KANNONKOSKI, Finland, Feb. 5, 2026 /PRNewswire/ -- Betolar Plc's Financial Statements Release for 1 January-31 December 2025 (unaudited)

Betolar Plc's Financial Statements Release 1-12/2025: Record high order intake and success in metal extraction

This is a summary of the 2025 Financial Statements Release, which is in its entirety attached to this release and can be downloaded from the company's website at https://www.betolar.com/investors

October-December 2025 in brief

- Net sales amounted to EUR 311 thousand (210 thousand)

- EBITDA amounted to EUR -617 thousand (-1,193 thousand)

- Cash and cash equivalents and short-term fund investments at the end of the period amounted to EUR 6,715 thousand (8,987 thousand)

- Liquidity and undrawn grants at the end of the period amounted to EUR 7,681 thousand (14,159 thousand)

- Order intake amounted to EUR 1,493 thousand (271 thousand)

- The number of new NRE projects was 1 (5)

- The average number of personnel during the period was 31 (37)

January-December 2025 in brief

- Net sales amounted to EUR 946 thousand (762 thousand)

- Gross margin amounted to EUR 724 thousand (564 thousand)

- EBITDA amounted to EUR -3,709 thousand (-5,816 thousand)

- Operating profit (loss) was EUR -5,840 thousand (-7,964 thousand)

- Profit for the financial period amounted to EUR -6,085 thousand (-7,732 thousand)

- Earnings per share were EUR -0.28 (-0.36)

- Cash and cash equivalents and short-term fund investments at the end of the period amounted to EUR 6,715 thousand (8,987 thousand)

- Liquidity and undrawn grants at the end of the period amounted to EUR 7,681 thousand (14,159 thousand)

- Order intake amounted to EUR 2,327 thousand (1,003 thousand)

- The number of new NRE projects was 9 (11)

- The average number of personnel during the period was 32 (46)

Guidance for 2026

- Net sales for 2026 is expected to grow significantly compared to the previous year.

Financial targets

- Achieving positive EBITDA by the end of Q4/2027.

Key events in the 2025 financial period

- Betolar Plc receives a significant order for an infrastructure project (10/25)

- Betolar and Jetcrete accelerate the adoption of low-carbon shotcrete in Australia (9/25)

- Betolar and Nordkalk collaborate to commercialize tailings-based circular calcite (9/25)

- Betolar develops low-carbon mining solution for Mandalay Resources and enters Australia's leading mining market (7/25)

- Betolar's new metal extraction technology to support Anglo American's drive towards circularity (6/25)

- Building the Future from Waste - high-performing green cement revolutionizes the industry (6/25)

- Betolar to develop cementless rockfill solution for Canadian Royalties Inc. (4/25)

- Betolar strengthens Finland's and EU's self-sufficiency in critical and strategic raw materials: Betolar's newly developed innovative method combines the separation of metals from waste material with the production of green cement (4/25)

- 99% yield confirmed in metal extraction (4/25)

- Betolar has been granted a patent for a climate cabinet that standardizes the storage conditions of test samples (3/25)

- Betolar studied the circular economy use of ashes generated from Alva-yhtiöt energy production using the SidePrime analysis service (2/25)

- The world's lowest-emission hollow core slabs developed by Betolar and Consolis Parma entered production phase (1/25)

- Amir Wafin has been appointed to the Management Team as Executive Vice President, Circular Materials (12/2025)

- Betolar updates business and financial targets (12/2025)

- Change to Betolar's Financial Calendar and the date of the Annual General Meeting 2026 (12/25)

- Betolar applies for trading of its shares on to the OTCQX marketplace in the United States (12/25)

- Betolar's financial calendar and annual general meeting in 2026 (9/25)

- Composition of Betolar Plc's Shareholders' Nomination Board (8/25)

- The Board of Directors of Betolar Plc resolved incentive plans for key employees of the Group (6/25)

- Betolar Capital Markets Day 2025: Significant Value from unutilized Industrial Sidestreams (5/25)

- Jyri Talja has been appointed as the new Chief Growth Officer and invited to join the Management Team as of 23 April 2025 (4/25)

- The Annual General Meeting was held on 27 March 2025 (3/25)

- Betolar updates its financial targets (2/25)

Key events after financial period

- Trading in Betolar's shares will begin on 20 January 2026 on the OTCQX International marketplace in the United States (1/26)

- Betolar Plc's Shareholders' Nomination Committee's proposals to the Annual General Meeting 2026 (1/26)

Betolar's consolidated financial statements for the year that ended 31 December 2025 have been prepared in accordance with the International Financial Reporting Standards (IFRS) and Interpretations Committee (IFRIC) in force on 31 December 2025.

The figures in parentheses in this report refer to the comparison period, i.e. the same period in 2024, unless otherwise specified. The figures for the comparison period are based on the audited financial statements. All figures are according to IFRS accounting standards.

The Board of Directors' proposal on the use of distributable unrestricted shareholders' equity

The Board of Directors proposes that no dividend be distributed for the financial period 1 January-31 December 2025 and that the loss for the financial period be carried over under retained earnings. The company has no distributable unrestricted equity.

CEO Tuija Kalpala comments on the financial period 2025

The year 2025 strengthened Betolar's position as a materials technology and circular economy company that builds scalable solutions for utilizing industrial sidestreams. We focused on our three core areas: industrial sidestreams, the mining and metals industry, and concrete solutions for construction. We achieved clear results and new openings in all of them.

We made a significant breakthrough in metal extraction technology. We developed a new technology that can recover critical and strategic metals from industrial sidestreams and mine tailings with up to 99% yield. We received our first order from Anglo American's Sakatti project, where the goal is to produce circular economy cement from mine tailings for the mine's own needs. This is concrete proof of the value creation our metal extraction technology brings to the mining industry.

We increased awareness of our metal extraction technology in Europe and Asia and filed eight patent applications to protect the technology, covering both different metallurgical slags and the production of cement-replacing binder. At the same time, international demand for low-carbon mining solutions increased, and we advanced low-carbon and fully cement-free shotcrete and rockfill solutions.

In industrial sidestreams, we strengthened our international procurement and logistics capabilities and increased sales of blast furnace slag, particularly in India. In addition, we built a complete supply chain for blast furnace slag for the Finnish market and advanced research projects. The development of the Sideprime analysis service and AI-based data platform improves our ability to identify the true value and potential uses of sidestreams. At the same time, we are evaluating new opportunities to process sidestreams into higher value-added products.

In our low-carbon concrete solutions, we shifted our focus to low-carbon infrastructure construction, where we see growing demand. At the end of the year, we received the largest order in the company's history for an infrastructure-related project, which serves as an opening for possible broader cooperation.

In December, we announced our updated business and financial targets. Our goal is to scale our metal extraction technology to an industrial scale and grow the business in material sales, which aims to replace cement in construction and infrastructure projects, among other things. In connection with the update of our business targets, we set our financial target to achieve a positive EBITDA by the end of 2027.

I would like to thank our customers, partners, investors, and above all, our employees. The year 2025 showed that our approach based on material technology and the circular economy is generating interest and providing us with a strong foundation for 2026.

Key figures

Key indicators for the Group

(EUR thousand, unless otherwise specified) | 10-12/ | 10-12/ | 7-12/ | 7-12/ | 2025 | 2024 |

Financial indicators | ||||||

Net sales | 311 | 210 | 529 | 486 | 946 | 762 |

Gross margin1 | 416 | 347 | 724 | 564 | ||

EBITDA1,2 | -617 | -1,193 | -1,587 | -2,167 | -3,709 | -5,816 |

Operating profit | -2,716 | -3,299 | -5,840 | -7,964 | ||

Earnings before interest and taxes | -2,860 | -3,228 | -5,932 | -7,798 | ||

Profit (loss) for the financial period | -3,046 | -3,198 | -6,085 | -7,732 | ||

Earnings per share, basic and diluted, EUR1,2,3 | -0.14 | -0.15 | -0.28 | -0.36 | ||

Cash and cash equivalents and short-term fund investments (at the end of the period) 1,2 | 6,715 | 8,987 | 6,715 | 8,987 | 6,715 | 8,987 |

Liquidity and undrawn grants (at the end of the period) 1,2 | 7,681 | 14,159 | 7,681 | 14,159 | 7,681 | 14,159 |

Operational indicators | ||||||

Order intake (EUR thousand) 1,2 | 1,493 | 271 | 1,807 | 508 | 2,327 | 1,003 |

Number of new NRE projects1,2 | 1 | 5 | 4 | 6 | 9 | 11 |

Personnel (average number during the financial period) | 31 | 37 | 32 | 40 | 32 | 46 |

1) Betolar uses certain indicators (gross margin, EBITDA, earnings per share, cash and cash equivalents and short-term fund investments, liquidity and undrawn grants, order intake, and number of new NRE projects) as indicators of operational profitability and business performance. The definitions and calculation formulas of these indicators can be found in the appendix to the report.

2) Betolar uses certain indicators (EBITDA, cash and cash equivalents and short-term fund investments, liquidity and undrawn grants, order intake, and number of new NRE projects) as quarterly indicators of operational profitability and business performance. The definitions and calculation formulas of these indicators can be found in the appendix to the report.

3) The number of shares used in the calculation of earnings per share at the end of the period and average number of shares during the period with comparative data: 31.12.2025: 21,567,570 shares, 1-12/2025: 21,567,570 shares, 7-12/2025: 21,567,570 shares, 31.12.2024: 21,567,570 shares, 1-12/2024: 20,587,226 shares, 7-12/2024: 20,587,226 shares.

Annual General Meeting

The Annual General Meeting of Betolar Plc is planned to be held on 18 March 2026. The notice of the Annual General Meeting will be published later.

Annual report and financial reporting

Betolar will publish the following financial reports in 2026:

- 23 April Q1 business review

- 12 August Half-yearly review

- 28 October Q3 business review

The Annual Report for 2025 will be published in the week starting 23 February 2026 (week 9). Betolar's financial reports are available on the company's website at www.betolar.com/investors.

Webcast for investors and media

Betolar will host a live webcast in English for investors and media on 5 February 2026 at 10.00 Finnish time.

You can follow the broadcast at https://betolar.events.inderes.com/q4-2025

In the English presentation, CEO & President Tuija Kalpala and CFO Mikko Wirkkala will present Betolar's financial statements and other topical issues. A recording of the event and the corresponding presentation will be available on Betolar's investor website later in the day.

More information

Tuija Kalpala, CEO & President, Betolar Plc, tuija.kalpala@betolar.com , +358 50 567 6608

Mikko Wirkkala, CFO, Betolar Plc, mikko.wirkkala@betolar.com , +358 50 458 4190

Certified Adviser

Aktia Alexander Corporate Finance Oy, +358 50 520 4098

About Betolar

Betolar is a circular economy and materials technology company. The company has groundbreaking technology to recover critical and strategic metals from industrial wastes. Through its metal extraction technology, valuable metals are recovered from mine tailings and unutilized industrial sidestreams. The remaining material is processed into a binder that replaces cement, thereby creating two new revenue streams from waste while simultaneously reducing the customer's environmental liabilities.

In addition, Betolar sells circular economy materials for applications in the construction and mining industries. The company's Geoprime geopolymer solution replaces cement in concrete products with low-carbon binders produced from industrial sidestreams. AI-based analytics optimize material performance and enable predictive modelling for sustainable production. By building circular economy value chains and enabling environmentally responsible industrial ecosystems globally, Betolar delivers significant benefits to both industry and society. The company's mission is to accelerate the decarbonization of industry by reducing CO2 emissions and minimizing the use of virgin natural resources through breakthrough technologies.

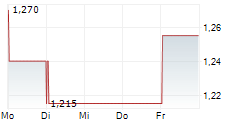

Betolar was founded in 2016 and is domiciled in Kannonkoski, Finland. Betolar is listed on the Nasdaq First North Growth Market (ticker:BETOLAR), and its shares are also traded in the United States on the OTCQX International marketplace (ticker:BTLRF). For more information www.betolar.com.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/betolar-oyj/r/betolar-plc-s-financial-statements-release-1-12-2025--record-high-order-intake-and-success-in-metal-,c4302860

The following files are available for download:

https://mb.cision.com/Main/21029/4302860/3918356.pdf | Betolar 2025 Financial Statements Release |

https://news.cision.com/betolar-oyj/i/3462713-0-png,c3508015 | 3462713_0.png |

![]() View original content:https://www.prnewswire.co.uk/news-releases/betolar-plcs-financial-statements-release-1-122025-record-high-order-intake-and-success-in-metal-extraction-302679875.html

View original content:https://www.prnewswire.co.uk/news-releases/betolar-plcs-financial-statements-release-1-122025-record-high-order-intake-and-success-in-metal-extraction-302679875.html