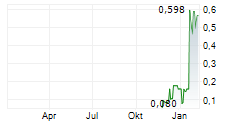

Vancouver, BC, Feb. 06, 2026 (GLOBE NEWSWIRE) -- Deep Sea Minerals Corp. (CSE: SEAS) (OTCPK: DSEAF) (FSE: X45) ("Deep Sea" or the "Company") a subsea mineral exploration and development company focused on advancing critical mineral opportunities from the deep ocean, is pleased to announce, further to its news release dated January 21, 2026, that the Company has closed the previously announced non-brokered private placement of common shares in the capital of the Company (the "Shares") by the issuance of 10,550,425 Shares at $0.40 per Share for gross proceeds of $4,220,170 (the "Offering").

In connection with the Offering, the Company paid finder's fees to eligible finders consisting of $95,620 in cash and 239,050 common share purchase warrants (the "Finder's Warrants"). Each Finder's Warrant is exercisable to acquire one Share at an exercise price of $0.40 for a period of 24 months from the date of issuance.

All securities issued in connection with the Offering are subject to a statutory hold period of four months plus a day ending on June 7, 2026, in accordance with applicable securities legislation and policies of the Canadian Securities Exchange ("CSE")

The Company intends to use the net proceeds from the Offering to complete certain business objectives, as more particularly described under the heading "Business Objectives and Milestones" in the Company's CSE Form 2A Listing Statement dated January 19, 2026 (the "Listing Statement"), a copy of which is available under the Company's profile on SEDAR+ at www.sedarplus.ca, repayment of the Loan (as defined in the Listing Statement), for marketing and for general working capital purposes.

"We are extremely pleased with the results of the initial private placement. The offering was significantly oversubscribed, validating the potential of the critical minerals sector and how we have positioned Deep Sea Minerals Corp. in this space. The momentum we are seeing in the sector is unprecedented; the private placement outcome is clear testament to that." said James Deckelman, Chief Executive Officer of Deep Sea Minerals Corp.

ABOUT DEEP SEA MINERALS CORP.

Deep Sea Minerals Corp. is a subsea mineral exploration and development company focused on evaluating opportunities to support the future supply of critical minerals through the acquisition, exploration, and development of deep-sea mineral assets.

The Company's strategy is centered on identifying jurisdictions and geological settings with potential exposure to polymetallic nodule systems, which are recognized for containing combinations of metals that may be relevant to defense, industrial manufacturing, clean energy infrastructure, advanced electronics, and artificial intelligence-related supply chains. These seabed resources represent a largely undeveloped component of the global mineral supply base and are the subject of increasing policy, scientific, and regulatory attention worldwide.

As part of this process, the Company has commenced early-stage engagement with selected governments and regulatory bodies in the Pacific Ocean region to assess potential pathways for future exploration initiatives, subject to applicable international, national, and environmental frameworks.

For further information, please see the Listing Statement, a copy of which is available under the Company's profile on SEDAR+ at www.sedarplus.ca

SOCIAL MEDIA

Website: https://www.deepseamineralscorp.com

Facebook: https://www.facebook.com/deepseacorp/

Instagram: https://www.instagram.com/deepseacorp

X: https://x.com/deepseacorp

LinkedIn: https://www.linkedin.com/company/deepseacorp

Youtube: https://www.youtube.com/@deepseacorp

ON BEHALF OF THE BOARD

- James A. Deckelman-

James A. Deckelman, Chief Executive Officer

For further information, please contact:

James A. Deckelman

Chief Executive Officer

Phone: 1-281-467-1279

Email: info@deepseamineralscorp.com

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release and has neither approved nor disapproved the contents of this press release.

Forward-Looking Statements

This news release includes "forward-looking information" that is subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. Forward-looking statements may include but are not limited to the use of proceeds and available funds following the completion of the Offering and are subject to all of the risks and uncertainties normally incident to such events. Investors are cautioned that any such statements are not guarantees of future events and that actual events or developments may differ materially from those projected in the forward-looking statements. Such forward-looking statements represent management's best judgment based on information currently available. No securities regulatory authority has either approved or disapproved of the contents of this news release. The Company undertakes no obligation to update publicly or otherwise revise any forward- looking statements, except as may be required by law.