LONDON (dpa-AFX) - Barratt Redrow Plc (BTDPY, BTDPF, BTRW.L), a residential property developer, reported Wednesday higher profit in its first half, with increased revenues and home completions.

Looking ahead for fiscal 2026, the company expects adjusted profit before tax and the impact of PPA adjustments to be within the current range of consensus estimates.

The company compiled consensus range for fiscal 2026 adjusted profit before tax was 558 million pounds to 617 million pounds.

The company also projects to deliver total home completions of 17,200-17,800, including around 600 JV completions, in line with previous guidance.

Further, Barratt Redrow declared an interim dividend of 5.0 pence per share, lower than last year's 5.5 pence per share, which will be paid on May 15, to all shareholders on the register on April 7.

In the first half, profit before tax was 156.2 million pounds, compared to last year's reported restated profit of 113.4 million pounds. Earnings per share increased to 7.1 pence from restated 5.5 pence a year ago.

The prior year's pre-tax profit was 85 million pounds on aggregated basis to include Redrow plc from July 1, 2024 to aid year on year comparability.

Adjusted profit before tax and the impact of PPA adjustments was 199.9 million pounds, compared to prior year's 232.1 million pounds on a restated basis, and 231.4 million pounds on aggregated basis.

Adjusted earnings per share before a reduction for PPA adjustments was 10.0 pence, 21.9 percent lower than the restated 12.8 pence reported last year.

Revenue grew 10.5 percent to 2.63 billion pounds from prior year's restated 2.28 billion pounds. The prior year's aggregated revenues were 2.38 billion pounds.

The firm delivered 7,444 total home completions, 4.7 percent ahead of the 7,107 aggregated total home completions in the comparable period. The prior year's restated home completions were 6,846 homes.

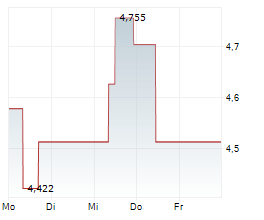

On the London Stock exchange, Barratt Redrow shares were trading at 359.10 pence, down 7.69%.

For more earnings news, earnings calendar, and earnings for stocks, visit rttnews.com.

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News