EQS-News: Eleving Group S.A.

/ Key word(s): Annual Results

Well-balanced growth delivering strong financial results Operational and strategic highlights Profitability

Growth

Operational milestones

Financial highlights and progress

Comments from Eleving Group CEO and CFO Modestas Sudnius, CEO of Eleving Group Year 2025 was a year of strong growth for Eleving Group, with its net loan portfolio increasing by 20.3%. We saw a strong demand for our products, which reinforced our growth initiatives. The Group implemented a well-balanced growth strategy that envisaged expansion in the existing markets through a broader product offering and new products and an entry into a new market. Latvia, Romania, and Kenya delivered a particularly strong performance, being the key contributors to the Group's overall growth in 2025. In European markets, the Group's strategic focus in 2025 was on maximizing the value of our existing customer base. In several of our markets, we expanded our product offering by introducing installment loans for our clients. This represented a natural step in our product evolution, as in Europe we have been operating for many years and have built a high-quality customer base. Those customers increasingly require more flexible, unsecured products not tied to a specific asset, such as a vehicle. With the primary focus on our existing customer base, we gradually began onboarding new customers as well. Within a relatively short period of time, we observed a strong demand for these products, which translated into notable portfolio growth. The approach has proven effective and will remain one of the key focus areas also in 2026. I am also very pleased with the performance of our Africa team. In 2025, we launched smartphone financing in Kenya and Uganda as a new addition to our product portfolio. By the end of 2025, the loan portfolio of smartphone financing had already reached EUR 13.5 million. In addition, during the year, we entered a new market-Tanzania-by introducing motorcycle financing, a product segment in which we have extensive experience. In 2026, we aim to further accelerate growth in Africa, supported by portfolio expansion and disciplined execution. Maintaining lean operations remains a core priority for Eleving Group. In 2025, we reduced our cost-to-income ratio and expect to maintain this approach going forward. Portfolio growth is one of the drivers supporting further improvements in the cost-to-income ratio; however, we see that additional measures are required to address the rising cost pressures. In 2026, we will focus on implementing automated solutions, such as AI voice agents at call centres, which we tested in 2025, to address these pressures and further improve operational efficiency. Looking ahead to 2026, Eleving Group is well positioned for further growth. Following the bond issuance completed in 2025, the Group has secured a strong funding base to support continued expansion. At the same time, we will continue to focus on operational excellence and cost efficiency to support sustainable and profitable growth. Maris Kreics, CFO of Eleving Group For Eleving Group, 2025 was a defining year in the capital markets. The year marked the first anniversary of the Group's IPO and was accompanied by the successful execution of two bond issuances. In March, we completed a EUR 40 million bond tap to the EUR 50 million bonds originally issued in 2023. In October, we successfully refinanced the bonds issued in 2021 and maturing in 2026, with a total amount of EUR 150 million, and issued new bonds, raising a total of EUR 275 million. This represented the largest and most successful bond issuance in Eleving Group's history. Both transactions attracted a strong demand from a diverse investor base, including global institutional investors and retail investors in the Baltics and Germany. The level of investor interest reflects the reputation Eleving Group has built as a reliable and well-established issuer in the capital markets. In parallel, we continued to successfully execute our strategy of raising funding in local currencies across the markets in which we operate, thereby reducing foreign exchange risk and supporting sustainable growth. In our first year as a publicly listed company, we remained firmly focused on delivering on the commitments made at the time of the IPO. Looking at our 2025 targets, we delivered a solid performance, achieving results in line with or close to our stated objectives. Our net portfolio exceeded expectations, surpassing the target by 24%, and reaching EUR 446.6 million at the end of 2025. The revenue reached EUR 250.1 million, representing 95% of the target, while the net profit before foreign exchange effects amounted to EUR 40.8 million, equivalent to 93% of the target level. Overall, I am satisfied with the results delivered during our first year post IPO; however, in 2026 we will focus more strongly on operational efficiency to meet the targets set for the year. Delivering on our IPO commitments, we distributed EUR 19.65 million in dividends in 2025, representing a total cash yield of 10%, calculated based on the IPO price. Looking ahead to 2026, we feel well-positioned from a funding perspective. We are prepared to support our growth objectives in the coming years, while maintaining a strong focus on profitability and a disciplined approach to cost management. Full unaudited consolidated report on the 12M period ended on 31 December: https://www.eleving.com/investors/reports Conference Call: the Group's management team will hold a conference call in English on 10 February 2026 at 15:00 CET to present the results. Conference call registration link here. About Eleving Group Eleving Group is a publicly listed international financial technology company founded in 2012. Today, the group operates in 17 countries across three continents, providing vehicle, smartphone and consumer financing services. Since its founding, Eleving Group has served more than 1.5 million registered users. The group employs over 4,300 people across its operations. The company's headquarters are located in Riga, Latvia. Since October 16, 2024, the Eleving Group shares have been listed on both the Nasdaq Baltic Official List and the Frankfurt Stock Exchange Prime Standard. Additional information: Elina Dobulane Group's Chief Corporate Affairs Officer, Eleving Group elina.dobulane@eleving.com | +371 25959447 IMPORTANT INFORMATION The financial information presented in this announcement is unaudited. This announcement may contain forward-looking statements. Actual results may differ materially from those expressed or implied. 09.02.2026 CET/CEST Dissemination of a Corporate News, transmitted by EQS News - a service of EQS Group. |

| Language: | English |

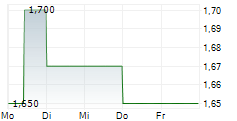

| Company: | Eleving Group S.A. |

| 8-10 avenue de la Gare | |

| 1610 Luxembourg | |

| Luxemburg | |

| Internet: | www.eleving.com |

| ISIN: | LU2818110020, XS2393240887 |

| WKN: | A40Q8F , A3KXK8 |

| Listed: | Regulated Market in Frankfurt (Prime Standard); Regulated Unofficial Market in Dusseldorf, Hamburg, Hanover, Munich, Stuttgart, Tradegate BSX; SIX |

| EQS News ID: | 2272996 |

| End of News | EQS News Service |

2272996 09.02.2026 CET/CEST

© 2026 EQS Group