Finnair Plc Stock Exchange Release 15 January 2026 at 9:30 a.m. EET

Number of members of the Board of Directors

The Shareholders' Nomination Board proposes to the Annual General Meeting to be held on 24 March 2026 that the number of members of the Board of Directors is confirmed as eight (8).

Composition of the Board of Directors

The Shareholders' Nomination Board proposes that all the current members of Finnair's Board of Directors - Andreas Bierwirth, Nicolas Boutin, Jukka Erlund, Lisa Farrar, Mika Ihamuotila, Hannele Jakosuo-Jansson, Jussi Siitonen and Sanna Suvanto-Harsaae - are re-elected for the term of office ending at the end of the next Annual General Meeting.

The Shareholders' Nomination Board further proposes that Sanna Suvanto-Harsaae is elected as the Chair of the Board and recommends to the Board of Directors that it elects Mika Ihamuotila as its Vice Chair.

All candidates have given their consent to the position, and they are all independent of the company and its significant owners.

The biographical details of the Board members proposed for election can be found at Finnair's company website: investors.finnair.com/en.

Board members' remuneration

The Shareholders' Nomination Board states that its remuneration proposal is part of a long-term program for bringing the Board members' remuneration to market level by 2026. In determining the market level, a benchmark prepared by an external expert has been used, selecting the most relevant peer group from Helsinki-listed companies with international operations.

With this proposal, the program has been completed.

In addition to proposing an increase in fixed annual fees, the Shareholders' Nomination Board recommends discontinuing the previously applied fixed committee fees to simplify the remuneration structure, as outlined below (previous term's fees in brackets).

- Annual fees for the Chair, Vice Chair and other members of the Board:

- Chair 85,000 euros (80,000)

- Vice Chair 50,000 euros (48,000)

- Committee Chair 50,000 euros (40,000), provided the person does not simultaneously serve as Chair or Vice Chair of the Board

- Member 44,000 euros (40,000)

In 2025, committee work was compensated with a fee of 6,000 euros for Chairs and 3,000 euros for members. Under this proposal, these separate fees will be discontinued.

- In addition to the fixed annual fees mentioned above, Board members will receive meeting fees for attending Board or committee meetings as follows:

- A meeting fee of 1,000 euros (800) is paid to Board members for each meeting, including committee meetings, or EUR 2,000 (EUR 3,200) if the member travels to the meeting outside their country of residence.

- For meetings held via telephone or other telecommunication means, the fee will correspond to that of a meeting held in the member's home country. No meeting fee will be paid for decisions confirmed in writing without holding a meeting.

- Members' travel expenses will be reimbursed in accordance with the company's travel policy.

Board members and their spouses are entitled to discounted travel on the company's flights in accordance with the company's discount ticket policy regarding the Board of Directors.

Part of the fixed annual fee will be paid in Finnair Plc shares acquired from the market as follows:

- 40% of the fixed annual fee will be paid in shares and the remainder in cash. Meeting fees will be paid in cash.

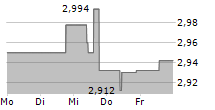

- Shares will be acquired on behalf of the Board members within two weeks starting from the first trading day on Nasdaq Helsinki following the publication of Finnair Plc's interim report for 1 January-31 March 2026.

- If the acquisition and/or delivery of shares is not carried out due to reasons related to the company or the Board member, the fee will be paid entirely in cash.

- The company will bear any transfer tax arising from the acquisition of shares.

Composition of the Shareholders' Nomination Board

The members of the Shareholders' Nomination Board are Maija Strandberg, Director General, Prime Minister's Office, Ownership Steering Department; Timo Sallinen, Director, Head of Listed Securities, Varma Mutual Pension Insurance Company; and Jukka Vähäpesola, Head of Equities, Elo Mutual Pension Insurance Company. Shareholders' right to appoint their representatives in the Shareholders' Nomination Board was based on the shareholder register of 1 June 2025.

The above proposals will also be included in the invitation to the Annual General Meeting 2026, which will be published later.

For further information, please contact:

Chair of the Shareholders' Nomination Board Maija Strandberg, Director General, Prime Minister's Office, Ownership Steering Department, tel. +358 50 407 8423

FINNAIR PLC

Further information:

Finnair communications, +358 9 818 4020, comms(a)finnair.com

Distribution:

NASDAQ OMX Helsinki

Principal media

Finnair is a network airline, specialising in connecting passenger and cargo traffic between Asia, North America and Europe. Finnair is the only airline with year-round direct flights to Lapland. Customers have chosen Finnair as the Best Airline in Northern Europe in the Skytrax Awards for 15 times in a row. Finnair is a member of the oneworld alliance. Finnair Plc's shares are quoted on Nasdaq Helsinki.