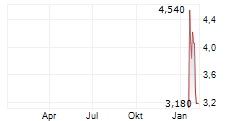

GOUVERNEUR, N.Y., Jan. 05, 2026 (GLOBE NEWSWIRE) -- Titan Mining Corporation (TSX:TI, NYSE-A:TII), ("Titan" or the "Company") an existing zinc concentrate producer in upstate New York and an emerging natural flake graphite producer (a key component of the broader rare earths and critical minerals ecosystem), announced that it has made the final scheduled payment of $5.2 million to extinguish its credit facility with National Bank of Canada. This reduction of short-term debt and the previously announced $15 million equity financing has materially strengthened the Company's balance sheet.

As a result of this repayment and the completed equity financing, Titan has reduced its net debt by approximately 60% from $25.1 million as at September 30, 2025 to approximately $9.5 million as at December 31, 2025. Following the repayment, the Company's remaining debt is primarily held by long-term strategic stakeholders.

Rita Adiani, President and Chief Executive Officer of Titan Mining, commented:

- This meaningful reduction in debt significantly strengthens our balance sheet and enhances our capacity to advance the next phase of our U.S. graphite strategy. With increased financial flexibility, we are better positioned to support graphite development activities alongside our existing operations, while maintaining disciplined capital allocation."

Net Debt

Net debt is calculated as the sum of the current and non-current portions of long-term debt, net of the cash and cash equivalent balance as at a particular date. A reconciliation of net debt is provided below, millions of dollars.

| As at December 31, 2025 (Estimate) | As at September 30, 2025 (Actual) | |||

| Current portion of debt | - | 9.9 | - | 7.6 |

| Non-current portion of debt | 17.1 | 21.8 | ||

| Total debt | - | 27.0 | - | 29.4 |

| Less: Cash and cash equivalents | (17.5) | (4.3) | ||

| Net debt | - | 9.5 | - | 25.1 |

Net debt is a non-GAAP measure. Accordingly, this financial measure is not a standardized financial measure under IFRS and might not be comparable to similar financial measures disclosed by other issuers. This financial measure has been calculated on a basis consistent with historical periods.

The debt and cash balance information is preliminary, unaudited and subject to change. The Company will release its Q4 2025 and audited annual 2025 financial and operating results in March 2025.

About Titan Mining Corporation

Titan is an Augusta Group company which produces zinc concentrate at its 100%-owned Empire State Mine located in New York state. Titan is also an emerging natural flake graphite producer and targeting to be the USA's first end to end producer of natural flake graphite in 70 years. Titan's goal is to deliver shareholder value through operational excellence, development and exploration. We have a strong commitment towards developing critical minerals assets which enhance the security of the domestic supply chain. For more information on the Company, please visit our website at www.titanminingcorp.com

Media & Investor Contact

Irina Kuznetsova

Director, Investor Relations

Phone: (778) 870-7735

Email: info@titanminingcorp.com

Cautionary Note Regarding Forward-Looking Information

Certain statements and information contained in this new release constitute "forward-looking statements", and "forward-looking information" within the meaning of applicable securities laws (collectively, "forward-looking statements"). These statements appear in a number of places in this news release and include statements regarding our intent, or the beliefs or current expectations of our officers and directors, including that we are better positioned to support graphite development activities alongside our existing operations, while maintaining disciplined capital allocation; and that the Company will release its Q4 2025 and audited annual 2025 financial and operating results in March 2025. When used in this news release words such as "to be", "will", "planned", "expected", "potential", and similar expressions are intended to identify these forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Company can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to vary materially from those anticipated in such forward-looking statements, including risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of zinc and graphite; the inherently hazardous nature of mining-related activities; potential effects on our operations of environmental regulations in New York State; risks due to legal proceedings; and risks related to operation of mining projects generally and the risks, uncertainties and other factors identified in the Company's periodic filings with Canadian securities regulators and the United States Securities and Exchange Commission. Such forward-looking statements are based on various assumptions, including assumptions made with regard to our forecasts and expected cash flows; our projected capital and operating costs; our expectations regarding mining and metallurgical recoveries; mine life and production rates; that laws or regulations impacting mining activities will remain consistent; our approved business plans; our mineral resource estimates and results of the preliminary economic assessment; our experience with regulators; political and social support of the mining industry in New York State; our experience and knowledge of the New York State mining industry and our expectations of economic conditions and the price of zinc and graphite; demand for graphite; exploration results; the ability to secure adequate financing (as needed); the Company maintaining its current strategy and objectives; and the Company's ability to achieve its growth objectives. While the Company considers these assumptions to be reasonable, based on information currently available, they may prove to be incorrect. Except as required by applicable law, we assume no obligation to update or to publicly announce the results of any change to any forward-looking statement contained herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If we update any one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. You should not place undue importance on forward-looking statements and should not rely upon these statements as of any other date. All forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.