- NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES -

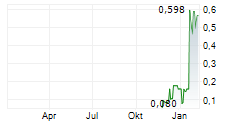

Vancouver, BC, Jan. 21, 2026 (GLOBE NEWSWIRE) -- Copperhead Resources Inc. (to be renamed Deep Sea Minerals Corp.) (CSE: CUH) (OTCPK: CUHRF) (FSE: X45) ("Deep Sea" or the "Company") is pleased to announce that it intends to complete a non-brokered private placement of up to 10,000,000 Shares at $0.40 per Share for aggregate gross proceeds of up to $4,000,000 (the "Offering"). The Offering is expected to close on or before February 6, 2026 and may close in one or more tranches.

In connection with the Offering, the Company will pay finders' fees of up to 7.0% of the gross proceeds raised by the Company from the sale of Shares to subscribers directly introduced to the Company by eligible finders. In addition, the Company will issue to eligible finders non-transferable finders' warrants of up to 7.0% of the number of Shares sold in the Offering. Each finders' warrant will entitle the holder to acquire one Share at a price of $0.40 per Share for a period of 24 months from the date of issuance, all in accordance with the policies of the Canadian Securities Exchange ("CSE").

The gross proceeds from the issuance of the Shares will be used to complete certain business objectives, as more particularly described under the heading "Business Objectives and Milestones (12 Months) in the Company's CSE Form 2A Listing Statement dated January 19, 2026 (the "Listing Statement"), a copy of which is available under the Company's profile on SEDAR+ at www.sedarplus.ca, repayment of the Loan (as defined in the Listing Statement) and for general working capital purposes.

Closing of the Offering is subject to a number of conditions, including receipt of all necessary corporate and regulatory approvals, including acceptance of the Offering by the CSE. The Offering is not subject to a minimum aggregate amount of subscriptions. All securities issued in connection with the Offering will be subject to a statutory hold period of four months plus a day from the date of issuance in accordance with applicable securities legislation and CSE policies.

"This private placement will enable Deep Sea to accelerate early-stage value capture and to deliver on its growth objectives," said James Deckelman, CEO of Deep Sea. "It will secure the working capital required to apply for subsea mineral rights in priority jurisdictions and to aggressively pursue other strategic initiatives."

STRATEGIC OBJECTIVES & RARE ENTRY POINT INTO UNTAPPED RESOURCES

The Offering is intended to fund the Company's initial execution phase as it advances its strategy to establish a foothold in the deep-sea critical minerals sector, one of the least developed, yet increasingly strategic, resource frontiers globally.

The Company will be focused on evaluating opportunities to support the future supply of critical minerals through the acquisition, exploration, and development of deep-sea mineral assets. The Company will seek to identify jurisdictions and geological settings with potential exposure to polymetallic nodule systems, which are recognized for containing combinations of metals that may be relevant to defense, industrial manufacturing, clean energy infrastructure, advanced electronics, and artificial intelligence-related supply chains.

As part of this process, the Company has commenced early-stage engagement with select governments and regulatory stakeholders in the Pacific Ocean region to assess potential pathways for future exploration initiatives, subject to applicable international, national, and environmental frameworks.

With limited competition, scarce available licenses, and rising geopolitical urgency around mineral security, the Company believes there is a narrow window of opportunity to establish early-mover positioning in this emerging sector. The Company's approach emphasizes technical and scientific rigor; environmental responsibility; regulatory coordination; and disciplined capital deployment.

ALIGNED WITH GLOBAL POLICY & NATIONAL SECURITY PRIORITIES

The Company's strategic focus aligns with recent policy actions by the United States government emphasizing the importance of securing long-term access to critical minerals. In particular, an Executive Order issued by President Donald J. Trump directed U.S. federal agencies to accelerate the assessment and development of deep-sea mineral resources as part of a broader effort to reduce reliance on foreign-controlled supply chains for materials deemed essential to national defense, advanced manufacturing, and economic security.

This Executive Order was reinforced in a January 14, 2026 Trump Administration Proclamation directing the U.S. Commerce Secretary to pursue negotiation of agreements to address the threatened impairment of the national security with respect to imports of Processed Critical Minerals and Derivative Products (PCMDPs) from any country.

Together, these actions signal growing recognition that seabed mineral resources may represent a strategically important component of future critical-minerals supply, particularly for the United States and allied economies.

KEY CORPORATE CHANGES

Further to the Company's strategic initiatives, Deep Sea has completed a corporate rebrand and launched a dedicated website at www.deepseamineralscorp.com, providing investors and stakeholders with an overview of the Company's strategic direction, governance framework, and evolving focus within the deep-sea critical minerals sector.

Additionally, subject to final approval from the Canadian Securities Exchange regarding the Company's name change, the Company expects the name change to be effective on or about January 26, 2026, at which time the common shares in the capital of the Company (the "Shares") are expected to trade on the Canadian Securities Exchange under the symbol "SEAS".

This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities being offered have not been, nor will they be, registered under the 1933 Act or under any U.S. state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act, as amended, and applicable state securities laws.

ABOUT DEEP SEA MINERALS CORP.

Deep Sea Minerals Corp. is a subsea mineral exploration and development company focused on evaluating opportunities to support the future supply of critical minerals through the acquisition, exploration, and development of deep-sea mineral assets.

The Company's strategy is centered on identifying jurisdictions and geological settings with potential exposure to polymetallic nodule systems, which are recognized for containing combinations of metals that may be relevant to defense, industrial manufacturing, clean energy infrastructure, advanced electronics, and artificial intelligence-related supply chains. These seabed resources represent a largely undeveloped component of the global mineral supply base and are the subject of increasing policy, scientific, and regulatory attention worldwide.

As part of this process, the Company has commenced early-stage engagement with select governments and regulatory stakeholders in the Pacific Ocean region to assess potential pathways for future exploration initiatives, subject to applicable international, national, and environmental frameworks.

For further information, please see the Listing Statement, a copy of which is available under the Company's profile on SEDAR+ at www.sedarplus.ca-

SOCIAL MEDIA

Website: https://deepseamineralscorp.com

Facebook: https://www.facebook.com/deepseacorp/

Instagram: https://www.instagram.com/deepseacorp

X: https://x.com/deepseacorp

LinkedIn: https://www.linkedin.com/company/deepseacorp

Youtube: https://www.youtube.com/@deepseacorp

ON BEHALF OF THE BOARD

- James A. Deckelman-

James A. Deckelman, Chief Executive Officer

For further information, please contact:

James A. Deckelman

Chief Executive Officer

Phone: 1-281-467-1279

Email: info@deepseamineralscorp.com

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release and has neither approved nor disapproved the contents of this press release.

Forward-Looking Statements

This news release includes "forward-looking information" that is subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. Forward-looking statements may include but are not limited to, statements relating to the completion of the Offering on the terms described herein or at all, and the use of proceeds and available funds following the completion of the Offering, the Company's plans, objectives and strategies, expected benefits of subsea mineral exploration and development, and are subject to all of the risks and uncertainties normally incident to such events. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. A variety of inherent risks, uncertainties and factors, many of which are beyond the Company's control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include: capital requirements and financing risk; permit and licensing risk; regulatory approvals for production; resource and property rights risk; continued operating losses; general business risk; legal, political, and civil instability; extensive government regulation; operational risks of subsea development; natural hazard risk; asset seizure or forced sale risk; equipment failure and technological obsolescence; dependence on key personnel; reliance on consultants and contractors; strategic changes and restructuring risk; uncertain market demand for minerals; mineral sales and disposition delays; uncertainty of mineral resource estimates; additional factors impacting resource estimates; inadequate insurance coverage; litigation exposure risk; vulnerability to short selling; and business expansion and integration risks. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Listing Statement filed under the Company's SEDAR+ profile at www.sedarplus.ca for a description of additional risk factors.

Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.