Kamoa-Kakula produced 388,838 tonnes of copper in concentrate in 2025, achieving guidance

Ivanhoe confirms previously set 2026 Kamoa-Kakula production guidance of 380,000 to 420,000 tonnes of copper

99.7%-pure copper anode production from Kamoa-Kakula smelter already averaging 500 tonnes per day; first exports expected imminently

Production of 98%-pure high-strength sulphuric acid from smelter averaging 1,200 tonnes per day; first sales complete

Kipushi produced record 203,168 tonnes of zinc in concentrate in 2025, achieving guidance, including a monthly record 22,629 tonnes in December

Ivanhoe sets 2026 Kipushi Mine production guidance of 240,000 to 290,000 tonnes of zinc

Ivanhoe Mines to issue 2025 financial results after market close on February 18; host conference call for investors on February 19

Johannesburg, South Africa--(Newsfile Corp. - January 15, 2026) - Ivanhoe Mines' (TSX: IVN) (OTCQX: IVPAF) Executive Co-Chair Robert Friedland and President and Chief Executive Officer Marna Cloete announced today the company's 2025 fourth quarter and full-year production results for the Kamoa-Kakula Copper Complex in the Democratic Republic of the Congo (DRC) and the ultra-high-grade Kipushi zinc mine, also in the DRC. Following the release of Kamoa-Kakula's 2026 and 2027 production guidance on December 3, 2025, the company also announced today 2026 production guidance for the Kipushi Mine.

Kamoa-Kakula produced 388,838 tonnes of copper in 2025, achieving guidance, including record production and throughput achieved by the Phase 3 concentrator.

Kamoa-Kakula produced a total of 388,838 tonnes of copper in concentrate in 2025, within the revised guidance range of 380,000 tonnes to 420,000 tonnes. Total copper production consisted of 385,808 tonnes of copper in concentrate produced by the Phase 1, 2 and 3 concentrators, as well as 3,030 tonnes of copper in concentrate produced by the slag concentrator located at the on-site smelter.

Kamoa-Kakula summary of quarterly and annual production data

| Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 | FY 2025 | ||||||

| Phase 1 & 2 | ||||||||||

| Ore tonnes milled (000's tonnes) | 2,211 | 1,991 | 1,838 | 1,712 | 7,752 | |||||

| Feed grade of ore processed (% copper) | 5.01% | 4.12% | 2.50% | 2.32% | 3.59% | |||||

| Copper recovery (%) | 88.3% | 85.4% | 81.3% | 83.2% | 85.6% | |||||

| Copper in concentrate produced (tonnes) | 97,575 | 71,401 | 37,744 | 34,602 | 241,315 | |||||

| Phase 3 | ||||||||||

| Ore tonnes milled (000's tonnes) | 1,512 | 1,631 | 1,618 | 1,662 | 6,423 | |||||

| Feed grade of ore processed (% copper) | 2.76% | 2.92% | 2.44% | 2.38% | 2.62% | |||||

| Copper recovery (%) | 85.1% | 85.5% | 84.2% | 88.2% | 85.7% | |||||

| Copper in concentrate produced (tonnes) | 35,545 | 40,608 | 33,522 | 34,814 | 144,493 | |||||

| Combined Phase 1, 2, and 3 | ||||||||||

| Ore tonnes milled (000's tonnes) | 3,723 | 3,622 | 3,456 | 3,374 | 14,175 | |||||

| Feed grade of ore processed (% copper) | 4.10% | 3.58% | 2.47% | 2.35% | 3.15% | |||||

| Copper recovery (%) | 87.4% | 85.4% | 82.7% | 85.7% | 85.6% | |||||

| Copper in concentrate produced (tonnes) | 133,120 | 112,009 | 71,266 | 69,419 | 385,808 | |||||

| Slag concentrator* | ||||||||||

| Copper in concentrate produced (tonnes) | 877 | 2,153 | 3,030 | |||||||

Data in bold denotes a quarterly / annual record

*Slag concentrator was temporarily used to assist with copper production prior to the start-up of the smelter in late Q4 2025

Prior to the first feed of concentrate into the smelter furnace, as announced on December 1, 2025, the smelter's slag concentrator was used to reprocess fines and spillage from the Phase 1, 2 and 3 concentrators during Q3 and Q4 2025. The smelter site at Kamoa-Kakula includes a 600,000-tonne-per-annum conventional concentrator plant, which under normal operating conditions is used to regrind and refloat slag produced by the smelter. Slag produced by the smelter contains approximately 4% copper, which, once reprocessed, enables the smelter to achieve a recovery rate of 98.5%. Concentrate produced by the concentrator was stored on site and will be fed into the Kamoa-Kakula smelter. With the smelter now operational, the slag concentrator will no longer produce additional copper in concentrate.

Kamoa-Kakula's copper production was supported by a record 144,493 tonnes of copper produced by the Phase 3 concentrator during 2025. The Phase 3 concentrator milled 6.4 million tonnes of ore during 2025, approximately 30% above the design capacity of 5.0 million tonnes per annum. The Phase 3 concentrator also achieved a record throughput of 1.66 million tonnes and averaged a record recovery rate of 88.2% in the fourth quarter.

Aerial view of the Kamoa-Kakula Copper Smelter, with the smelter's 600,000-tonne-per-annum slag concentrator (bottom right). Ahead of starting up the smelter furnace in December 2025, the slag concentrator assisted with copper concentrate production.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3396/280491_ivanhoe01151en.jpg

Smelter ramp-up advances with 99.7%-pure anode production already at approximately 500 tonnes per day, in line with specification; first truck-loads of anodes loaded for export.

As announced on January 2, 2026, the casting of the first anode at Kamoa-Kakula copper smelter took place in December 2025. Ramp-up of 99.7%-pure copper anode production since the first casting is advancing to plan, with current production averaging 500 tonnes per day, equivalent to an annualized production rate of 150,000 tonnes per annum after accounting for availability.

The first truckloads of 99.7% pure copper anodes were recently loaded and are ready for export, with provisional revenues expected to be recognized imminently.

2026 copper sales are expected to be approximately 20,000 tonnes higher than copper production as the on-site inventory of unsold copper concentrate is destocked, predominantly during H1 2026. Prior to the first feed of concentrate into the smelter, Kamoa-Kakula's on-site concentrate inventory contained approximately 37,000 tonnes of copper. Total unsold copper in concentrate at the smelter, held in stockpiles and the smelting circuit, is expected to be reduced to approximately 17,000 tonnes during 2026 as the smelter ramps up. As destocking occurs, Kamoa-Kakula's management aims to capitalize on near-record-high copper prices.

99.7%-pure copper anodes are inspected in the anode yard of the smelter prior to loadout and export.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3396/280491_ivanhoe01152en.jpg

The first batch of copper anodes were recently loaded onto trucks ready for export. Revenues from the first export of anodes are expected imminently.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3396/280491_e32bd7f37400fbe4_004full.jpg

Kamoa-Kakula's operating margins are set to expand due to reduced logistics costs and from revenue generated from by-product, high-strength sulphuric acid sales.

Kamoa-Kakula's margins are expected to expand as the smelter ramps up, as concentrates produced by Phase 1, 2, and 3 concentrators are smelted on-site rather than exported unbeneficiated. Kamoa-Kakula's logistics costs are expected to approximately halve as the copper content per truck-load exported more than doubles, from approximately 45% contained copper in concentrate to 99.7%-pure copper anodes.

Further improvement in Kamoa-Kakula's margins is also expected to be achieved through the revenues generated from sulphuric acid sales. In addition to the production of copper anodes, the Kamoa-Kakula smelter is currently producing on average 1,200 tonnes per day of sulphuric acid, equivalent to an annualized production rate of 400,000 tonnes per annum. The smelter is expected to produce up to 700,000 tonnes per annum of high-strength sulphuric acid at steady-state operations, which will be sold locally. The first sales of acid from the smelter have already taken place, with the first shipment to nearby mining operations in the DRC Copperbelt expected imminently.

Sulphuric acid is currently in high demand by other mining operations across the Central African Copperbelt, especially following the export ban of acid by Zambia in September 2025. Spot acid prices have reached as high as $700 per tonne in Kolwezi in recent months. Recent sales have taken place at materially higher prices than the $150 per tonne forecast price used in the Kamoa-Kakula Integrated Development Plan 2023 Technical Report, dated March 6, 2023.

A smelter operator takes a sample while 99.7%-pure copper anodes are poured and cast at the Kamoa-Kakula Copper Smelter.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3396/280491_ivanhoe01154en.jpg

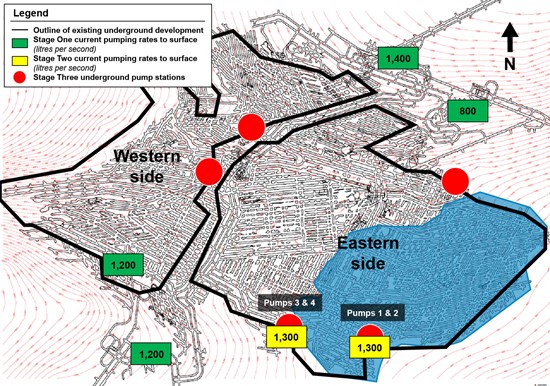

Stage Two dewatering of Kakula Mine complete; selective mining on the eastern side commenced ahead of schedule in late December

As announced on January 2, 2026, Stage Two dewatering activities are complete, with the first pair of high-capacity submersible dewatering pumps (Pumps 3 and 4) running dry. As announced on December 3, 2025, following an underground survey, Pumps 3 and 4 were repositioned lower in late November to enable an additional Stage Two dewatering. Since then, the water level has declined by a further 19 metres to the level shown in Figure 1. The second pair of Stage Two pumps (Pumps 1 and 2), which are approximately 20 metres lower in elevation compared with Pumps 3 and 4 are expected to run dry in January 2026.

Stage Three dewatering activities will take over from Stage Two dewatering, and consist of re-commissioning the existing, water-damaged underground horizontal pump stations, which are used for steady-state operations. The rehabilitation work consists of fitting new pump motors, substations and electrical cabling. All required equipment is on site, and installation will begin once access to the horizontal pump stations becomes available.

Figure 1. A schematic of the underground water levels at the Kakula Mine as at December 22, 2025, overlaid with the underground pumping infrastructure.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3396/280491_e32bd7f37400fbe4_006full.jpg

There is currently 5,600 litres per second of installed pumping capacity at the Kakula Mine, excluding the Stage Two pumping infrastructure. Stage Three dewatering activities are expected to continue into Q2 2026 and will not be on the critical path for Kakula's mining operations.

In addition, the western side of the Kakula Mine has been dewatered, enabling the mining of higher-grade areas. Head grades from mining areas on the western side of Kakula are expected to increase from 3.5% copper in January to approximately 4.0% copper by the end of Q1 2026. In addition, selective mining on the eastern side of the Kakula Mine began ahead of schedule at the end of December.

The Kipushi concentrator produced a record 203,168 tonnes of zinc in 2025, including a quarterly record of 61,444 tonnes in Q4 2025, achieving guidance.

Zinc production from the Kipushi concentrator continued to improve in the fourth quarter, breaking the third-quarter throughput and production records. The improvement in production rates was attributed to the ramp-up following the completion of the debottlenecking program in the third quarter, as well as improved power availability due to the installation of additional back-up generator power in the fourth quarter.

Following improved production rates in the second half of 2025, the Kipushi operations achieved the originally stated production guidance of between 180,000 and 240,000 tonnes of zinc.

Summary of quarterly production data from Kipushi

| Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 | FY 2025 | |

| Kipushi Concentrator | |||||

| Ore tonnes milled (tonnes) | 151,403 | 153,342 | 168,862 | 194,140 | 667,748 |

| Feed grade of ore milled (% zinc) | 32.16 | 33.37 | 37.81 | 36.18 | 35.20 |

| Zinc recovery (%) | 87.93 | 85.22 | 89.36 | 87.71 | 87.30 |

| Zinc in concentrate produced (tonnes) | 42,736 | 41,788 | 52,700 | 61,444 | 203,168 |

Data in bold denotes a quarterly record

Engineering work on the debottlenecking program commenced in September 2024 to boost the concentrator throughput rate by 20% from 800,000 to 960,000 tonnes of ore per annum. The debottlenecking program was completed in early August, both ahead of schedule and under budget, following a seven-day planned shutdown.

Multiple concentrator records have since been achieved, including a monthly record of 22,629 tonnes of zinc in concentrate produced in December. In addition, during December, recoveries averaged a record 93.4%. The production record is equivalent to an annual production rate of over 270,000 tonnes of zinc. Maintaining this production rate would make the Kipushi Mine the world's fifth-largest zinc mine.

Despite improved production rates, operations remain affected by electrical grid instability. An additional six megawatts of back-up generator capacity were installed in the fourth quarter, improving operational consistency. The new generators increase the total onsite back-up power to 20 megawatts, sufficient to maintain steady-state operations during periods of grid instability.

Aerial view of the Kipushi concentrator. The concentrator produced a record 203,168 tonnes of zinc in concentrate during 2025, achieving guidance.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3396/280491_ivanhoe01155en.jpg

2026 Production Guidance

Ivanhoe Mines' 2026 production guidance is based on several assumptions and estimates as of December 31, 2025. The guidance provides estimates of known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially.

Although mining in the western side of the Kakula Mine has restarted, risk factors remain, including the integrity of underground infrastructure once fully dewatered, the ability to ramp up underground operations in line with expectations, the ability to access in the required time new mining areas. The 2026 guidance range for Kamoa-Kakula is based on an assessment of these factors that management believes are reasonable at this time, given all available information. Metal reported in concentrate is before refining losses or deductions associated with smelter terms.

| 2026 Production Guidance | ||

| Kamoa-Kakula | 380,000 - 420,000 | Contained copper in concentrate (tonnes) |

| Kipushi | 240,000 - 290,000 | Contained zinc in concentrate (tonnes) |

All figures are on a 100%-project basis and metal reported in concentrate is before refining losses or payability deductions associated with smelter terms.

As disclosed on December 3, 2025, Kamoa-Kakula's 2027 copper production guidance was set at between 500,000 and 540,000 tonnes of copper. Production rates are expected to steadily improve as the Kakula Mine recovery plan is completed, and annualized copper production expected to return to approximately 550,000 tonnes over the medium and long term.

The ramp-up of the Kamoa-Kakula smelter to its annualized run rate of 500,000 tonnes per annum is expected towards year-end. In the meantime, Kamoa-Kakula's management team will prioritize the processing of concentrates produced by the Phase 1, 2, and 3 concentrators through the on-site smelter, with any excess concentrate toll-treated at the Lualaba Copper Smelter (LCS), near Kolwezi, on the DRC Copperbelt. The mid-point of Kamoa-Kakula's copper production is 400,000 tonnes of copper, representing approximately 80% of the smelter's total capacity.

Ivanhoe Mines will provide C1 cash cost (C1) per pound of payable copper and payable zinc guidance for 2026, as well as group capital expenditure guidance in its 2025 year-end financial results release on February 18, 2026. Guidance on Platreef's production and C1 cash costs will be provided once the ramp-up of Phase 1 concentrator is sufficiently advanced.

Ramp up of Platreef Phase 1 concentrator advancing to plan

As announced on January 12, 2026, ramp up of the Platreef Phase 1 concentrator continues to advance in line with expectations, following first production of platinum-palladium-nickel-rhodium-gold-copper concentrate on November 18, 2025.

As previously guided, lower-grade development ore will continue to be fed into the concentrator during the initial ramp-up stages until Shaft #3 is ready to hoist in early Q2 2026, at which point feed will be increasingly replaced by production ore. From early Q2 2026, the concentrator is expected to steadily ramp-up, consistently achieving 80% of nameplate capacity by mid-year.

Ivanhoe Mines to issue 2025 financial results after market close on February 18 and host conference call for investors on February 19

Ivanhoe Mines will report its Q4 and full-year 2025 financial results, and a detailed update on its operations and exploration activities, after market close on Wednesday, February 18, 2026.

The company plans to hold an investor conference call to discuss the full-year 2025 financial results the following day on Thursday, February 19, 2026. Details of the call will be shared closer to the date.

An audio webcast recording of the conference call, together with supporting presentation slides, will be available on Ivanhoe Mines' website at www.ivanhoemines.com.

After issuance, the Financial Statements and Management's Discussion and Analysis will be available at www.ivanhoemines.com and www.sedarplus.ca.

Qualified Persons

Disclosures of a scientific or technical nature at the Kamoa-Kakula Copper Complex, the Kipushi Mine and the Platreef Mine, in this news release have been reviewed and approved by Steve Amos, who is considered, by virtue of his education, experience, and professional association, a Qualified Person under the terms of NI 43-101. Mr. Amos is not considered independent under NI 43-101 as he is Ivanhoe Mines' Executive Vice President, Projects. Mr. Amos has verified the technical data disclosed in this news release.

Ivanhoe has prepared independent, NI 43-101-compliant technical reports for the Kamoa-Kakula Copper Complex, the Kipushi Mine and the Platreef Mine, which are available on the company's website and under the company's SEDAR+ profile at www.sedarplus.ca:

- Kamoa-Kakula Integrated Development Plan 2023 Technical Report dated March 6, 2023, prepared by OreWin Pty Ltd.; China Nerin Engineering Co. Ltd.; DRA Global; Epoch Resources; Golder Associates Africa; Metso Outotec Oyj; Paterson and Cooke; SRK Consulting Ltd.; and The MSA Group.

- The Kipushi 2022 Feasibility Study dated February 14, 2022, prepared by OreWin Pty Ltd., MSA Group (Pty) Ltd., SRK Consulting (South Africa) (Pty) Ltd, and METC Engineering.

- The Platreef Integrated Development Plan 2025, filed on March 31, 2025, prepared by OreWin Pty Ltd., Mine Technical Services, SRK Consulting Inc., DRA Projects (Pty) Ltd, and Golder Associates Africa.

The technical reports include relevant information regarding the assumptions, parameters, and methods of the mineral resource estimates on the Kamoa-Kakula Copper Complex, the Kipushi Mine and the Platreef Mine cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release.

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal operations in Southern Africa; the Kamoa-Kakula Copper Complex in the DRC, the ultra-high-grade Kipushi zinc-copper-germanium-silver mine, also in the DRC; and the tier-one Platreef platinum-palladium-nickel-rhodium-gold-copper mine in South Africa.

Ivanhoe Mines is exploring for copper in its highly prospective, 54-100% owned exploration licences in the Western Forelands, covering an area over six times larger than the adjacent Kamoa-Kakula Copper Complex, including the high- grade discoveries in the Makoko District. Ivanhoe is also exploring for new sedimentary copper discoveries in new horizons including Angola, Kazakhstan, and Zambia.

Follow Robert Friedland (@robert_ivanhoe) and Ivanhoe Mines (@IvanhoeMines_) on X.

Information contact

Investors

Tommy Horton: +44 7866 913 207 (London)

Media

Tanya Todd: +1 604 331 9834 (Vancouver)

Website: www.ivanhoemines.com

Forward-looking statements

Certain statements in this release constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of the company, its projects, or industry results, to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified using words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology, or state that certain actions, events, or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. These statements reflect the company's current expectations regarding future events, performance, and results and speak only as of the date of this release.

Such statements include without limitation: (i) statements that 2026 copper sales are expected to be approximately 20,000 tonnes higher than copper production as the on-site inventory of unsold copper concentrate is destocked, predominantly during H1 2026; (ii) statements that total unsold copper in concentrate at the smelter, held in stockpiles and the smelting circuit, is expected to be reduced to approximately 17,000 tonnes during 2026 as the smelter ramps up; (iii) statements that revenues from the first export of anodes are expected imminently; (iv) statements that Kamoa-Kakula's margins are expected to expand as the smelter ramps up, as concentrates produced by Phase 1, 2, and 3 concentrators are smelted on-site rather than exported unbeneficiated; (v) statements that Kamoa-Kakula's logistics costs are expected to approximately halve as the copper content per truck-load exported more than doubles, from approximately 45% contained copper in concentrate to 99.7%-pure copper anodes; (vi) statements that further improvement in Kamoa-Kakula's margins is also expected to be achieved through the revenues generated from sulphuric acid sales, as the smelter is expected to produce up to 700,000 tonnes per annum of high-strength sulphuric acid at steady-state operations; (vii) statements that the second pair of Stage Two pumps (Pumps 1 and 2), which are approximately 20 metres lower in elevation compared with Pumps 3 and 4 are expected to run dry in January 2026; (viii) statements that Stage Three dewatering activities are expected to continue into Q2 2026 and will not be on the critical path for Kakula's mining operations; (xiv) statements that head grades from mining areas on the western side of Kakula are expected to increase from 3.5% copper in January to approximately 4.0% copper by the end of Q1 2026; (x) statements regarding the 2026 annual production guidance for Kamoa-Kakula being estimated at between 380,000 and 420,000 tonnes of copper concentrate; (xi) statements regarding the 2026 annual production guidance for Kipushi being estimated at between 240,000 and 290,000 tonnes of zinc concentrate; (xii) statements that production rates are expected to steadily improve as the Kakula Mine recovery plan is completed, and annualized copper production expected to return to approximately 550,000 tonnes over the medium and long term; (xii) statements that the ramp-up of the Kamoa-Kakula smelter to its annualized run rate of 500,000 tonnes per annum is expected towards year-end; and(xiii) statements that from early Q2 2026, the concentrator at Kipushi is expected to steadily ramp-up, consistently achieving 80% of nameplate capacity by mid-year.

Furthermore, concerning this specific forward-looking information concerning the operation and development of the Kamoa-Kakula Copper Complex, the Kipushi Project and the Platreef Mine, the company has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include: (i) the adequacy of infrastructure; (ii) geological characteristics; (iii) metallurgical characteristics of the mineralization; (iv) the ability to develop adequate processing capacity; (v) the price of copper and zinc, as applicable; (vi) the availability of equipment and facilities necessary to complete development and exploration; (vii) the cost of consumables and mining and processing equipment; (viii) unforeseen technological and engineering problems; (ix) accidents or acts of sabotage or terrorism; (x) currency fluctuations; (xi) changes in regulations; (xii) the compliance by joint venture partners with terms of agreements; (xiii) the availability and productivity of skilled labour; (xiv) the regulation of the mining industry by various governmental agencies; (xv) the ability to raise sufficient capital to develop such projects; (xvi) changes in project scope or design; (xvii) recoveries, mining rates and grade; (xviii) political factors; (xviii) water inflow into the mine and its potential effect on mining operations, and (xix) the consistency and availability of electric power.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indicators of whether such results will be achieved. Many factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, however not limited to, the factors discussed above and under the "Risk Factors" and elsewhere in the company's MD&A for the three and nine months ended September 30, 2025 and in its current annual information form, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this release.

The company's actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors outlined in the "Risk Factors" section in the company's MD&A for the three and nine months ended September 30, 2025 and its current annual information form.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280491

Source: Ivanhoe Mines Ltd.