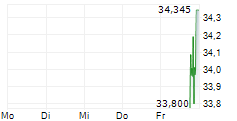

WASHINGTON (dpa-AFX) - York Space Systems, a modern defense prime built for speed and scale, announced the launch of its roadshow for a proposed initial public offering of 16 million shares of common stock. The IPO price is expected to range between $30 and $34 per share. In addition, York plans to grant underwriters a 30-day option to purchase up to an additional 2.4 million shares at the IPO price, less underwriting discounts and commissions.

The company has applied to list its common stock on the New York Stock Exchange under the ticker symbol 'YSS.'

Goldman Sachs & Co. LLC, Jefferies, and Wells Fargo Securities are acting as lead bookrunning managers for the proposed offering. J.P. Morgan and Citigroup are acting as joint bookrunning managers. Truist Securities, Baird, and Raymond James are acting as bookrunners. Canaccord Genuity, Needham & Company, and Academy Securities will serve as co-managers.

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News