GRAND CAYMAN, Cayman Islands, Jan. 02, 2026 (GLOBE NEWSWIRE) -- Patria Investments Limited ("Patria") (NASDAQ: PAX), a global alternative asset manager, confirmed today the completion of its previously announced acquisition of a 51% stake in Solis Investimentos, a leading Brazilian investment manager specializing in the structuring and management of CLOs.

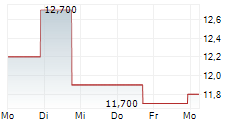

Pro-forma as of 3Q25, the addition of Solis' approximate US$ 3.5 bn of Fee-Earning AUM ("FEAUM") will increase Patria's total Credit FEAUM by over 40% to more than US$ 11.7 bn, solidifying its position as a leading Credit platform in Latin America.

The partnership positions Solis for a new cycle of growth by connecting its high-quality credit origination, analysis, and monitoring capabilities to Patria's platform, expanding its access to both local and global capital.

Following the acquisition, Solis will continue to be led by its founders Delano Macedo and Ricardo Binelli. The Solis team, comprising over 100 professionals, will remain in their current roles, with offices in Fortaleza and São Paulo, Brazil.

Additional information on the transaction is available on the Shareholders Section of Patria's website at https://ir.patria.com.

About Patria Investments

Patria is a global middle market alternative asset manager, specializing in key resilient and growth sectors. We are a leading asset manager in Latin America and have a strong presence in Europe through our extensive network of General Partners relationships. Our on-the-ground presence combines investment leaders, sector experts, company managers, and strategic relationships, allowing us to identify compelling investment opportunities accessible only to those with local proficiency. With 37 years of experience and over $51 billion in assets under management, we consistently deliver attractive returns through long-term investments, while promoting inclusive and sustainable development in the regions where we operate. Further information is available at www.patria.com.

Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You can identify these forward-looking statements by the use of words such as "outlook," "indicator," "believes," "expects," "potential," "continues," "may," "can," "will," "should," "seeks," "approximately," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include but are not limited to those described under the section entitled "Risk Factors" in our annual report on Form 20-F, as such factors may be updated from time to time in our periodic filings with the United States Securities and Exchange Commission ("SEC"), which are accessible on the SEC's website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in our periodic filings. The forward-looking statements speak only as of the date of this press release, and we undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

Media contact:

Burson / +44 20 7113 3468 / patria@hillandknowlton.com

Patria Shareholder Relations:

E. PatriaShareholderRelations@patria.com

T. +1 917 769 1611