Toronto, Ontario--(Newsfile Corp. - January 19, 2026) - Entheon Biomedical Corp. (CSE: ENBI) (OTCQB: ENTBF) (FSE: 1XU) ("Entheon" or the "Company") is pleased to announce that it has entered into a definitive business combination agreement (the "Business Combination Agreement") with Nutravisor Inc. ("Nutravisor"), dated January 19, 2026, pursuant to which the parties have agreed to complete a business combination involving a "three-cornered" amalgamation of Nutravisor with a wholly-owned subsidiary of Entheon ("Subco") that will have the effect of Entheon acquiring all of the issued and outstanding common shares (the "Nutravisor Shares") and other securities of Nutravisor in exchange for securities of Entheon, and resulting in the reverse takeover of Entheon by Nutravisor (the "Proposed Transaction"). A copy of the Business Combination Agreement will be made available on Entheon's SEDAR+ profile at www.sedarplus.ca.

Nutravisor is a company creating a portfolio of nutraceutical and Nixodine pouches alongside on-demand products that support health, performance, and longevity. Upon closing of the Proposed Transaction ("Closing"), Entheon will adopt the business of Nutravisor and change its name to "STRYK Brands Inc." or such other name as determined by Nutravisor.

The Proposed Transaction will constitute a "Fundamental Change" of the Company as defined by the Canadian Securities Exchange (the "CSE"). It is a condition to Closing that the resulting issuer (the "Resulting Issuer") obtain conditional approval to list its common shares (the "Resulting Issuer Shares") on the CSE. In connection therewith, Entheon expects to file a Form 2A Listing Statement (the "Listing Statement") with the CSE, in accordance with the policies of the CSE.

THE PROPOSED TRANSACTION

The execution of the Business Combination Agreement follows the execution by the parties of a binding letter of intent as previously announced in Entheon's news release dated December 22, 2025.

In accordance with the terms of the Business Combination Agreement, the Proposed Transaction will be structured as a "three-cornered amalgamation" pursuant to the provisions of the Business Corporations Act (Ontario) involving Entheon, Subco and Nutravisor. In connection with Closing, it is expected that, among other things:

- Entheon will consolidate its issued and outstanding common shares (the "Consolidation") on the basis of one (1) post-Consolidation common share (each, an "Entheon Share") for every 6.93 pre-Consolidation Entheon Shares, or such other consolidation ratio as agreed to between Entheon and Nutravisor to preserve the respective valuation of the parties;

- Nutravisor intends to complete one or more equity financings (collectively, the "Nutravisor Financings") for aggregate gross proceeds of not less than $4,000,000 and up to $10,000,000, comprised of a combination of a non-brokered private placement of Nutravisor Shares and a concurrent financing of subscription receipts (or other securities) to be completed in connection with the Proposed Transaction and priced in accordance with the policies of the CSE;

- The Proposed Transaction values Nutravisor at a deemed value of $40,000,000, resulting in the issuance of approximately 53,333,333 post-Consolidation Entheon Shares to the shareholders of Nutravisor (each, a "Nutravisor Shareholder"), assuming a consolidation ratio of 6.93:1 and excluding the issuance of Entheon Shares in exchange for Nutravisor Shares issued pursuant to the Nutravisor Financings;

- Nutravisor and Subco will be amalgamated under the Business Corporations Act (Ontario) (the "Amalgamation") and the resulting amalgamated entity ("Amalco") will become a wholly-owned subsidiary of Entheon;

- each Nutravisor Shareholder will receive 4.2395 post-Consolidation Entheon Shares for each Nutravisor Share held (the "Exchange Ratio") immediately prior to Closing, and all of the holders of convertible securities in Nutravisor will receive post-Consolidation Entheon Shares, calculated in accordance with the Exchange Ratio, in lieu of Nutravisor Shares that such holder is entitled to receive upon conversion of such Nutravisor convertible security;

- in addition to any escrow requirements of the CSE, the Entheon Shares issued to former Nutravisor Shareholders will be subject to a voluntary lock-up agreement, pursuant to which 25% of the shares will be released 6 months following the Closing, with an additional 25% released every 6 months thereafter; and

- the Resulting Issuer will be renamed to "STRYK Inc.", "STRYK Brands Inc.", or such other name as agreed by Entheon and Nutravisor (the "Name Change").

Completion of the Proposed Transaction is subject to a number of conditions including, but not limited to, completion of the Consolidation, completion of the Nutravisor Financings, applicable shareholder approvals and regulatory approvals, including approval of the CSE. There can be no assurance that the proposed transactions described in this news release will be completed as proposed, or at all.

The Business Combination Agreement contains customary deal protection provisions, including a mutual break fee in the amount of $100,000 payable if the Proposed Transaction is terminated by either party under certain specific circumstances.

In connection with the Proposed Transaction, a finder's fee of $500,000 is payable to ALOE Finance Inc., an arm's length finder, to be satisfied through the issuance of Resulting Issuer Shares (or as otherwise agreed by the parties) at a deemed price of $0.75 on Closing, subject to applicable securities laws and the policies of the CSE.

Further details of the Proposed Transaction, the Company and Nutravisor will be included in the Listing Statement, the Entheon Circular (defined below) and in subsequent news releases and other public filings.

ENTHEON MEETING

In connection with the Proposed Transaction, Entheon will hold an annual general and special meeting of its shareholders (the "Entheon Shareholder Meeting"), and shall prepare a circular in connection therewith (the "Entheon Circular") to approve, among other things, the Proposed Transaction the appointment of the directors to be appointed to the board of the Resulting Issuer upon Closing, the Consolidation and the Name Change, applicable.

Entheon anticipates holding the Entheon Shareholder Meeting in March, 2026. The Entheon Circular will contain further information with respect to the matters that will be put before the Entheon shareholders at the Entheon Shareholder Meeting and will be made available under Entheon's SEDAR+ profile at www.sedarplus.ca.

PROPOSED MANAGEMENT OF THE RESULTING ISSUER:

Upon completion of the Proposed Transaction, it is anticipated that the board of directors and executive team of the Resulting Issuer will be comprised of a minimum of three directors, led by Max Krangle as Chief Executive Officer and Director, alongside other nominees to be determined by Nutravisor. Further information regarding these individuals, including their bios, will be included in the Entheon Circular and the Listing Statement.

LISTING STATEMENT, CIRCULAR AND CAUTION

Investors are cautioned that, except as will be disclosed in the Entheon Circular and as will be disclosed in the Listing Statement, any information released or received with respect to the Proposed Transaction or the Entheon Shareholder Meeting may not be accurate or complete and should not be relied upon.

TRADING IN COMPANY SHARES

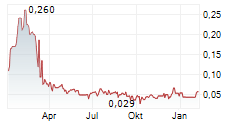

Trading in the common shares of the Company is currently halted and will remain halted until such time as all required documentation in connection with the Transaction has been filed with and accepted by the CSE and permission to resume trading has been obtained from the CSE.

ABOUT ENTHEON BIOMEDICAL CORP.

Entheon is a biotechnology research and development company interested in treating addiction and substance use disorders.

ABOUT NUTRAVISOR INC.

Nutravisor is creating a portfolio of nutraceutical and Nixodine pouches alongside on-demand products that support health, performance, and longevity.

Timothy Ko, CEO, President and Director

For more information, please contact the Company at:

Entheon Biomedical Corp.

Timothy Ko, CEO

1 (604) 562-3932

timothy@entheonbiomedical.com

https://entheonbiomedical.com

This news release does not constitute an offer to sell, or a solicitation of an offer to buy, any securities under the Nutravisor Financings in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Forward-Looking Information and Statements

This press release contains certain "forward-looking information" within the meaning of applicable Canadian securities legislation. Such forward-looking information and forward-looking statements are not representative of historical facts or information or current condition, but instead represent only the Company's beliefs regarding future events, plans or objectives, many of which, by their nature, are inherently uncertain and outside of the Company's control. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or may contain statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "will continue", "will occur" or "will be achieved".

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the failure to satisfy all conditions precedent to the Proposed Transaction; failure to achieve satisfaction or waiver of all conditions to the Business Combination Transaction; failure to obtain all regulatory approvals, including CSE approval, for the Proposed Transaction; failure to receive necessary Entheon Shareholder approval for the Proposed Transaction; failure to complete the Name Change; failure to complete the Nutravisor Financings; the anticipated costs to complete the Proposed Transaction may exceed current expectations; Nutravisor (and therefore, the Resulting Issuer) may be unable to successfully execute its business strategy such that future growth, results of operations, performance and business prospects and opportunities of Nutravisor (and therefore, the Resulting Issuer) may not be as currently anticipated; and new laws or regulations could adversely affect the Resulting Issuer's business and results of operations. There are numerous other factors, many of which are out of Nutravisor's and Entheon's control, that could cause Nutravisor's and Entheon's actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others, currency fluctuations; limited business history of the parties; disruptions or changes in the credit or security markets or the economy generally; results of operation activities and development of projects; unanticipated costs and expenses; and general market and industry conditions. These factors and fluctuations may adversely affect the price of the Resulting Issuer's securities, regardless of its operating performance. The parties undertake no obligation to comment on analyses, expectations or statements made by third parties in respect of their securities or their respective financial or operating results (as applicable).

Entheon and Nutravisor caution that the foregoing list of material factors is not exhaustive. When relying on these forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. The parties have assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. However, the list of factors is not exhaustive and subject to change. There can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking statements contained in this press release represent Entheon's and Nutravisor's expectations as of the date of this press release and are subject to change after such date. Entheon and Nutravisor have no intention, and undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

There can be no assurance that the Proposed Transaction will be completed as proposed or at all.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280858

Source: Entheon Biomedical Corp.