Q4 2025

(Q3 2025)

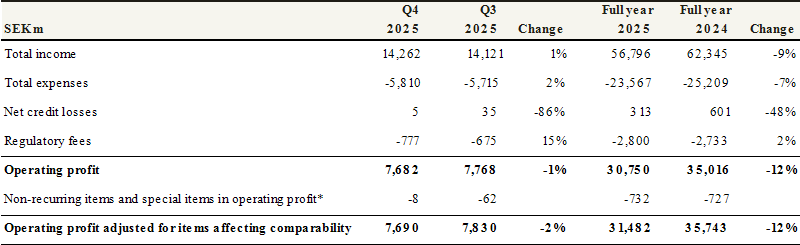

- Operating profit was SEK 7,682m (7,768).

- Return on equity was 13.0% (13.3).

- Earnings per share were SEK 3.01 (3.00).

- The C/I ratio was 40.7% (40.5).

- The credit loss ratio (net reversals) was 0.00% (-0.01).

- The common equity tier 1 ratio was 17.6% (18.2).

January - December 2025

(January - December 2024)

- Operating profit was SEK 30,750m (35,016).

- Return on equity was 13.0% (14.6).

- Earnings per share amounted to SEK 11.98 (13.86).

- The C/I ratio was 41.5% (40.4).

- The credit loss ratio (net reversals) was -0.01% (-0.02).

- The common equity tier 1 ratio was 17.6% (18.8).

- The Board of Directors proposes a total dividend of SEK 17.50 (15.00) per share, comprised of an ordinary dividend of SEK 8.00 (7.50) per share.

Increasing customer activity and good growth in the savings business

Net interest income was negatively affected during the quarter by lower net interest margins due to lower market rates. At the same time, the savings business continued to exhibit good growth with assets under management reaching the highest level so far. Lending in the UK and the Netherlands, where the Bank's market shares are relatively small and the long-term potential for growth is large, continued to show improving growth within both household and corporate lending.

Lower expenses and strong credit quality

Improved efficiency, particularly within central and business support units, has over the past two years contributed to a general increase in cost awareness across the Bank. Expenses increased during the quarter, reflecting seasonally higher activity levels, but to a less extent than in previous years. Expenses for the full year fell by 7% compared with the preceding year. Credit quality remained strong with net credit loss reversals for the eighth consecutive quarter.

A position of financial strength

The Bank distinguishes itself as one of the world's most stable banks, which is reflected in the fact that no other privately owned bank in the world has a higher overall credit rating from the leading rating agencies. This is achieved through a locally connected, long-term, and customer-centric business model with low risk tolerance and a strong financial position. The common equity tier 1 ratio, after deduction of the proposed dividends, amounted to 2.85 percentage points over the regulatory requirement by the Swedish Financial Supervisory Authority and was thus within the Bank's long-term target range of 1-3 percentage points above the regulatory requirement. The Bank's financial strength creates trust and confidence, as well as prerequisite for continued stable and profitable growth.

* Items affecting comparability consist of foreign exchange effects, non-recurring items and special items, which are presented in the tables on pages 5 and 6.

Information regarding the press conference

A press conference will be held on 4 February 2026 at 8:15 a.m. (CET).

Press releases, presentations, a fact book and a recording of the press conference will be available at

handelsbanken.com/ir.

The Annual and Sustainability Report for 2025 will be published in the week beginning 23 February and will be available from handelsbanken.se/ir.

The annual general meeting will be held on 25 March 2026.

The interim report for January - March 2026 will be published on 22 April 2026.

For further information, please contact:

Michael Green, President and Chief Executive Officer

Tel: +46 (0)8 22 92 20

Mårten Bjurman, CFO

Tel: +46 (0)8 22 92 20

Peter Grabe, Head of Investor Relations

Tel: +46 (0)70 559 11 67, peter.grabe@handelsbanken.se

This information is of the type that Svenska Handelsbanken AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Swedish Securities Markets Act. The information was submitted for publication through the agency of the contact person set out above, at 07:00 a.m. CET on 4 February 2026.

For more information about Handelsbanken, please go to: handelsbanken.com