BRUSSELS (dpa-AFX) - U.K. stocks gained notable ground in positive territory Thursday morning with rising metal prices triggering some strong buying in the mining sector. Investors also digested a mixed batch of earnings updates, and the Federal Reserve's decision to leave interest rates unchanged.

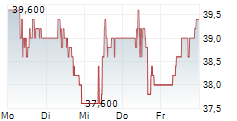

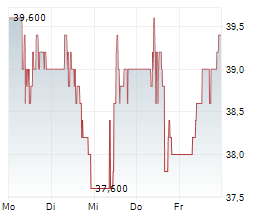

The FTSE 100, which climbed to 10,221.50 in few minutes after the opening bell, was up 37.13 points or 0.36% at 10,191.56 a little while ago.

3i Group soared nearly 11% after the company reported that its non-food discounter, Action has registered an increase in operating EBITDA and sales for the 12-month period on strong demand.

For the 12-month period to December 28, 2025, the Group's Action posted an operating EBITDA of EUR 2.367 billion, higher than EUR 2.076 billion in the previous year.

Sales stood at EUR 16 billion, higher than EUR 13.781 billion last year. Net asset value per share moved up to 3,017 pence as of December 31, 2025, from 2,857 pence per share, recorded on September 30, 2025.

Mining stock Antofagasta climbed nearly 7% after reporting a modest 1.6% drop in its 2025 copper production. Endeavour Mining and Anglo Amerian Plc moved up by 4.8% and 3.7%, respectively. Glencore moved up 3.2%, while Rio Tinto gained 2.5%, and Fresnillo advanced 1.5%.

Weir Group and Metlen Energy & Metals gained 2.8% and 2.7%, respectively. BP, Shell, Scottish Mortgage, Diageo and IMI moved up 1% - 3%.

Ashtead Group dropped more than 5%. AutoTrader Group, The Sage Group, Croda International, Pershing Square Holdings, Relx, Airtel Africa and Associated British Foods lost 1.6% - 2.5%.

Marks & Spencer, Next, Bunzl, British Land and Rentokil Initial also declined sharply. British budget airline EasyJet rallied more than 2.5% after reiterating its full-year guidance, but pared gains subsequently and dropped into negative territory, losing about 1.25%.

Data from the Society of Motor Manufacturers and Traders Limited (SMMT) showed UK car production rose 17.7% year-on-year to 53,003 units in December 2025.

However, total vehicle production fell 15.5% in 2025 to 764,715 units, weighed down by the cyber disruption, new trade tariffs, plant consolidation in the commercial vehicle segment, and ongoing restructuring as the industry shifts.

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News