VANCOUVER, British Columbia, Jan. 20, 2026 (GLOBE NEWSWIRE) -- Midnight Sun Mining Corp. (TSXV: MMA / OTCQX: MDNGF) ("Midnight Sun" or the "Company") is pleased to announce the completion of a maiden Mineral Resource Estimate for the near-surface Kazhiba Main Oxide Copper Deposit, located in Solwezi, Zambia.

The maiden Mineral Resource Estimate ("MRE") consists of 2.33 million tonnes of Indicated mineral resources grading 1.41% copper (Cu) at a selected base case cut-off of 0.10 % Cu over all rock type categories. The initial MRE was prepared for the Company by DMT Kai Batla PTY Ltd. and has an effective date of January 20, 2026.

Midnight Sun CEO Al Fabbro states: "The delivery of this resource estimate for Kazhiba Main represents a significant milestone for Midnight Sun. Kazhiba Main hosts a meaningful inventory of near-surface, acid-soluble copper within a compact footprint, extending to an average maximum depth of only about 30 metres and grading 1.41%, well above typical economic thresholds for oxide copper. Our goal is to convert this deposit into a non-dilutive funding source to advance our flagship Dumbwa Project. This opportunity is incredibly rare in the mineral exploration sector, and Midnight Sun is well positioned for an exciting future. The Company now intends to move forward with its plan to monetize Kazhiba Main and expects to immediately commence discussions with key counterparties to that end."

The table below summarizes the MRE of the Kazhiba Main Copper Oxide Deposit.

| Mineral Resource Estimate - Kazhiba Main Oxide Copper Deposit | ||||

| Classification | Grade Cut-off %Cu | Tonnes | % Cu Grade | Cu (Mlbs) |

| Indicated | 0.10 | 2,327,200 | 1.41 | 72.3 |

Notes:

| ||||

The Qualified Person selected a base case cut-off grade scenario of 0.10% copper, based on the following key economic considerations:

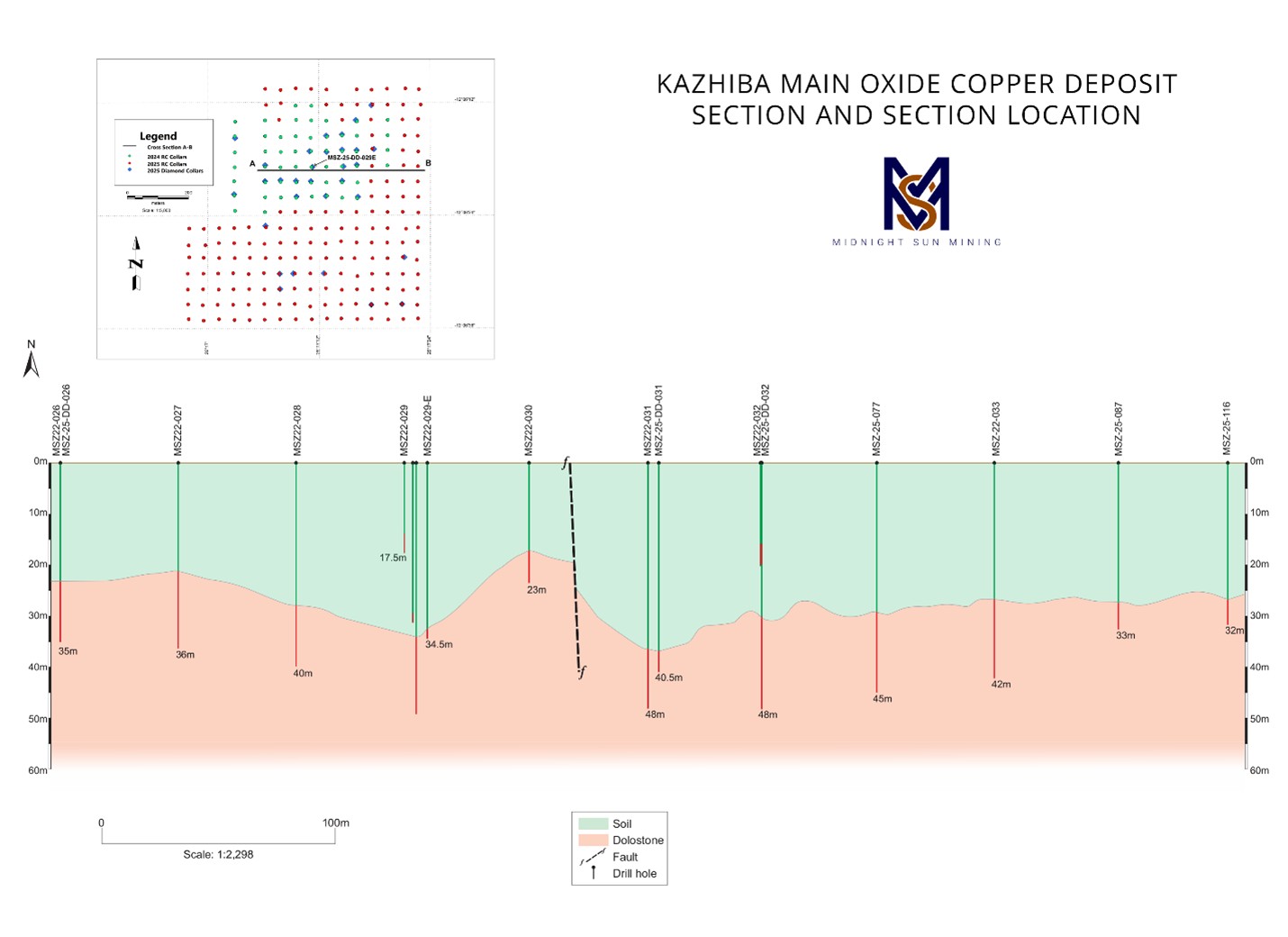

- Grade and scale: The 1.41% average grade is well above typical economic thresholds for oxide heap leach operations. The deposit is comprised almost entirely of acid-soluble malachite, and is near surface with an average maximum depth of 30 metres;

- Processing costs: Heap leaching of copper oxides is among the lowest-cost methods, with operating costs typically US$1.50-3.00/lb Cu (or lower for oxides), driven by low energy use and simple infrastructure;

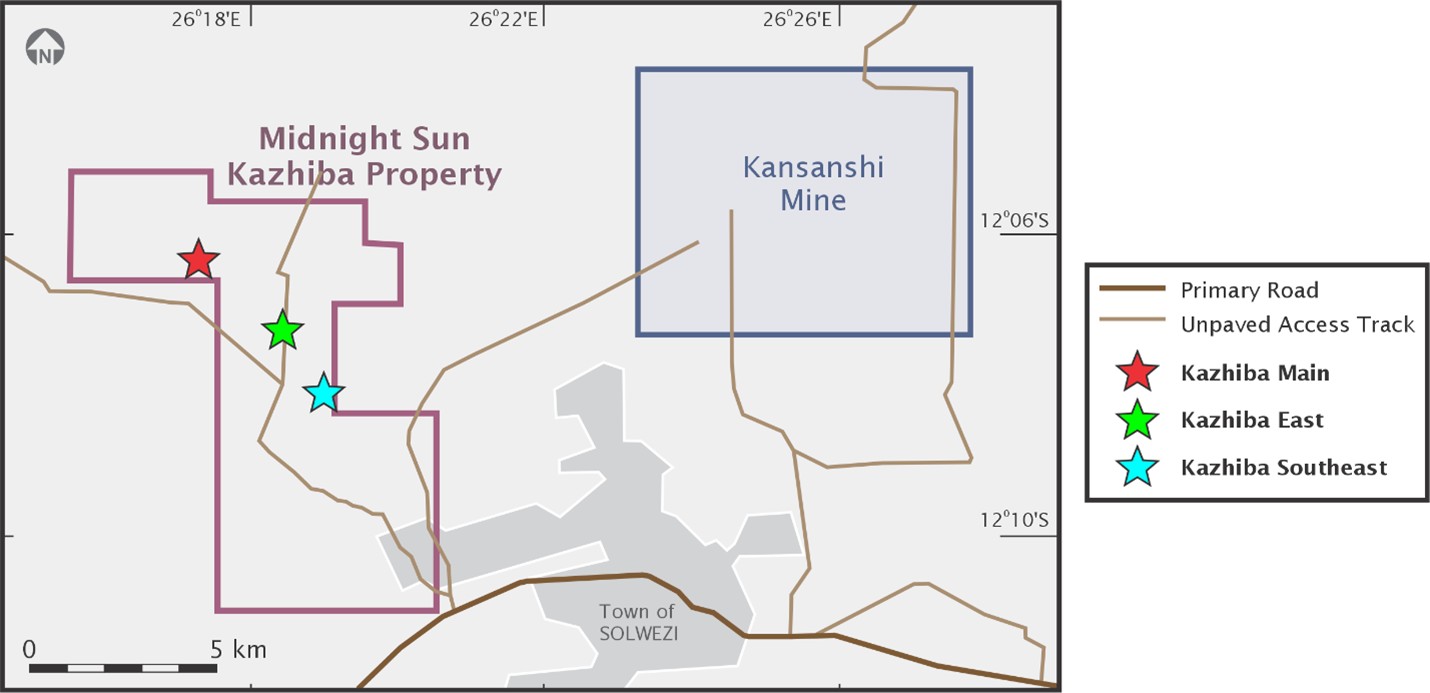

- Proximity to infrastructure: The deposit is strategically located proximal to existing infrastructure, including First Quantum's Kansanshi Mine, with the deposit located within 6.8 kilometres of the paved bypass road maintained by First Quantum;

- Market context: As of early 2026, copper prices exceeded US$5.50/lb, providing substantial headroom over costs even at conservative recoveries (70% to 80%) and moderate acid consumption;

Figure 1: Kazhiba location, showing proximity to First Quantum's Kansanshi Mine, and location of Kazhiba Main Copper Oxide Deposit

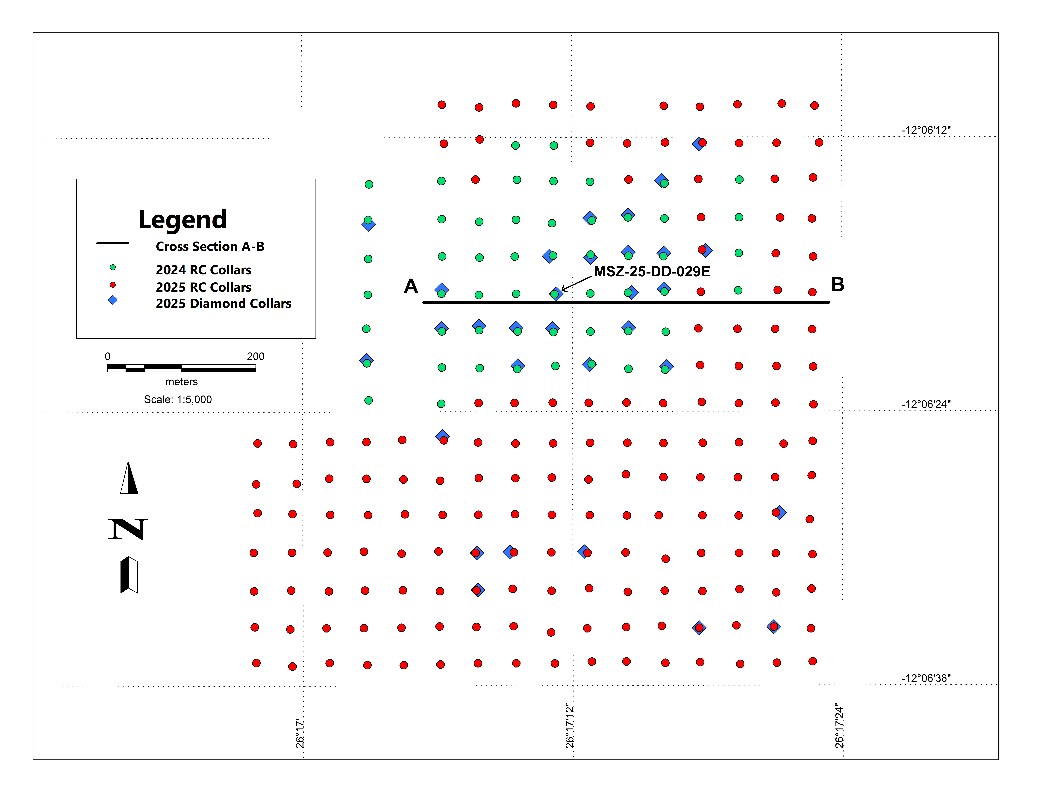

Figure 2: Kazhiba Main 2024 and 2025 drill hole locations. Note: Location of MSZ-25-DD-029E and location of section shown in Figure 4 (A to B).

Figure 3: Malachite mineralization in Drill Hole MSZ-25-DD-029E. See Figure 2 for location.

Figure 4: Kazhiba Main Copper Oxide Deposit section. Location detail showing in Figure 2, denoted A to B.

National Instrument 43-101 Disclosure

The Company will file a National Instrument 43-101 (NI 43-101) technical report on SEDAR+ within the mandated 45-day period following the date of this press release.

Dexter Ferreira, of DMT Kai Batla Pty Ltd, who is independent of the Company, has reviewed and approved the scientific and technical information herein regarding the Kazhiba Copper Oxide project. Mr. Ferreira was responsible for the Kazhiba Copper Oxide Mineral Resource Estimate and has approved the scientific and technical information pertaining to the Mineral Resource Estimate in this news release.

Darin Labrenz, P.Geo., a consulting geologist for the Company, is the Qualified Person for this news release and has reviewed and verified that the technical information contained in this news release is accurate and approves of the written disclosure of the same.

Each of Mr. Ferreira, and Mr. Labrenz are Qualified Persons as defined in NI 43-101.

The Qualified Persons have reviewed and verified the sampling and analytical procedures, results of the Quality Assurance / Quality Control (QAQC) program, the database, domain interpretation, estimation parameters, and validation of the block model and are of the opinion that a generally prudent and acceptable approach has been adopted in developing the estimate. There was no limitation on the verification process.

About Midnight Sun and Kazhiba Main

Midnight Sun is focused on exploring our flagship Solwezi Project, located in Zambia. Situated in the heart of the Zambia-Congo Copperbelt, the second largest copper producing region in the world, our property is vast and highly prospective. Our property is comprised of three exploration licences, with the Kazhiba Main Oxide Copper Deposit contained within exploration licence 21509-HQ-LEL, held by the Company's subsidiary, Zambian High Light Mining Investment Ltd. The Solwezi Project is surrounded by producing copper mines, including Africa's largest copper mining complex right next door, First Quantum's Kansanshi Mine. Led by an experienced geological team with multiple discoveries and mines around the world to their credit, Midnight Sun's goal is to find and develop Zambia's next generational copper deposit.

ON BEHALF OF THE BOARD OF MIDNIGHT SUN MINING CORP.

Al Fabbro

President & CEO

For Further Information Contact:

Adrian O'Brien

VP Business Development and Communications

Tel: +1 604 809 6890

Em: adrian@midnightsunmining.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

Cautionary Note Regarding Mineral Resources

Mineral resources that are not mineral reserves do not have demonstrated economic viability. The mineral resource estimate contained in this news release is based on limited information and is subject to various assumptions, qualifications, and procedures described herein. There is no certainty that the mineral resources estimated will be realized. The economic viability of mineral resources is influenced by many factors including commodity prices, mining and processing costs, metallurgical recoveries, capital costs, and regulatory requirements, all of which are subject to change and uncertainty.

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. Forward-looking statements in this news release include, but are not limited to, statements regarding: the Company's plans to monetize the Kazhiba Main Deposit and commence discussions with counterparties; the Company's goal to convert the deposit into a non-dilutive funding source to advance the Dumbwa Project; the MRE; the timing for filing the NI 43-101 technical report on SEDAR+; assumptions regarding mining methods, processing methods, and metallurgical recoveries; assumptions regarding copper prices, processing costs, mining costs, and other economic parameters used in the conceptual pit shell; statements regarding the potential economic viability of the Kazhiba Main Deposit; and the Company's plans and expectations for future exploration and development activities. Such forward-looking statements are based on various assumptions and factors that may prove to be incorrect, including but not limited to assumptions about: copper prices; exchange rates; processing and recovery rates that can be achieved; mining and processing costs; the results of future metallurgical testwork; the ability to obtain necessary permits and approvals; the availability of financing; and general business and economic conditions.

Forward-looking statements involve known and unknown risks, performance uncertainties and other factors which may cause the actual results, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, among others: the mineral resources disclosed herein are not mineral reserves and do not have demonstrated economic viability; there is no assurance that the mineral resources can be converted into mineral reserves; the assumptions underlying the MRE, may not be accurate or achievable; there is no assurance that the assumed mining method, processing method, or recovery rates can be achieved; no metallurgical test work has been completed on the Kazhiba Main Deposit and actual recoveries may differ materially from the assumptions used; fluctuations in copper prices and exchange rates; increases in mining, processing, or capital costs; the preliminary and conceptual nature of the economic assumptions and pit shell parameters; risks relating to the timing and ability of the Company to obtain regulatory approvals; risks relating to the Company's ability to monetize the deposit or obtain financing; risks inherent in mineral exploration and development; the availability of contractors and equipment; geopolitical risks; environmental risks; community and non-governmental actions; political risks; and the global economic climate. The Company cautions that the foregoing list of factors is not exhaustive. Further information regarding risks and uncertainties is included in the Company's continuous disclosure filings available on SEDAR+ at www.sedarplus.ca. The Company does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law. Readers are cautioned not to place undue reliance on forward-looking statements. Additional information regarding the mineral resource estimate, including key assumptions, parameters, and methods used, will be provided in the NI 43-101 technical report to be filed on SEDAR+ within 45 days of this news release, and readers are encouraged to review that report in its entirety.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0209cb32-bbc6-4224-8037-6bc2eb05e01d

https://www.globenewswire.com/NewsRoom/AttachmentNg/560939b5-b460-4c4c-9848-06d64c8dddce

https://www.globenewswire.com/NewsRoom/AttachmentNg/5abfc668-2932-40c8-89af-84b034c54b26

https://www.globenewswire.com/NewsRoom/AttachmentNg/9e8a7617-586b-4001-a2c4-6db9d45bb30a