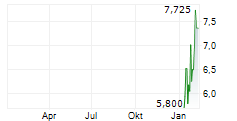

SHANGHAI, Dec. 31, 2025 /PRNewswire/ -- Insilico Medicine (03696.HK), a global leader in AI-driven drug discovery and a portfolio company of Qiming Venture Partners, today successfully listed on the Hong Kong Stock Exchange (HKEX). The listing marks the largest biotech IPO on the Hong Kong stock market in 2025. With an issue price of HK$ 24.05 per share, Insilico Medicine opened at HK$35.00 per share, representing a market capitalization of approximately HK$ 19.51 billion.

Qiming Venture Partners is one of Insilico Medicine's most important institutional investors. Qiming Venture Partners led the Company's Series B financing round in 2019 and continued its support in subsequent Series C and D rounds, with an about 7 percent stake in Insilico Medicine before its IPO.

Founded in 2014, Insilico Medicine employs a business model based on the Pharma.AI platform, focuses on internal drug research and development through artificial intelligence. It has gradually expanded the application of Pharma. AI to more industries such as advanced materials, agriculture, nutritional products, and veterinary drugs. It has now efficiently built a pipeline portfolio covering over 30 innovative projects in a wide range of fields with extensive demands, such as oncology, immunology, fibrosis, and metabolism, and owns the world's most advanced first-in-class AI-based drugs.

To date, 13 of the world's top 20 pharmaceutical companies by revenue have entered into software platform collaborations with Insilico Medicine. Insilico Medicine has also reached licensing agreements on three pipelines with global drugmakers such as Exelixis and Menarini, bringing a potential revenue of USD2 billion for the company. The Company has also established drug R&D partnerships with other internationally renowned pharmaceutical firms including Sanofi, Lilly, and Shanghai Fosun Pharmaceutical (Group) Co., Ltd.

"Insilico is dedicated to extending human productive longevity and this listing provides us with more resources to advance our mission. Over the past few years, we set very clear industry benchmarks demonstrating that AI can help make drug discovery faster, cheaper, and deliver higher success rates in preclinical and early clinical development. We have validated the end-to-end capabilities of AI-empowered programs from novel target discovery to molecular generation, and then to preclinical and clinical stages. Going forward, we will continue to increase investment in our AI platform and innovative pipeline, accelerate the advancement of differentiated innovative programs into clinic, and bring truly accessible, affordable, and breakthrough treatment solutions to patients worldwide." said Alex Zhavoronkov, PhD, Founder and CEO, Chief Business Officer of Insilico Medicine.

"We invest in Insilico Medicine based on a simple belief that 'AI will profoundly change the pathway and efficiency of drug development.' We decided to invest in Insilico Medicine in 2019 because of its research in frontier areas when generative AI was not yet popularized. Now the value of Insilico Medicine in the field of AI pharmaceuticals is gradually being realized through preclinical validation and pipeline licensing. We expect AI to not only empower early-stage research and development but also effectively accelerate the clinical stage process in the future to enable new drugs to benefit patients earlier," Dr. Chen Kan, Partner and Healthcare Co-Lead at Qiming Venture Partners, said.

About Qiming Venture Partners

Qiming Venture Partners was founded in 2006. Currently, Qiming Venture Partners manages eleven US Dollar funds and seven RMB funds with $9.5 billion in capital raised. Since our establishment, we have invested in outstanding companies in the Technology and Healthcare industries at the early and growth stages.

Since our debut, we have backed over 580 fast-growing and innovative companies. Over 210 of our portfolio companies have achieved exits through IPOs at the NYSE, NASDAQ, HKEX, Shanghai Stock Exchange, or Shenzhen Stock Exchange, or through M&A or other means. There are also over 80 portfolio companies that have achieved unicorn or super unicorn status.

Many of our portfolio companies are today's most influential firms in their respective sectors, including Xiaomi, Meituan, Bilibili, Zhihu, Roborock, Hesai Technology, UBTech, WeRide, HyperStrong, Insta360, Unisound, Gan & Lee Pharmaceuticals, Tigermed, Zai Lab, CanSino Biologics, Schrödinger, APT Medical, Sanyou Medical, AmoyDx, SinocellTech, Insilico Medicine (SEHK:03696), AusperBio, Yuanxin Technology, Medilink Therapeutics, LaNova Medicines, zai, StepFun, among many others.

![]() View original content:https://www.prnewswire.co.uk/news-releases/qiming-venture-partners-insilico-medicine-successfully-lists-on-hong-kong-stock-exchange-302650996.html

View original content:https://www.prnewswire.co.uk/news-releases/qiming-venture-partners-insilico-medicine-successfully-lists-on-hong-kong-stock-exchange-302650996.html