Thunder Bay, Ontario--(Newsfile Corp. - January 26, 2026) - Thunder Gold Corp. (TSXV: TGOL) (FSE: Z25) (OTCQB: TGOLF) ("Thunder Gold" or the "Company") is pleased to announce results of the Mineral Resource Estimate ("MRE") at its 100%-owned, 2,500-hectare, Tower Mountain Gold Property, located 40 kilometres from the port city of Thunder Bay, Ontario.

Key Highlights:

- Indicated Resource of 34.5 million tonnes averaging 0.46 g/t Au (514,000 oz. Au);

- Inferred Resource of 211.1 million tonnes averaging 0.45 g/t Au (3,053,000 oz. Au);

- 100% of the estimated Resources are within an optimized open pit (the "ultimate pit");

- The ultimate pit does not impact current or proposed critical public infrastructure;

- Waste to Ore strip ratio = 1.8:1; and,

- All in discovery costs of ~ C$3.95 per ounce;

- The Company shall file a ("NI") 43-101 Technical Report within 45 days.

Wes Hanson, President and CEO states, "This Mineral Resource Estimate represents a pivotal milestone for Tower Mountain and validates our strategic decision in Q4 2025 to direct capital toward resource definition drilling along the western contact of the Tower Mountain Intrusive Complex ("TMIC"). The estimate confirms a large, continuous resource fully contained within an optimized open pit ("the ultimate pit"), demonstrating the project's strong development potential, operational flexibility and capital efficiency at a US$3,000 per ounce gold price and an assumed metallurgical recovery of 80%.

There is immediate, short-term discovery potential within and immediately adjacent to the ultimate pit and longer term, the remaining 80% of the TMIC contact, interpreted to represent the upper expression of an Intrusion Related Gold Deposit, is untested, representing a compelling exploration target.

The ultimate pit design provides meaningful optionality to enhance project economics through selective cut-off strategies that prioritize higher-grade material, while incremental mill feed can be stockpiled for later processing. This flexibility is particularly compelling at Tower Mountain, where initial Acid Base Accounting test work indicates the mineralization is net acid neutralizing, supporting a positive environmental and permitting profile.

As anticipated, this estimate sharpens our focus and streamlines our objectives for 2026, positioning the project for continued growth and de-risking:

- Resource conversion of Inferred resources to Measured and Indicated classification;

- Resource expansion within, and immediately adjacent to, the defined ultimate pit limit;

- Metallurgical testing to increase gold recovery and define process plant options; and

- Environmental baseline studies to benchmark site criteria.

Our objective is to deliver an updated Mineral Resource Estimate and an initial Scoping Study (Preliminary Economic Assessment) in 2027, creating a clear pathway toward accelerated project development while leveraging the property's proximity to established public infrastructure."

The MRE was completed under the supervision of Micon International Limited ("MICON"), Toronto, Ontario, Canada. MICON is an independent engineering firm specializing in mineral resource and reserve estimation for a global client pool.

The qualified persons responsible for the mineral resource disclosed herein are William J. Lewis, P.Geo., Charley Murahwi, P.Geo., FAusIMM, and Tudorel Ciuculescu, P.Geo.

The Company shall publish a National Instrument ("NI") 43-101 Technical Report within forty-five (45) days of this news release. The Technical Report shall be available on the Company's website and SEDAR+ profile.

Mineral Resource Estimate

The gold mineralization model at Tower Mountain is manifested as the upper expression of an Intrusion Related Gold Deposit ("IRGD"). The MRE which has been prepared by Micon International focuses on the UV, Bench, Ellen, A, 110 and 3738 targets, arrayed along the western contact of the TMIC, which represent only about 20% of the total circular distance/length surrounding the TMIC. The project database contained information from 230 diamond drill holes and 30 channels. The MRE has an effective date of January 19, 2026. Table 1 summarizes the MRE.

Table 1. Tower Mountain Mineral Resource Estimate - January 19, 2026

| Category | Tonnage (Mt) | Grade (g/t Au) | Contained Metal ('000 oz gold) |

| Indicated | 34.5 | 0.46 | 514 |

| Inferred | 211.1 | 0.45 | 3,053 |

Notes:

- The effective date of this MRE is January 19, 2026.

- Messrs. William Lewis, P.Geo., Charley Murahwi, P.Geo., FAusIMM, and Tudorel Ciuculescu, P.Geo. from Micon International Limited are the Qualified Persons (QPs) responsible for this MRE.

- The MRE has been classified in the Indicated and Inferred categories. At this time, there are no Measured resources at the Tower Mountain Project.

- The calculated gold cut-off grade is 0.19 g/t Au.

- An average specific gravity (SG) value of 2.77 g/cm3 was used.

- The MRE used economic assumptions for open pit mining. The following economic parameters were used for generating the cut-off grade: a gold price of US$3,000/oz, 80% recovery, open pit mining cost of US$3.0/t, processing costs of US$8.0/t, general and administration cost of US$3.5/t, transportation cost of US$2.5/oz of gold, and a royalty of 3%.

- The open pit used slope angles of 30° in overburden and 50° in fresh rock.

- The block model is orthogonal and has a parent block size of 5 m x 5 m x 5 m, with minimum sub-block size of 2.5 m x 2.5 m x 2.5 m.

- The open pit optimization used a re-blocked size of 10 m x 10 m x 10 m.

- The mineral resources described above have been prepared in accordance with the current Canadian Institute of Mining, Metallurgy and Petroleum Standards and Practices.

- Numbers have been rounded to the nearest million tonnes and nearest thousand ounces. Differences may occur in totals due to rounding.

- Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Mineral Resources are uncertain in nature and there has been insufficient exploration; however, it is reasonably expected that a significant portion of Inferred Mineral Resources could be upgraded into Indicated Mineral Resources with further exploration.

- Micon QPs have not identified any legal, political, environmental, or other relevant factors that could materially affect the potential development of the mineral resources and of the estimate.

Seequent's Leapfrog Geo/EDGE software was used to build the block model supporting the estimate. Gold assays show a natural break differentiating anomalous from background values at a threshold value of 0.1 g/t Au; hence no wireframe was used to constrain the mineralization. Assay results were composited in 3 m long intervals, with intervals shorter than 1 m being added to the previous composite. The gold grade was estimated in a single pass. The inverse distance cubed (ID3) interpolation method was used, with a spherical search of 100 m radius. Additional estimation methods (Ordinary Kriging and Nearest Neighbour) were used for validation purposes.

Micon classified the mineral resources in the Indicated and Inferred categories. For Indicated category, blocks within a nominal distance of 30 m away from a drill hole and informed by at least two drill holes were initially selected, then a wireframe was built around the target blocks to ensure continuity of the selected volume. The remaining estimated blocks were classified as Inferred.

A pit optimization algorithm was used to define a constraining resource shell for Tower Mountain. The MRE was constrained with a resource shell corresponding to a price of $3,000/oz gold. A cut-off grade of 0.19 g/t Au was applied for reporting mineral resources.

Figure 1 shows the outline of the ultimate pit with diamond drill hole locations shown within the existing claim boundaries and infrastructure.

Figure 1. 2026 Ultimate Pit, Existing Infrastructure and Diamond Drill Locations (Thunder Gold, 2026).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/281462_b33abafdb4c098e8_001full.jpg

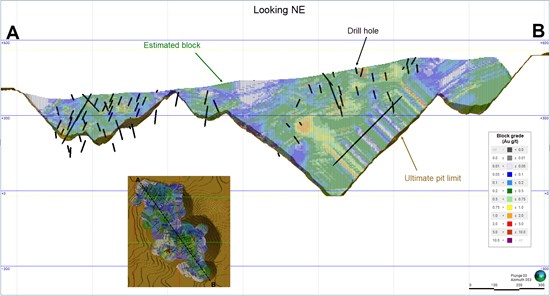

Figure 2 shows the mineral resource estimate block grade distribution within the ultimate pit.

Figure 2. Mineral Resource Estimate Block Grade Distribution within the Ultimate Pit (Micon International Limited, 2026).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/281462_b33abafdb4c098e8_002full.jpg

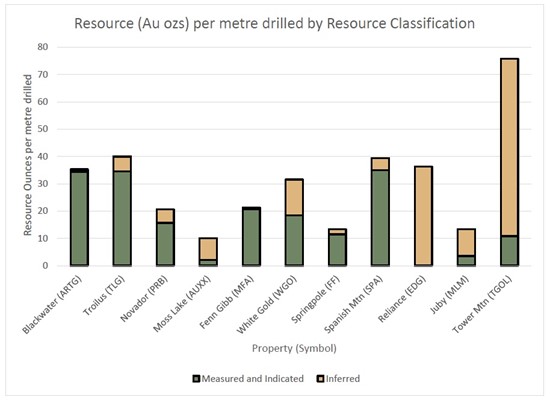

Discovery Cost per Ounce

The Company estimates all in discovery cost per ounce as follows:

All-in cost per metre / (ounces / metres drilled) (project to date).

Specific to Tower Mountain, the equation above would be:

Indicated resource all-in discovery cost per ounce = C$ 300 / (514,000 / 6,760) = C$ 3.95.

Inferred resource all-in discovery cost per ounce = C$ 300 / (3,053,000 / 40,240) = C$ 3.95.

Figure 3 shows a comparative analysis of resource ounces per metre drilled of comparable properties similar to Tower Mountain.

Figure 3. Sector Comparables, Total Resource Ounces per Metre Drilled (Thunder Gold, 2026).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/281462_figure3.jpg

Drilling to date at Tower Mountain totals approximately 47,000 metres. The all in cost per meter drilled at Tower Mountain for the period 2024 through 2025 range from C$ 275 to C$ 325 per metre for an average of C$ 300.

Care and Control Procedures

Diamond drilling is conducted by qualified contractors independent of the Company. All drilling is completed using N-diameter (47.6 mm) tooling. The independent drill contractor maintains security of the core until it is delivered to the Company's logging facility. On receipt of the core, independent contractors receive the core, log it for physical and geotechnical information and photograph the core for reference. A contract geologist, under the supervision of the Company's qualified person ("QP") logs the core for geological information and marks the core for sampling employing a standard 1.5 metre sample length. The contract geologist enters the data into the Company's electronic database under the supervision of the Company QP. Contract core splitters cut the core in half using a rotary diamond saw. One half is placed into sequentially numbered plastic sample bags that are sealed. The remaining half is returned to the core box and stored sequentially in racks at the Company's logging facility. The bagged samples are delivered to an independent assaying facility for analysis.

Quality Assurance and Quality Control

The Company inserts Certified Reference Materials ("CRMs") into the sample stream to monitor laboratory performance. The CRMs consist of certified standards and blanks prepared and sold by CDN Resource Laboratories of Langley B.C. an independent laboratory serving the global market.

Typically, four (4) to six (6) standards are utilized. Each standard is certified at a gold grade ranging from 0.20 to 2.00 g/t Au, representative of the large tonnage, low-grade target being evaluated. Standards are inserted at a rate of one standard for every twenty (20) samples. Certified blanks are inserted into the sample stream at an identical one in twenty sample rate.

Blanks and Standard performance is monitored by the Company QP. Standards returning values outside the certified limits are investigated and if necessary, re-assayed at the discretion of the Company QP.

In 2026, the Company shall begin blind duplicate analyses of 5% of the sample population at a secondary laboratory. Pulp rejects from the primary assay facility shall be pulled from the sample stream and shipped to a second independent laboratory for gold analysis.

Assaying

The Company's primary laboratory is Activation Laboratories Ltd. ("Actlabs") facility in Thunder Bay, Ontario.

The Company's secondary laboratory is AGAT Laboratories ("AGAT") also located in Thunder Bay.

Both Actlabs and AGAT are independent from the Company and fully accredited by the Standards Council of Canada ("SCC") as per SCC-15308 ISO/IEC 17025:2017.

Samples are received, dried, crushed, split and pulverized to produce a representative, 250-gram sample for analysis. The crushed reject is stored for return to the client. The 250-gram pulverized sample is split to obtain an approximate 30-gram sample for assay. The reject portion of the 250-gram pulverized sample is stored for return to the client.

The 30-gram sample aliquot is analyzed using Actlabs 1A2 procedure, lead collection fire assay fusion (FA) with an atomic absorption (AAS) finish. All assay results greater than 5.0 g/t Au are re-assayed using Actlabs 1A3-30 method which uses a gravimetric finish for higher accuracy. All assays greater than 30.0 g/t Au are re-assayed using Actlabs 1A4-1000 screen metallics method where a representative 1000-gram sample is split from the crushed reject fraction, pulverized to 95% passing 149 micron and sieved and analyzed by size fraction. Assays are performed on the entire +149 µm fraction and two splits of the -149 µm fraction. A final assay is calculated based on the weight of each size fraction. All the above is completed at Actlabs Thunder Bay facility.

Actlabs reports the results to the Company's QP and Logistics Manager. The QP is responsible for monitoring CRM results, flagging and investigating any failures and if necessary, requesting any re-assaying.

Qualified Person

Technical information in this news release has been reviewed and approved by Wes Hanson, P.Geo., President and CEO of Thunder Gold Corp., who is a Qualified Person under the definitions established by National Instrument 43-101.

About the Tower Mountain Gold Property

The 100%-owned Tower Mountain Gold Property is located adjacent to the Trans-Canada highway, approximately 40 km west of the international port city of Thunder Bay, Ontario. The 2,500-hectare property surrounds the largest, exposed, intrusive complex in the eastern Shebandowan Greenstone Belt where most known gold occurrences have been described as occurring either within, or proximal to, intrusive rocks. Gold at Tower Mountain is localized within extremely altered rocks surrounding the Tower Mountain Intrusive Complex, a multi-phase, long duration intrusive complex that control gold distribution on the Property. Historical drilling has established anomalous gold extending out from the intrusive contact for over 500 metres along a 1,500-metre strike length, to depths of over 500 metres from surface. The remaining 75% of the perimeter surrounding the intrusion shows identical geology, alteration, and geophysical response, offering a compelling exploration opportunity.

About Thunder Gold Corp.

Thunder Gold is advancing the Tower Mountain Project in Thunder Bay, Ontario - an emerging gold system with the scale, consistency, and quality to support a long-life, open-pit operation. Results from our disciplined drill programs have consistently reinforced confidence in the continuity and predictability of the discovery, while highlighting significant potential for expansion across multiple zones of the Tower Mountain Intrusive Complex. With industry-leading drilling costs, existing infrastructure and a skilled local workforce, Tower Mountain represents a rare combination of size, scalability, and cost-effective growth.

At Thunder Gold, our vision is clear: to unlock a discovery that has the potential to become a transformational gold project, delivering long-term value for shareholders while contributing to the future of Canada's mining industry. For more information about the Company please visit:

www.thundergoldcorp.com

On behalf of the Board of Directors,

Wes Hanson, P.Geo., President and CEO

For further information contact:

Wes Hanson, CEO

(647) 202-7686

whanson@thundergoldcorp.com

Kaitlin Taylor, Investor Relations

IR@thundergoldcorp.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation (collectively, "forward-looking statements"). Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. All statements, other than statements of historical fact, are forward-looking statements and are based on predictions, expectations, beliefs, plans, projections, objectives and assumptions made as of the date of this news release, including without limitation; anticipated results of geophysical drilling programs, geological interpretations and potential mineral recovery. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to the gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty or reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise any forward-looking statements, other than as required by applicable law, to reflect new information, events or circumstances, or changes in management's estimates, projections or opinions. Actual events or results could differ materially from those anticipated in the forward-looking statements or from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281462

Source: Thunder Gold Corp.