London / Zurich, 28 January 2026

PRESS RELEASE

GAM Portfolio managers upping the pressure further on the Yutaka Giken deal by challenging controlling shareholder Honda.

Albert Saporta and Randel Freeman question why Honda sold controlling stake for less than half the minority tender price and demand transparency on potential ancillary transactions

On 27 January 2026 the portfolio managers of the GAM Japan Special Situations Investment Strategy published an open letter to Honda Motor Co., Ltd. Chairman Toshihiro Mibe, questioning Honda's decision to sell its controlling stake in Yutaka Giken at a 50% discount to the price being offered to minority shareholders.

This third letter in the campaign follows communications to Yutaka Giken's Board on 22 December 2025 and 21 January 2026. The portfolio managers now directly challenge Honda's role as the controlling shareholder that initiated and structured the transaction.

The letter highlights that Honda is selling its 50.65% controlling shareholding for ¥1,470 per share whilst SAMIL's tender offer to minority shareholders is ¥3,024 per share. The portfolio managers state: 'A controlling shareholder should command a significant premium in a transaction, not a 50% discount! There is even an expression for that: "control premium".'

The letter poses the question: 'In Japan, a country which has made tremendous strides in corporate governance over the last decade, why would Honda, a prominent Japanese company with global stature counting some of the largest international institutional investors, and moreover with a NYSE listing, "sell out" their minority shareholders in such a blatant disregard for its fiduciary responsibilities?'

The portfolio managers demand transparency on several ancillary transactions referenced in Yutaka's tender offer document, including SAMIL's purchases of Yutaka Autoparts India and an 11% stake in Shinnichi Kogyo directly from Honda, asking: 'How will Honda be "compensated" for handing over its Yutaka stake for an implied negative value?'

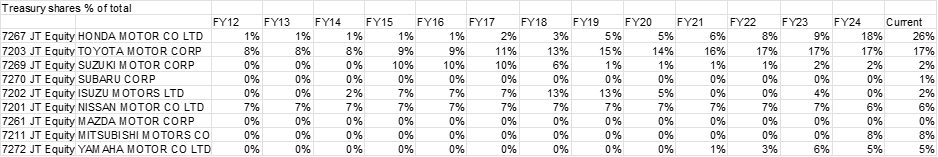

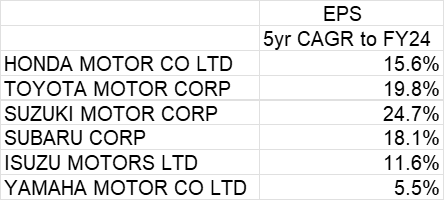

The letter also addresses Honda's exceptionally large treasury share holding of approximately 26% of shares outstanding, significantly higher than peer OEM companies. The portfolio managers note that Honda's EPS growth has consistently lagged most competitors and call for immediate cancellation of these treasury shares as 'highly accretive' and adherent to best corporate governance standards.

Albert Saporta and Randel Freeman, Co-Heads of GAM Alternatives, said:

'From our standpoint, the only plausible explanation is that minority shareholders are not being told the whole story. Honda's shareholders deserve answers to these questions and full transparency on the Yutaka sales process. Unfortunately, from our current vantage point, this transaction raises serious governance concerns and potential material breaches of fiduciary responsibilities.'

The full open letter, dated 27 January 2026, follows below:

This communication relates solely to the investment activities of the mentioned Special Situations Investment funds. Activist engagement is undertaken by the fund's investment managers in pursuit of the fund's stated investment objective. It should not be interpreted as a statement of corporate policy or opinion by GAM Investments.

Toshihiro Mibe

Chairman

Honda Motor Co. Ltd.

Open letter to the Board of Directors

January 27, 2026

Dear Mibe San,

We are the managers of the GAM Japan Special Situations Fund and are shareholders in Honda Motor Co., Ltd. ("Honda"). We are writing to highlight two matters of the utmost concern to us as shareholders in Honda and should be to all fellow Honda minority investors.

Firstly, the incomprehensibly low price which Honda willingly sold its controlling interest in Yutaka Giken Co., Ltd. ("Yutaka") to Samvardhana Motherson International ("SAMIL"). Honda is selling a 50.65% controlling shareholding in Yutaka for ¥1,470/sh, implying a value of ¥22bn1 for 100% of Yutaka. To put this perspective, SAMIL's tender offer price to the other Yutaka minority shareholders is ¥3024/sh. On this measure alone, Honda is selling a controlling interest in Yutaka for less than half of what minority investors will be receiving for their holdings. A controlling shareholder should command a significant premium in a transaction, not a 50% discount! There is even an expression for that: "control premium". Adding further insult to minority investors, the price which Honda agreed to sell Yutaka to SAMIL was one of the most appalling low takeover offers we have ever witnessed in our many decades of investing in the Japanese market. Honda is selling a controlling interest in Yutaka, a cash and asset rich and profitable company, for an implied valuation of ¥22bn, for a company with net cash of ¥42.2bn and tangible book value of ¥100.2bn! Effectively, the acquirer SAMIL is getting paid to take all of Yutaka's factories and its business.

The question is…in Japan, a country which has made tremendous strides in corporate governance over the last decade, why would Honda, a prominent Japanese company with global stature counting some of the largest international institutional investors, and moreover with a NYSE listing, "sell out" their minority shareholders in a such a blatant disregard for its fiduciary responsibilities?

From our standpoint, the only plausible explanation is that minority shareholders are not being told the whole story. This transaction leaves several unanswered questions which raise serious concerns about conflicts of interest. Was a proper auction conducted for Yutaka? It appears to us that this transaction was a bi-lateral agreement between Honda and SAMIL. What are the terms of the SAMIL's 100% purchase of Yutaka Autoparts India Private Ltd.? What are the terms of the SAMIL's 11% purchase of Shinnichi Kogyo being purchased directly from Honda? Both transactions will occur after the tender for the minority shareholders of Yutaka closes. The Yutaka Giken tender offer document mentions "the possibility of transactions ancillary to this transaction occurring between the Tender Offeror [SAMIL], the Target Company [Yutaka] and Honda." Does this mean Honda will receive favorable pricing on future contracts with SAMIL? How will Honda be "compensated" for handing over its Yutaka stake for an implied negative value? Honda's shareholders deserve answers to these questions and full transparency on the Yutaka sales process. Unfortunately, from our current vantage point, this transaction raises serious governance concerns and potential material breaches of fiduciary responsibilities. We and all Honda shareholders must insist on full transparency to understand Honda's reasoning for selling its controlling stake in a profitable and extremely cash and asset rich company for such a derisory price.

Secondly, we (and other shareholders) need a detailed explanation for how Honda plans to deal with its exceedingly large holding of treasury shares (c. 26% of shares outstanding as of 30/9/25). Such a significant holding of treasury shares is not only uncharacteristic amongst your peer OEM companies but within Japan in general.

The immediate cancellation of this excessive quantum of treasury shares held on Honda's balance sheet would not only be highly accretive to Honda's earning per share (EPS) but would adhere to the best corporate governance standards.

Your company's EPS growth has consistently lagged that most of your competitors and so has your stock price to the lament of Honda's shareholders.

We look forward to your prompt response on these matters.

Best regards,

Albert Saporta

Co-CIO GAM Alternatives

GAM Investment Management (Switzerland) AG

Randel Freeman

Co-CIO GAM Alternatives

GAM USA Inc.

www.gam.com

1 [(50.65% x ¥1,470/sh x 14.82m total shares outstanding)] / 50.65%

For further information please contact:

| Investment Team | Media Relations |

| Albert Saporta, Co-CIO GAM Alternatives GAM Investment Management (Switzerland) AG albert.saporta@gam.com Randel Freeman, Co-CIO GAM Alternatives GAM USA Inc. randel.freeman@gam.com | Colin Bennett colin.bennett@gam.com T +44 (0) 207 393 8544 Visit us: www.gam.com Follow us: X and LinkedIn |

About the GAM Global Special Situations Strategies

The investment managers of the GAM Special Situations Strategies have long held the fundamental belief that markets can be inefficient, and securities go through distinct periods of mispricing, especially in complex corporate situations and when related securities are traded across different markets.

We believe by incorporating these securities in a thoughtfully structured portfolio and employing sophisticated hedging strategies we can achieve superior uncorrelated risk-adjusted returns across all market cycles.

The GAM Global Special Situations Strategies invest globally long and short in securities of companies, intra and across markets and within complex corporate capital structures, which are often undergoing significant corporate change. Rigorous quantitative modelling and screening is combined with fundamental analysis and our deep understanding of event-driven dynamics.

The investment strategies are co-managed by Albert Saporta and Randel Freeman - two of the pioneers in global event-driven and special situations investing with over 70 years combined experience.

About GAM

GAM is an independent investment manager that is listed in Switzerland. It is an active, independent global asset manager that delivers distinctive and differentiated investment solutions for its clients across its Investment and Wealth Management Businesses. Its purpose is to protect and enhance its clients' financial future. It attracts and empowers the brightest minds to provide investment leadership, innovation and a positive impact on society and the environment.

Total assets under management were CHF 12.7 billion as of 30 June 2025. GAM has global distribution with offices in 15 countries and is geographically diverse with clients in almost every continent. Headquartered in Zurich, GAM Investments was founded in 1983 and its registered office is at Hardstrasse 201 Zurich, 8005 Switzerland.

Other important information

This press release is issued by the portfolio managers of the funds referenced above for information purposes only. It does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Views expressed are those of the portfolio managers as at the date of publication and are subject to change. References to specific securities or transactions are for illustrative purposes only and do not constitute a recommendation. Past performance is not a reliable indicator of future results.

This release contains or may contain statements that constitute forward-looking statements. Any such statements in this release speak only as of the date hereof and are based on assumptions and contingencies subject to change without notice. Any forward-looking statements in this release are not indications, guarantees, assurances or predictions of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond the control of the person making such statements. You are strongly cautioned not to place undue reliance on forward-looking statements.

Attachments

- Randel Freeman, Co-CIO GAM Alternatives

- Albert Saporta, Co-CIO GAM Alternatives

- GAM Portfolio managers challenge Honda Motor over Yutaka Giken Sale