During 2025, the number of customers in the commercial stage increased with 50 %, creating a strong foundation for scalable growth and gradually improved profitability. The new Advanced segment accounted for the largest share of total order value and represents the strongest short-term sales potential. In a new business update, Tor Einar Norbakk, CEO of Svenska Aerogel (the "Company"), comments on the current business situation and shares expectations for 2026.

2025 concluded with Svenska Aerogel receiving its largest material order to date, as Outlast® Technologies placed their first ramp-up order. The order follows a successful launch of the Aersulate® product, which enables thermal insulation in wadding applications, including duvets, pillows, footwear and clothing.

"This order represents Svenska Aerogel's largest material purchase to date. The customer has high expectations for the product, and the order volume at this stage reinforces the business's future growth potential," says Tor Einar Norbakk.

Outlook for 2026

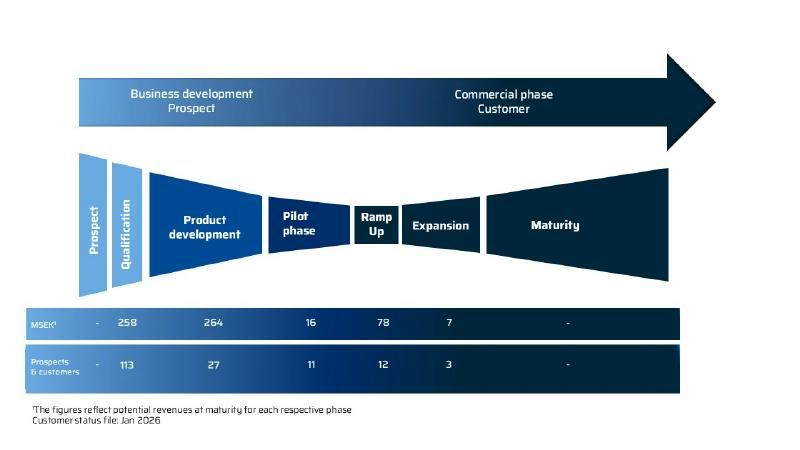

The Company enters the year with a total of 15 customers in the commercial phase, representing a clear progression compared to the 10 customers at year-end 2024 (See the figure below). This development has been driven by several customers successfully certifying their products and initiating market launches. The majority of these customers are within Building & Construction, followed by Advanced and the Process industry. With these 15 customers, the Company has the potential to achieve positive cash flow. A conservative estimate of the potential annual value at maturity is 85 MSEK.

Building & Construction - companies entering the commercial phase

Within the Building & Construction segment, the companies currently in the ramp-up phase are primarily SMEs. Most customers are based across Europe, with end-use applications such as insulating render and cool-roof systems (reflective and thermally insulating roof coatings).

"We are very pleased to see three additional companies with groundbreaking products entering the commercial phase. These customers are expected to drive increased demand for Quartzene®, which in the long term will contribute to the Company's financial stability. The broader geographic footprint of our customer base also increases brand awareness and generates growing interest in our material among other market participants," continues Tor Einar.

Advanced - largest share of sales and large-scale volume potential

The Advanced segment recorded the highest order intake in 2025, driven by demand from customers in insulating textiles. The segment includes innovative, technology-driven customers with the potential to scale to large volumes over the coming years. These products are based on disruptive innovation and address multiple geographic markets, including Europe and North America.

"A key strength is that Quartzene® is tailored specifically to their products, which reduces the risk of alternative solutions. We believe these customers have the potential to become true game changers, particularly as some offer applications in both civilian and defence markets," concludes Tor Einar Norbakk.

Stay up to date with the latest news from Svenska Aerogel - subscribe to the Company's press releases here: aerogel.se.

For further information, please contact:

Tor Einar Norbakk, CEO. Telephone: +46 (0)70 616 08 67. E-mail: toreinar.norbakk@aerogel.se

About Svenska Aerogel Holding AB (publ)

Svenska Aerogel manufactures and commercializes the mesoporous material Quartzene®. Svenska Aerogel's business concept is to meet the market's need for new materials that are in line with global sustainability objectives. Quartzene® is flexible and can be tailored to different applications to add essential properties to an end product. The company's vision is to be the most valued business partner providing pioneering material solutions for a sustainable world.

Svenska Aerogel Holding AB is listed on Nasdaq First North Growth Market. Certified Adviser is FNCA.

Gävle, January 20, 2026