection with the Proposed Transaction.

In conjunction with, or prior to the closing of the Proposed Transaction, Nutravisor may complete a private placement of up to approximately $5,000,000 (the "Concurrent Offering"). The terms of the Concurrent Offering will be determined in the context of the market not to be lower than the discount market price of the Entheon shares as of today's date (on a post-consolidation basis). The securities issued by Nutravisor in connection with the Concurrent Offering will be exchanged for shares of Entheon on the same terms as disclosed above in connection with the Proposed Transaction.

The LOI contains customary deal protection provisions, including a mutual break fee in the amount of $40,000 payable if the Proposed Transaction is terminated by either party under certain specific circumstances.

Management, Governance and Name Change

Following the transaction, Nutravisor's existing management team will assume leadership of the Resulting Issuer. All but one of the directors of Entheon shall resign and the board of directors will be comprised of directors nominated by Nutravisor. Full details will be disclosed upon execution of the Definitive Agreement. Entheon is expected to change its name concurrent with closing, subject to regulatory approval.

Conditions and Approvals

Completion of the Proposed Transaction is subject to standard conditions, including, but not limited to:

Execution of the Definitive Agreement;

Completion of satisfactory due diligence;

Receipt of all required regulatory, corporate, and shareholder approvals;

Acceptance of the Proposed Transaction by the Canadian Securities Exchange (the "CSE");

Receipt of approval for the listing of the common shares of the Resulting Issuer by the CSE;

Completion of the Concurrent Offering;

Delivery of financial statements of both Entheon and Nutravisor; and

No material adverse changes in either party.

There can, however, be no assurance that the Proposed Transaction will be completed as proposed or at all. The Definitive Agreement is expected to be executed in January, 2026, with closing targeted on or before March 30, 2026.

The Proposed Transaction is expected to constitute a "Fundamental Change" as defined and in accordance with CSE Policy 8 and will result in a change of control of the Company. Trading in the common shares of the Company is expected to be halted prior to market open on December 22, 2025 and will remain halted pending the review of the Proposed Transaction by the CSE and the filing of required documentation, including a listing statement, in accordance with CSE Policy 8.

ABOUT ENTHEON BIOMEDICAL CORP.

Entheon is a biotechnology research and development company interested in treating addiction and substance use disorders.

ABOUT NUTRAVISOR INC.

Nutravisor is creating a portfolio of nutraceutical and NixodineTM pouches alongside on-demand products that support health, performance, and longevity.

On Behalf of the Board of Directors,

Timothy Ko, CEO, President and Director

For more information, please contact the Company at:

Entheon Biomedical Corp.

Timothy Ko, CEO

1 (604) 562-3932

timothy@entheonbiomedical.com

https://entheonbiomedical.com

Medical and Regulatory Disclaimer

The specific products and claims regarding health, performance, and longevity referred to in this news release have not been evaluated by the U.S. Food and Drug Administration (FDA) or Health Canada. These products are not intended to diagnose, treat, cure, or prevent any disease or medical condition.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" within the meaning of applicable Canadian securities laws. All statements, other than statements of historical fact, included in this news release are forward-looking statements, including, without limitation, statements regarding: the completion and timing of the Proposed Transaction; the ability of Entheon and Nutravisor to satisfy conditions to closing, including the negotiation of a Definitive Agreement and the receipt of shareholder, regulatory, and CSE approvals; the expected change in management and directors of the Resulting Issuer; the expected name change in connection with the Proposed Transaction; the completion of the Concurrent Financing; the constitution of the Proposed Transaction as a Fundamental Change in accordance with CSE Policy 8; the trade halt of the Company's common shares; and the market acceptance of Nutravisor's nutraceutical and pouch products.

Forward-looking statements are often, but not always, identified by words such as "expects", "anticipates", "believes", "plans", "intends", "estimates", "projects", "targeted", "scheduled", "may", "will", "could", or "should" occur or be achieved.

These forward-looking statements are based on current expectations and assumptions that, while considered reasonable by management at the time of preparation, are inherently subject to significant business, economic, competitive, market, regulatory, and other risks and uncertainties. Key assumptions include but are not limited to the ability of the parties to execute the Definitive Agreement; the receipt of all required approvals including but not limited to, shareholder, regulatory, and CSE approvals, in a timely manner; the ability for the Company to change its name; the ability to effect the change in management and directors of the Company; the absence of material adverse changes in the business or industry of either party; the completion of the Concurrent Financing; and the continued demand for nutraceutical and pouch products.

Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual results to differ materially from those anticipated, including: the risk that the Proposed Transaction may not be completed on the terms proposed or at all; the failure to obtain satisfactory due diligence results; the inability to obtain all required approvals including but not limited to, shareholder, regulatory, and CSE approvals; inability to effect the change in name of the Company; inability to effect the change in directors and management of the Company; inability to complete the Concurrent Financing; and risks related to the regulatory environment for nutraceuticals and biotechnology, including Health Canada or FDA approvals;

Readers are cautioned not to place undue reliance on forward-looking statements. The forward-looking statements contained in this news release are made as of the date hereof, and Entheon does not undertake any obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278823

Source: Entheon Biomedical Corp.