Critical Mineral Resources Plc - Equity Fundraise

PR Newswire

LONDON, United Kingdom, January 22

22 January 2026

Critical Mineral Resources Plc

2026 Resource Drilling Plan and Placing

Critical Mineral Resources plc ("CMR", "Company"), which has a diversified portfolio of high-quality development and exploration projects in Morocco, is pleased to announce the successful completion of a heavily oversubscribed fundraise completed by Shard Capital Partners, raising gross proceeds of £2.925 million before costs. The capital will enable CMR to accelerate its near-term resource drilling plans, enhancing the value of its portfolio.

The fundraise is subject to the approval of a prospectus by the Financial Conduct Authority. The Company is pleased to report that it is in the final stages of obtaining approval of a prospectus. Once approval has been obtained, the Company will make an application for the new ordinary shares issued in relation to the fundraise to be admitted to trading on the Main Market of the London Stock Exchange which is expected to be on or around 29 January 2026.

PLACING OF NEW SHARES

The company announces:

- Placing of 108,888,885 new ordinary shares in the capital of the Company at 2.25p per share, raising gross proceeds of £2.45m.

- Subscription of 21,111,110 new ordinary shares in the capital of the Company at 2.25p per share, raising gross proceeds of £0.475m including continued support of our strategic major shareholder.

- Grant of Placing Warrants for all subscribers in the fundraising on a 1 for 1 basis, exercisable at 4.5p per share.

- Shard Capital Partners appointed as joint broker to the Company.

USE OF FUNDS AND FAST TRACK DEVELOPMENT

Proceeds from the Fundraising will be used to accelerate the Company's near-term value catalysts, with a focus on resource definition and portfolio enhancement:

- Continued resource drilling on near-surface mineralisation identified at Zones 1 and 2 at the Company's flagship copper project at Agadir Melloul, supporting rapid progression towards a maiden mineral resource estimate.

- Deployment of both the Company's diamond drill rig and a contractor drill rig, targeting approximately 1,000 metres per month of drilling and enabling increased operational momentum.

- The programme is designed to deliver the project's first JORC compliant mineral resource estimate by early Q3 2026.

- In parallel, CMR is evaluating several value-accretive acquisition opportunities in Morocco, including potential additions of assets during H1 2026, intended to further advance the Company's stated growth strategy.

ABOUT AGADIR MELLOUL

The Project exhibits characteristics consistent with a potentially low-capex development pathway with meaningful exploration upside:

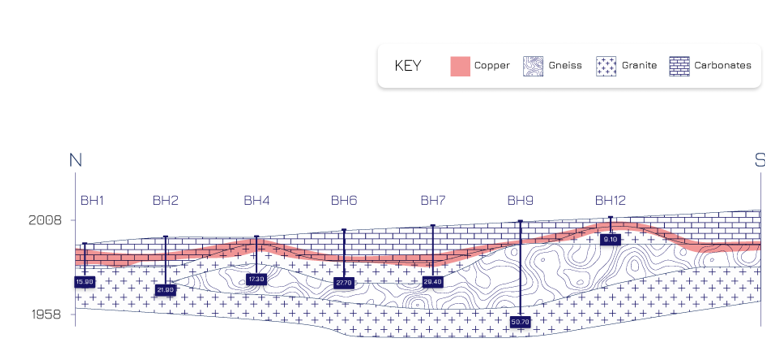

- A shallow, near-surface tabular copper deposit that offers low capex and a rapid development path. Its geometry is suitable for open-pit operations, enabling our investors to benefit from the favourable economics of surface assets while capitalising on scale potential.

- Less than 1% of the project area drilled. Ongoing mapping confirms a district wide mineralised envelope, consistent with our 25 million tonne Initial Exploration Target with an equivalent grade of 1.2% copper.

- The existence of potential economic grades of gold and silver within the permits, providing shareholders with additional upside potential.

- The rhyolite copper-silver discovery, a second style of mineralisation which has potential to become a new project alongside the existing sedimentary copper target.

- Agadir Melloul is proximal to the Tizert Project (resource of 130Mt grading 0.9% copper) and shares the same geology and style of copper mineralisation.

- The Project has benefited from systematic work programmes including drilling, mapping, trenching, channel sampling and initial metallurgical testwork, progressing it materially along the development curve.

- Metallurgical testwork returned recoveries of 80.1% and 61.3% for copper and silver respectively.

- Initial drill results include: 5.8m at 1.12% copper and 19g/t silver, 6.5m at 1.03% copper 4.7m at 1.48% copper, 4.7m at 1.03% copper, 6.0m at 1.4% copper and 31g/t silver, 10.0m at 1.1% copper and 20g/t silver and 0.12g/t, 1.0m at 2.5g/t gold from 5.0m, 1.0m at 1.05g/t gold, 0.8m at 1.67g/t gold.

Fig.1Zone 1 North, long section showing shallow undulating mineralisation

Source: Company

Charlie Long CEO commented:

"We are grateful for the support from both new and existing shareholders of CMR whom have shown their conviction in our strategy and the value creation pathway we are executing. The fundraising enables the company to materially accelerate drilling to more than 1,000 meters per month to test and expand the near surface mineralisation discovered at Agadir Melloul. We expect to complete approximately 20 drill holes per month, with results aimed at delineating a maiden JORC-compliant resource within approximately six months"

ENDS

Critical Mineral Resources plc Charles Long, Chief Executive Officer | info@cmrplc.com |

Shard Capital LLP Erik Woolgar Damon Heath

AlbR Capital Jon Belliss | +44 (0) 207 186 9952 +44 (0) 20 7399 9425 |

Notes To Editors

Critical Mineral Resources (CMR) PLC is an exploration and development company focused on developing assets that produce critical minerals for the global economy, including those essential for electrification and the clean energy revolution. Many of these commodities are widely recognised as being at the start of a supply and demand super cycle.

CMR is building a diversified portfolio of high-quality metals exploration and development projects in Morocco, focusing on copper, silver and potentially other critical minerals and metals. CMR identified Morocco as an ideal mining-friendly jurisdiction that meets its acquisition and operational criteria. The country is perfectly located to supply raw materials to Europe and possesses excellent prospective geology, good infrastructure and attractive permitting, tax and royalty conditions. In 2023, the Company acquired an 80% stake in leading Moroccan exploration and geological services company Atlantic Research Minerals SARL.

The Company is listed on the London Stock Exchange (CMRS.L). More information regarding the Company can be found at www.cmrplc.com

4296120_0.png |  Screenshot 2026-01-22 065450 |