- Insilico Medicine achieved an R&D collaboration with Servier valued at up to US$888 million, focused on discovering and developing innovative oncology therapies, by combining Insilico's AI-driven drug discovery platforms with Servier's global expertise in cancer drug development.

- Under the terms of the agreement, Insilico will be eligible to receive up to US$32 million in upfront and near-term R&D payments and will leverage its proprietary AI-powered technologies to identify and advance potential drug candidates that meet predefined scientific and development criteria.

- Servier will participate in sharing research and development costs, and, upon the successful identification of promising candidates, will lead subsequent clinical validation, regulatory interactions, and worldwide commercialization of the resulting oncology drug candidates.

CAMBRIDGE, Mass., Jan. 4, 2026 /PRNewswire/ -- Insilico Medicine ("Insilico"), a world-leading artificial intelligence (AI)-driven drug discovery company, today announced a multi-year research and development (R&D) collaboration with Servier, an independent international pharmaceutical company governed by a foundation. This strategic alliance is focused on identifying and developing novel therapeutics for challenging targets in the oncology space by leveraging Insilico's proprietary AI platform, Pharma.AI.

Under the agreement, Insilico will be eligible to receive up to US$32 million in upfront and near-term R&D payments and will lead the AI-driven discovery and development of potential drug candidates that meet predefined criteria, while Servier will share the R&D expenses and lead clinical validation and commercialization processes.

"This collaboration underscores Servier's commitment to applying cutting-edge technologies to address unmet medical needs for the benefit of patients and reflects our confidence in Insilico's internally developed and validated AI platform", said Christophe Thurieau, Executive Director Research at Servier.

"I am excited to see the collaboration-it is yet another strong acknowledgment of our AI capabilities and R&D expertise", said Alex Zhavoronkov, PhD, founder, CEO and CBO of Insilico Medicine. "As we deepen the integration of generative AI into every stage of the pharma value chain, I believe the future of pharmaceutical superintelligence is never so close, where AI agents could actually make decisions and design experiments, driving a virtuous cycle of faster, smarter, and safer drug development."

Insilico has extensive experience in AI-driven oncology drug discovery and development. The company has established a robust oncology pipeline that targets multiple cancer indications, leveraging both moderately novel and well-established mechanisms. Among its most promising assets, the potential best-in-class pan-TEAD inhibitor ISM6331 and the MAT2A inhibitor ISM3412 are both undergoing global, multicenter Phase I clinical trials. Additionally, four other oncology programs have been fully or partially out-licensed to partners, with Phase I clinical trials actively in progress.

Harnessing state-of-the-art AI and automation technologies, Insilico has significantly improved the efficiency of preclinical drug development, setting a benchmark for AI-driven drug R&D. While traditional early-stage drug discovery typically requires an average of 4.5 years, Insilico has nominated 20 preclinical candidates from 2021 to 2024, with an average timeline-from project initiation to preclinical candidate (PCC) nomination-of just 12 to 18 months per program, with only 60 to 200 molecules synthesized and tested in each program.

About Insilico Medicine

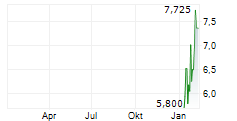

Insilico Medicine is a pioneering global biotechnology company dedicated to integrating artificial intelligence and automation technologies to accelerate drug discovery, drive innovation in the life sciences, and extend health longevity to people on the planet. The company was listed on the Main Board of the Hong Kong Stock Exchange on December 30, 2025, under the stock code 03696.HK.

By integrating AI and automation technologies and deep in-house drug discovery capabilities, Insilico is delivering innovative drug solutions for unmet needs including fibrosis, oncology, immunology, pain, and obesity and metabolic disorders. Additionally, Insilico extends the reach of Pharma.AI across diverse industries, such as advanced materials, agriculture, nutritional products and veterinary medicine. For more information, please visit www.insilico.com

SOURCE Insilico Medicine