2025 performance driven by production systems and the rollout of ROSIE

Revenues of €40.3 million in line with guidance

Order book at December 31, 2025: €26.9 million (+24%)

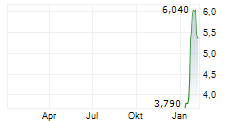

Bezons (France), February 2, 2026 - 8:00 am (CET) - RIBER, a global market leader in MBE equipment for the semiconductor industry, is reporting its full-year revenues for 2025.

Change in revenues

| €m | 2025 | 2024 | Change |

| First half | 10.7 | 13.7 | -22% |

| Second half | 29.5 | 27.4 | +7% |

| Full year | 40.3 | 41.2 | -2% |

| €m | 2025 | 2024 | Change |

| Systems | 30.9 | 31.0 | - |

| Services and accessories | 9.4 | 10.2 | -8% |

| Full year | 40.3 | 41.2 | -2% |

2025 full-year revenues amounted to €40.3 million, in line with the Company's guidance.

This performance reflects both the continued strong activity in production systems and the gradual ramp-up of ROSIE, the new MBE platform dedicated to silicon photonics. The first two ROSIE systems were ordered in 2025, confirming growing industrial interest in MBE solutions compatible with 300 mm production lines.

MBE systems revenues reached €30.9 million, stable compared with 2024. This corresponds to the invoicing of 12 machines, including 9 production systems, as well as the delivery of the first ROSIE platform.

Revenue from services and accessories amounted to €9.4 million, slightly down year-on-year, due in particular to budgetary restrictions in the United States, but showed a recovery in the second half of the year (+8.5%).

In 2025, the geographical breakdown of annual revenue evolved as follows: Europe, up year-on-year, accounted for 45.1% (vs. 35.7% in 2024), Asia for 39.7% (vs. 57.3%), and North America, also up year-on-year, for 15.2% (vs. 7.1%). These changes reflect increased diversification of the markets served.

Order book developments

| At December 31 (€m) | 2025 | 2024 | Change |

| Systems | 20,3 | 16,7 | +22% |

| Services and accessories | 6,6 | 5,0 | +31% |

| Full year | 26,9 | 21,7 | +24% |

At December 31, 2025, total order book reached €26.9 million, up 24%, despite a particularly high level of deliveries at year-end.

The MBE systems order book, up 22%, amounted to €20.3 million, corresponding to 6 systems, including 4 production machines and 1 ROSIE platform. It does not include the order announced on January 19, 2026 for a production system in Japan, scheduled for delivery in 2026.

The services and accessories order book reached €6.6 million, up 31% compared with a favorable prior-year comparison base.

Certain commercial opportunities, representing a cumulative amount of €4 million, were subject to export license refusals during the year.

Outlook

Against a backdrop of large-scale investment programs in artificial intelligence, data infrastructure and quantum technologies, RIBER benefits from a pioneering technological positioning at the core of the semiconductor value chain.

For 2026, RIBER expects:

- a continued strong demand driven by the need for MBE production systems for quantum dot lasers used in data centers;

- the industrialization and gradual ramp-up of the ROSIE platform, a breakthrough technology in silicon-based integrated photonics, addressing high-potential markets.

In 2026, the manufacturing of ROSIE 2, the dual-chamber version, as well as the availability - within the framework of the partnership with NQCP1 - of the first samples of BTO/STO2 thin films on silicon wafers for the scientific and industrial community, will represent a key milestone in RIBER's technological roadmap.

Given the visibility provided by its order book, and subject to obtaining the export licenses required to materialize the identified opportunities in its systems and services businesses, RIBER aims to achieve revenues growth compared with 2025.

Next date: RIBER will announce its 2025 full-year earnings on April 8, 2026 (before start of trading).

About RIBER

Founded in 1964, RIBER is the global market leader for MBE - molecular beam epitaxy - equipment. It designs and produces equipment for the semiconductor industry and provides scientific and technical support for its clients (hardware and software), maintaining their equipment and optimizing their performance and output levels. Accelerating the performance of electronics, RIBER's equipment performs an essential role in the development of advanced semiconductors that are used in numerous applications, from information technologies to photonics (lasers, sensors, etc.), 5G telecommunications networks and research, including quantum computing. RIBER is a BPI France-approved innovative company and is listed on the Euronext Growth Paris market (ISIN: FR0000075954).

www.riber.com

Contacts

RIBER

Annie Geoffroy | Tel: +33 (0)1 39 96 65 00 | invest@riber.com

ACTUS FINANCE & COMMUNICATION

Cyril Combe - Investors relations | Tel: +33 (0)1 53 67 36 36 | ccombe@actus.fr

Serena Boni - Press relations | Tel: +33 (0)4 72 18 04 92 | sboni@actus.fr

1 Novo Nordisk Foundation Quantum Computing Programme

2 barium titanate (BTO) and strontium titanate (STO)