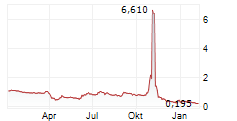

SINGAPORE, Feb. 06, 2026 (GLOBE NEWSWIRE) -- Davis Commodities Limited ("Davis Commodities" or the "Company") announced that shareholders have approved a share consolidation proposal at an Extraordinary General Meeting (EGM) held on February 4, 2026, at Genting Hotel Jurong in Singapore. The measure is aimed at increasing the Company's share price, regaining compliance with minimum bid price requirements, enhancing market credibility and investor confidence, and moderating excessive share price volatility.

The approved resolution authorized the consolidation of both Class A and Class B ordinary shares of the Company. The board of directors resolved on February 5, 2026 to implement the share consolidation at a ratio of 20-for-1 with immediate effect. The effective date of the trading of the consolidated shares on the Nasdaq Capital Market ("Nasdaq") is expected to be on or about February 16, 2026 subject to confirmation by Nasdaq and the completion of the relevant procedures. The board is also authorized to deal with any fractional entitlements arising from the share consolidation, including by capitalizing reserves or profits and issuing additional shares where necessary to round up fractional holdings.

The resolution further grants the directors broad authority to take all steps required to implement the share consolidation, including any related corporate actions. Shareholders were able to vote either by proxy, via internet or mail, or in person at the EGM, with the ordinary resolution requiring a simple majority of votes cast by Class A and Class B shareholders voting together as a single class.

The proposal passed with strong support. Holders of Class A ordinary shares cast 121,876 votes in favor, 137,089 against and 1,850 abstentions, while Class B shareholders-whose votes carry 30 votes per share-cast 495,449,430 votes in favor and none against. In total, 495,571,306 votes were cast for the resolution, 137,089 against and 1,850 abstentions, representing 97.91% of the 506,305,124 votes attached to the Company's issued and outstanding shares.

About Davis Commodities Limited

Based in Singapore, Davis Commodities Limited is an agricultural commodity trading company that specializes in trading sugar, rice, and oil and fat products in various markets, including Asia, Africa and the Middle East. The Company sources, markets, and distributes commodities under two main brands: Maxwill and Taffy in Singapore. The Company also provides customers of its commodity offerings with complementary and ancillary services, such as warehouse handling and storage and logistics services. The Company utilizes an established global network of third-party commodity suppliers and logistics service providers to distribute sugar, rice, and oil and fat products to customers in over 20 countries.

For more information, visit https://ir.daviscl.com

Forward-Looking Statements

This press release contains certain forward-looking statements, within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by terms such as "believe," "project," "predict," "budget," "forecast," "continue," "expect," "anticipate," "estimate," "intend," "strategy," "future," "opportunity," "plan," "may," "could," "should," "will," "would," and similar expressions or negative versions of those expressions.

Forward-looking statements are predictions, projections, and other statements about future events that are based on current expectations and assumptions and, therefore, subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements contained in this press release. The Company's filings with the SEC identify and discuss other important risks and uncertainties that could cause events and results to differ materially from those indicated in these forward-looking statements.

Forward-looking statements speak only as of the date on which they are made. Readers are cautioned not to place undue reliance upon forward-looking statements. Davis Commodities Limited assumes no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.