Company Achieves ~2.8 EH/s with a 110 MW Expansion Well Underway

VANCOUVER, BC, Jan. 27, 2026 /PRNewswire/ -- Bitzero Holdings Inc., (CSE: BITZ.U) (OTCQB: BTZRF) (FSE: 000) ("Bitzero" or the "Company"), a provider of sustainable blockchain and high-performance compute (HPC) data center infrastructure, today announced an operational update of the Company's self-mining operations.

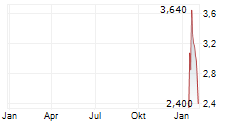

Since last reported in September 2025, the Company has significantly increased its hashrate to approximately 2.80 EH/s, compared to 1.76 EH/s previously reported, representing an increase of approximately 59%. At this operating level, the Company is currently receiving approximately 1.1 bitcoin per day, subject to network conditions. This improvement, together with the Company's previously announced reduction in energy costs following the execution of new power purchase agreements, enhances the Company's operating profile and is expected to support improved revenue generation and profitability. As previously reported, the Company's operations are currently supported by a blended power cost of approximately US$0.03-0.035 per kWh.

As previously announced, Bitzero remains on track to enter the next phase of expansion which is expected to deliver a total of approximately 110 MW of energized capacity by Q4 2026. Based on current forecasts, this level of capacity could support ~10.0 EH/s if fully allocated to Bitcoin mining. A further potential expansion phase is planned for completion by Q4 2027 and would increase total energized capacity to approximately 325 MW if completed as contemplated. A fully dedicated 325 MW of capacity to Bitcoin mining could support up to ~ 30.0 EH/s.

"The steady growth of our compute power is a direct reflection of our disciplined execution and long-term strategy," said Mohammed Bakhashwain, CEO and President of Bitzero. "With our expansion well underway, we're scaling efficiently, strengthening our infrastructure, and positioning the company to capture meaningful value as the Bitcoin network continues to evolve."

To learn more about Bitzero's sites, visit www.bitzero.com.

About Bitzero Holdings Inc.

Bitzero Holdings Inc. is a provider of IT energy infrastructure and high-efficiency power for data centers. The Company focuses on data center development, Bitcoin mining, and obtaining strategic data center hosting partnerships. Bitzero Holdings Inc. now has four data center locations in the North American and Scandinavian regions, powered by clean, low-carbon energy sources. Visit www.bitzero.com for more information.

Bitzero Contact

Mohammed Bakhashwain

+44 777 303 0394

[email protected]

Bitzero Press Contact

[email protected]

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities laws, including statements regarding the Company's projected energized capacity at Namsskogan, Norway; expected timing for completion of expansion phases (Q4 2026 and Q4 2027); potential hashrate at various capacity levels (including ~10 EH/s and ~30 EH/s) if fully allocated to Bitcoin mining; and anticipated operating efficiencies, power costs and their impact on revenue generation and profitability. Forward-looking information is based on management's current expectations and assumptions, including with respect to construction timelines, availability and performance of mining equipment, network difficulty, Bitcoin price, power availability and pricing, curtailment, uptime, regulatory approvals and general economic conditions.

Forward-looking information is inherently subject to known and unknown risks and uncertainties that may cause actual results to differ materially from those expressed or implied, including risks related to construction and commissioning, supply chains, equipment performance, power markets and curtailment, permitting and regulatory matters, digital asset price volatility, network difficulty, cybersecurity, financing, and other factors described under "Risk Factors" in the Company's public filings. Readers are cautioned not to place undue reliance on forward-looking information. The Company undertakes no obligation to update any forward-looking information except as required by applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release

Contact

Bitzero Press Contact

[email protected]

Photo - https://mma.prnewswire.com/media/2870974/Bitzero_Holdings_Photo_1.jpg

SOURCE Bitzero Holdings Inc.