VANCOUVER, British Columbia, Jan. 22, 2026 (GLOBE NEWSWIRE) -- Imperial Metals Corporation ("Imperial" or the "Company") (TSX:III) reports on the first diamond drill hole from the Mount Polley 2025 Phase 2 Diamond Drill Program which includes 11.0 metres with a grade of 4.43% copper, 1.53 g/t gold and 41.7 g/t silver. The nine hole Phase 2 program consisted of 3,718.3 metres.

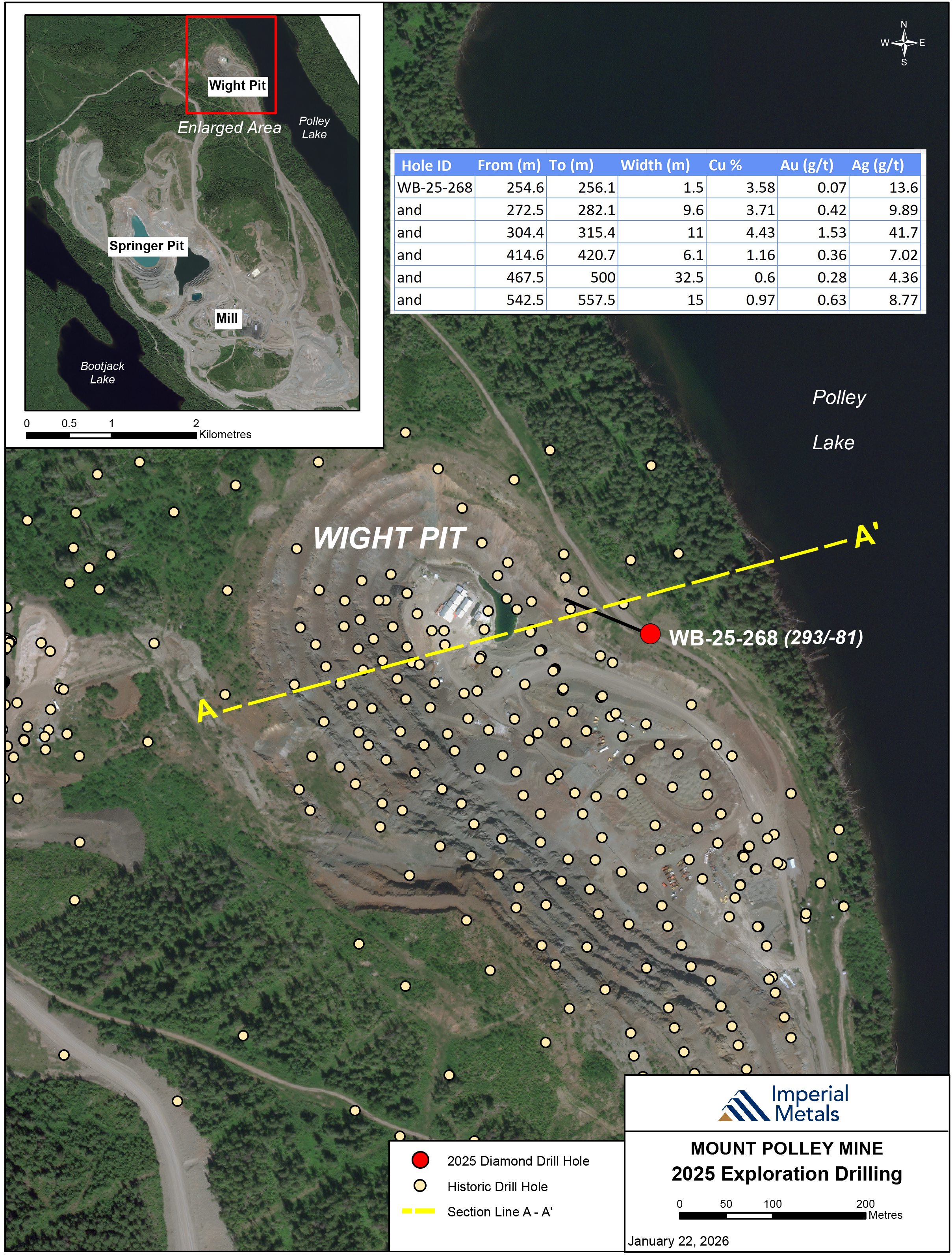

The Mount Polley 2025 Phase 2 program had three goals; to test a high-grade zone beneath the Wight Pit (See Figure 1), to expand and determine the boundaries for mineralization in the higher gold grade encountered at depth in the C2 zone, and to test beneath the previously mined Bell Pit for depth extension using new targeting techniques successfully deployed in the Springer Pit. The results of the first hole drilled in this program have been received, with the remainder pending.

Figure 1: Wight Pit Drill Plan

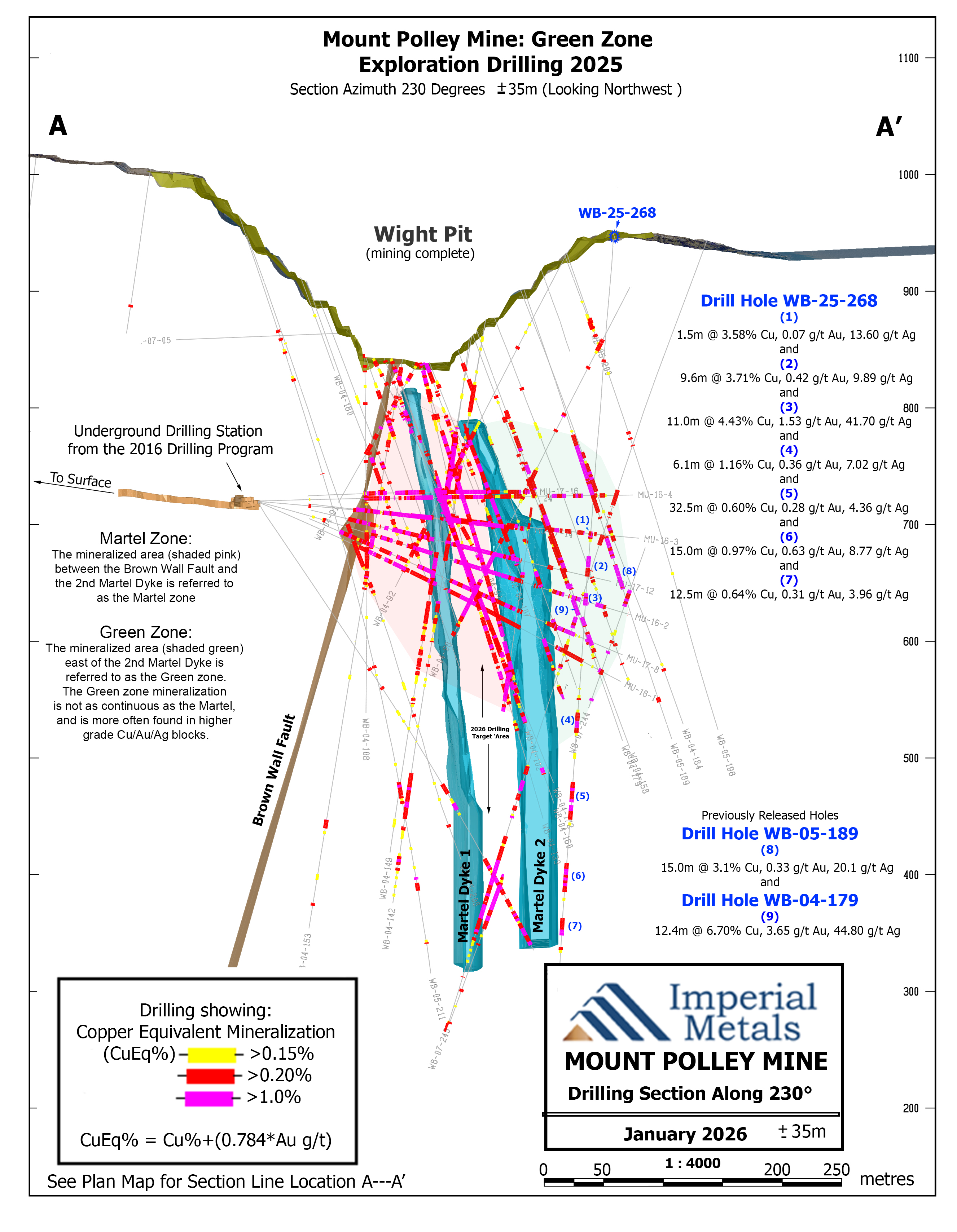

Drill hole WB-25-268 was collared on the eastern edge of the previously mined Wight Pit and targeted a high-grade area located in the Green zone, adjacent to the Martel zone, at depth beneath the Wight Pit (See Figure 2). The goal of drill hole WB-25-268 was to test the continuity and further define the high-grade zone originally defined by holes WB-05-189 (15.0 metres grading 3.1% copper, 0.33 g/t gold, and 20.1 g/t silver) and WB-04-179 (12.4 metres grading 6.7% copper, 3.65 g/t gold, and 44.8 g/t silver).

Figure 2: Wight Pit Drill Cross Section

Hole WB-25-268 intercepted a hydrothermal fragmental potassic-altered breccia hosting significant bornite and chalcopyrite cement at the target depth that returned from 304.4 metres, 11.0 metres grading 4.43% copper, 1.53 g/t gold and 41.7 g/t silver. In addition to the mineralization intercepted in the targeted zone the hole intersected a number of other higher-grade sections, both above and below the targeted area, including 9.6 metres grading 3.71% copper, 0.42 g/t gold and 9.89 g/t silver starting at 272.5 metres.

Table 1. Drill results from WB-25-268

| Hole ID | From (m) | To (m) | Width (m) | Copper (%) | Gold (g/t) | Silver (g/t) |

| WB-25-268 | 254.6 | 256.1 | 1.5 | 3.58 | 0.07 | 13.6 |

| and | 272.5 | 282.1 | 9.6 | 3.71 | 0.42 | 9.89 |

| and | 304.4 | 315.4 | 11.0 | 4.43 | 1.53 | 41.7 |

| and | 414.6 | 420.7 | 6.1 | 1.16 | 0.36 | 7.0 |

| and | 467.5 | 500.0 | 32.5 | 0.60 | 0.28 | 4.4 |

| and | 542.5 | 557.5 | 15.0 | 0.97 | 0.63 | 8.8 |

The higher silver to copper ratio returned in this hole is typical of mineralization in the northeast quadrant of the Mount Polley property. Additional diamond drilling will target this area in 2026.

The Martel zone has previously been defined as an underground resource (See Table 2).

Table 2. Martel zone Underground Resource

| Mount Polley Martel Underground Indicated Resource at January 1, 2025 | |||||||

| Grade | Contained Metal | ||||||

| Martel | Tonnes Ore | Copper % | Gold g/t | Silver g/t | Copper lbs | Gold Oz | Silver Oz |

| Underground | 2,272,000 | 1.14 | 0.30 | 7.20 | 57,344,000 | 22,000 | 526,000 |

* source Imperial 2024 AIF (March 31, 2025)

Jim Miller-Tait, P.Geo., Imperial's VP Exploration, has reviewed this news release as the designated Qualified Person as defined by National Instrument 43-101 for the Mount Polley exploration program. Samples reported were analyzed at Activation Laboratories Ltd. located in Kamloops. A full QA/QC program using blanks, standards and duplicates was completed for all diamond drilling samples submitted to the labs. Significant assay intervals reported represent apparent widths. Insufficient geological information is available to confirm the geological model and true width of significant assay intervals.

About Imperial

Imperial is a Vancouver based exploration, mine development and operating company with holdings that include the Mount Polley mine (100%), the Huckleberry mine (100%), and the Red Chris mine (30%). Imperial also holds a portfolio of 23 exploration properties in British Columbia.

Company Contacts

Brian Kynoch - President - 604.669.8959

Jim Miller-Tait - VP Exploration - jim.miller-tait@imperialmetals.com

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this news release are not statements of historical fact and are "forward-looking" statements. Forward-looking statements relate to future events or future performance and reflect the Company's management's expectations or beliefs regarding future events and include, but are not limited to, statements regarding the Company's expectations with respect to exploration drilling programs at Mount Polley; potential quantity and/or grade of minerals and the potential size of the mineralized zone. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "outlook", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative of these terms or comparable terminology. By their very nature forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In making the forward-looking statements in this news release, the Company has applied certain factors and assumptions that are based on information currently available to the Company as well as the Company's current beliefs and assumptions. These factors and assumptions and beliefs and assumptions include the risk factors detailed from time to time in the Company's annual information form, interim and annual financial statements and management's discussion and analysis of those statements, all of which are filed and available for review on SEDAR+ at www.sedarplus.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended, many of which are beyond the Company's ability to control or predict. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and all forward-looking statements in this news release are qualified by these cautionary statements.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/26f1ab74-a874-4fa2-b5f2-59b218a76311

https://www.globenewswire.com/NewsRoom/AttachmentNg/283ba931-bf9f-4991-959d-46eb26183339