- Consolidated revenue of €16.5m, in line with expectations;

- Fourfold increase in revenue on a constant scope basis (given the disposal of the "Data Acceleration Platform " business), from €3.6m in 2024 to €14.3m in 2025;

- Continued industrial cooperation with Openchip in the field of DPUs for AI and ongoing discussions with other players to replicate and expand this new business model;

- Significant improvement in profitability in the second half of the year and confirmation of a strongly positive EBITDA[1] for FY 2025.

Grenoble, January 13th, 2026 - Kalray (Euronext Growth Paris: ALKAL) provider of hardware and software technologies and solutions for intensive data processing from Cloud to Edge, announces its 2025 revenue and confirms its financial guidance.

Eric Baissus, Chairman of the Management Board of Kalray, stated:

" In 2025, Kalray demonstrated its ability to adapt by successfully refocusing its strategy on its historical core business, DPUs, while evolving its business model. Kalray is now focusing on developing its DPU-based technologies and rolling out licensing, co-development, and high value-added services agreements that generate rapid returns on investment. This strategic refocusing and the signing of a first major industrial partnership with Openchip have enabled Kalray to return to a path of profitability.

From a financial standpoint, 2025 annual revenue shows a clear increase on a comparable basis in the semiconductor business. At the same time, the continued improvement in operational performance in the second half of the year enabled us to confirm a strongly positive EBITDA for the full year.

On an operational level, industrial cooperation with Openchip continues in line with the plans. Openchip is now positioning itself as a key player in the sector, with a first strategic agreement announced with NEC. Building on this momentum, Kalray, the only European player in the DPU world, is actively pursuing new opportunities leveraging its technologies and unique expertise, at a time when DPUs are set to play a crucial role in artificial intelligence and AI gigafactories, as well as in strategic sectors such as telecommunications, space and defense."

STRONG INCREASE IN 2025 REVENUE AT COMPARABLE SCOPE BASIS

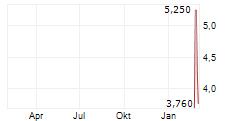

At the end of the 2025 financial year, Kalray reported consolidated revenue of €16,453k[2], compared with €24,824k one year earlier, in line with the Company's expectations[3]. This figure reflects a significant scope effect related to the disposal of the Data Acceleration Platform" business (or the "Company") on February 5th, 2025[4].

On the new semiconductor operating scope (new scope of operations), Kalray's revenue was multiplied by 4 over the period, reaching €14,274k as of December 31st, 2025, compared with €3,607k as of December 31st, 2024. This strong growth reflects the strategic partnership with Openchip[5], which includes a non-exclusive license agreement covering part of Kalray's intellectual property for €4 million, as well as a services agreement worth approximately €10 million.

CONTINUATION OF THE INDUSTRIAL COOPERATION AGREEMENT WITH OPENCHIP AND REVIEW OF NEW OPPORTUNITIES TO REPLICATE AND EXPAND THE MODEL

The combined licensing and services industrial partnership with Openchip is continuing in line with the plan[6]. This agreement was accompanied by a temporary transfer of activities, including around 50 employees, who have been working alongside Openchip's teams for the past 6 months.

Building on this initial success, Kalray is in advanced discussions with other players with a view to replicating and expanding its new business model. This model is now based on the development and licensing of its DPU technologies, combined with an offering to develop specialized DPU products through the provision of high value-added services. The projects under consideration notably target artificial intelligence and AI gigafactories, as well as HPC, telecommunications, space and defense.

CONFIRMATION OF THE STRONG IMPROVEMENT IN PROFITABIITY IN 2025 AND UPDATE ON THE FINANCIAL POSITION

Thanks to the success of the new business model deployed by the Company, consolidated EBITDA for 2025 is expected to be strongly positive for the full year (compared with €-8.2 million last year), with a clear sequential improvement in the second half (+€0.3 million in the first half of 2025).

Available cash stood at €2.9 million at the end of 2025, and Kalray currently estimates that its funding horizon extends beyond June 30th, 2026, without considering new opportunities currently under discussion[7]. A detailed update will be provided at the time of the publication of the Company's 2025 annual results.

It should be noted that the Company is expected to soon settle the financing line signed with IRIS in July 2024, on which only €300,000 remains to be repaid through the issuance of new shares.

For 2026, the Company intends to build on this positive momentum and will provide further details to the market upon the release of its 2025 annual results.

Next press release: FY 2025 results on Thursday 23rd April 2026

ABOUT KALRAY

Kalray (Euronext Growth Paris - FR0010722819 - ALKAL) is a fabless semiconductor company, leader in a new generation of processors designed for applications that process massive data flows, particularly through artificial intelligence. At the forefront of innovation, Kalray's teams have developed unique technology and associated solutions that enable its customers to maximize workload performance, optimize infrastructure utilization and reduce power consumption.

Thanks to their patented "manycore" architecture, Kalray's MPPA intelligent processors (known as DPU or xPU) can manage multiple data streams in parallel-without bottlenecks-enabling applications that process massive amounts of data to be smarter, more efficient, and energy-conscious, complementing traditional approaches (CPU and GPU).

Kalray's offering includes hardware and software acceleration solutions, as well as co-development or custom-design services for processors and acceleration solutions optimized for specific use cases in high-growth sectors such as data centers, AI Gigafactories, telecoms, space, defense, and many others.A spin-off from CEA founded in 2008, Kalray's investors include NXP Semiconductors, CEA, Safran, and Bpifrance. www.kalrayinc.com

Disclaimer

This press release may contain forward-looking statements regarding the Company's objectives and outlook. These forward-looking statements are based on the current estimates and expectations of the Company's management and are subject to risks and uncertainties, including those described in Appendix 1 of the Management Board's report, available on the Company's website.

Readers' attention is particularly drawn to the fact that the Company's current financing horizon is extended beyond June 30th, 2026 at the present date of the press release. The forward-looking statements mentioned in this press release may not be achieved due to these factors or other unknown risks and uncertainties, or those not currently deemed significant by the Company.

| INVESTOR RELATION CONTACTS Eric BAISSUS contactinvestisseurs@kalrayinc.com Phone +33 4 76 18 90 71 ACTUS Finance & Communication Anne-Pauline PETUREAUX kalray@actus.fr Phone + 33 1 53 67 36 72 | MEDIA CONTACTS ELLYN KALIFA communication@kalrayinc.com Phone +33 4 76 18 90 71 ACTUS Finance & Communication Serena BONI sboni@actus.fr Phone +33 4 72 18 04 92 |

[1] Earnings Before Interest, Taxes, Depreciation and Amortization

[2] EUR/GBP 1.19. Unaudited data

[3] See press release as of September, 9, 2025

[4] See press release as of February 5, 2025

[5] See press release as of May 22, 2025, and July,10, 2025

[6] See press release as of May 22, 2025, and July,10, 2025

[7] An agreement with banking partners on the restructuring of schedules and the terms and conditions of loans under the PGE program was reached on November 28, 2025, resulting in a suspension of principal repayments until October 1, 2026

- SECURITY MASTER Key: yW+blcpmZJjJypxuk8hpaJeVbmZiyGWWZZTGlmhsap6baGxgm5eUb5maZnJmnm1n

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-95981-pr_kalray_2025_revenue_en_version.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free