NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES

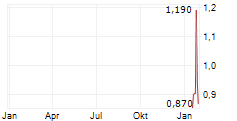

VANCOUVER, British Columbia, Jan. 15, 2026 (GLOBE NEWSWIRE) -- Pacifica Silver Corp. ("Pacifica" or the "Company") (CSE: PISL) (OTCQB: PAGFF) is pleased to announce that it has entered into an agreement with Raymond James Ltd., as sole bookrunner and lead agent, on behalf of a syndicate of agents (collectively, the "Agents"), in connection with a brokered private placement offering (the "Offering") of 6,900,000 common shares of the Company (the "Common Shares") at a price of $1.45 per Common Share (the "Offering Price") for aggregate gross proceeds to the Company of up to $10,005,000.

The Company has agreed to grant the Agents an option, exercisable, in part or in whole at the Agents' sole discretion, up to 48 hours prior to the Closing Date (as defined below), to offer for sale up to an additional 1,035,000 Common Shares which is equal to 15% of the Common Shares comprising the Offering at the Offering Price.

The net proceeds of the Offering will be used to advance exploration and drilling activity at the Company's Claudia Project (the "Project"), located in Durango, Mexico, and for working capital and general corporate purposes.

The Common Shares issued under the Offering will be issued and sold to eligible purchasers pursuant to the 'listed issuer financing exemption' under Part 5A of National Instrument 45-106 - Prospectus Exemptions as amended by Coordinated Blanket Order 45-935 - Exemptions from Certain Conditions of the Listed Issuer Financing Exemption (the "LIFE Exemption"), will be issued to purchasers in each of the provinces of Canada, except Québec, and other qualifying jurisdictions, including the United States on a private placement basis pursuant to available exemptions from the registration requirements under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"). The Common Shares to be issued and sold under the Offering will not be subject to resale restrictions pursuant to applicable Canadian securities laws.

There is an offering document related to the Offering that can be accessed under the Company's issuer profile at www.sedarplus.ca and on the Company's website at www.pacificasilver.com. Prospective investors should read this offering document before making an investment decision concerning the Common Shares.

The Offering is expected to close on or about January 23, 2026 (the "Closing Date") and is subject to certain closing conditions including, but not limited to, the receipt of all necessary approvals including the conditional listing approval of the Canadian Securities Exchange ("CSE") and the applicable securities regulatory authorities. The Offering is subject to final acceptance of the CSE.

The Common Shares have not been registered and will not be registered under the U.S. Securities Act, or any state securities laws and may not be offered or sold in the United States or to, or for the account or benefit of, "U.S. Persons" (as such term is defined in Regulation S under the U.S. Securities Act) absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful.

About Pacifica Silver Corp.

Pacifica Silver Corp. is a Canadian resource company led by a proven management team with decades of mining and exploration experience in Mexico. The Company is focused on its 100% owned Project located in Durango, Mexico. Spanning 11,876 hectares, the Project encompasses most of the historic El Papantón Mining District where at least nine small mines operated throughout the 20th century. Since 1990, sampling and drilling within have returned high-grade silver and gold intercepts across multiple vein systems, with approximately 10% of over 30 kilometres of known veins having been drilled. Today, the Project is a prime target for modern exploration and holds exceptional potential for new high-grade discoveries.

"Todd Anthony"

Chief Executive Officer

FOR FURTHER INFORMATION PLEASE CONTACT:

Todd Anthony

Phone: 778-999-2627

Email: info@pacificasilver.com

Neither the CSE nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains certain "forward-looking information" and "forward-looking statements" within the meaning of Canadian securities legislation as may be amended from time to time, including, without limitation, statements regarding: the perceived merit of the Project, potential quantity and/or grade of minerals and the potential size of the mineralized zone; the closing of the Offering; the timing of the Closing Date; the intended use of proceeds of the Offering; and regulatory approval of the Offering. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made, and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding: the price of gold and silver; the accuracy of mineral resource estimates; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting, as well as in respect of the Offering; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; that there will be no significant disruptions affecting the Company or its properties; the closing of the Offering on the anticipated terms or at all; and the Company using the net proceeds of the Offering as anticipated. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: the Offering does not close on the anticipated timing or at all; the Company raises less than the maximum amount of gross proceeds of the Offering; the Company does not use the proceeds from the Offering as expected; risks related to not receiving regulatory approval of the Offering; risks associated with the business of the Company, including the execution of the Company's objectives and strategies, including costs and expenses; business and economic conditions in the mining industry generally; delays and costs inherent to consulting and accommodating rights of local communities; environmental risks; title risks, including concession renewal; commodity price and exchange rate fluctuations; delays in or failure to receive access agreements or amended permits; risks inherent in the estimation of mineral resources; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); and other risk factors as detailed from time to time. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company's Management's Discussion and Analysis, available on www.sedarplus.ca. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.